Have you wondered what’s so special about Systematic Investment Plans (SIP)? One of the main reasons for recommending the SIP strategy of investment is to maximize your profits. Ask any mutual funds‘ expert how to achieve a long-term financial goal and her/his answer would be, “Start an SIP investment in an equity-based mutual fund”. But before we get to that, let’s understand what an SIP is.

What is SIP?

An SIP is a mode of investment in mutual fund schemes. It allows individuals to periodically invest small amounts over a specific period. The frequency of the investment can be daily, weekly, monthly, quarterly, or annually.

The popularity of investing via SIP in mutual funds has gone up in the past few years and several individuals have discovered the charm of investing in mutual funds via SIPs. Another factor that led to the popularity of SIPs and mutual funds is AMFI’s [Association of Mutual Funds in India] ‘Mutual Fund Sahi Hai’ campaign.

The SIP methodology aids you to stagger your investments in equity mutual fund schemes over a specific period. Mutual fund experts believe that staggering your investments is a better way to invest in mutual funds as SIPs help average out purchase costs and maximize profits. This concept is known as rupee cost averaging. It allows you to purchase more units of a mutual fund when the markets are low and vice versa. What’s more, SIPs are a convenient tool for salaried individuals to invest in mutual funds regularly. Here’s a quick guide on how to invest in SIP.

You can engage in an SIP mutual fund investment with a pre-fixed amount regularly, depending on your convenience, through post-dated cheques or electronic transfers. For this, you have to fill up an SIP mandate form and an application form on which you need to indicate a date of choice on which the SIP should be debited. Subsequent SIPs will be automatically debited courtesy of the standing instructions you provide with this application. You can submit these forms to the office of the Investor Service Centre/Mutual Fund or the closest service centre of the Registrar & Transfer Agent.

You also need to specify the amount that will be debited from your account and credited to the mutual fund scheme periodically. You can start investing with amounts as low as Rs. 500 per month. You can use a SIP Calculator to calculate the returns you would earn on your SIP investments and also tells you how much you would need to invest every month to earn a target corpus.

Why should you be a part of the mutual fund SIP revolution?

SIP investment helps inculcate financial discipline into your life. It also aids you to invest regularly without wrestling with market movements, research, etc.

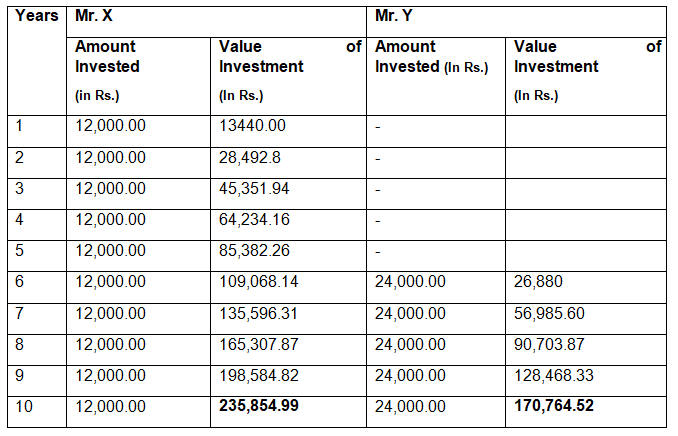

Another benefit of investing via SIP is the power of compounding. When you regularly invest for a long duration, you get to earn returns on the returns earned by your investments, i.e. your money starts to compound. This helps build a large corpus over time that ultimately helps you achieve your long-term financial goals.

Choosing to start an SIP is the first step towards financial independence and the sooner you start, the more beneficial it would turn out for you.