First salary is all about achievement, being excited, dreams coming true, pride, and being successful. Everybody has plans for what to do with their first salary, but not many would think of investing that hard-earned money. It may sound unappealing to invest your first paycheck, as you may want to spend it freely without being accountable to anyone.

However, do not forget that you are accountable to your retirement, your ambitions and your financial goals. The retirement corpus or any other financial goal cannot be achieved over night. The path towards achieving financial goal is time, consistency and long-term investing.

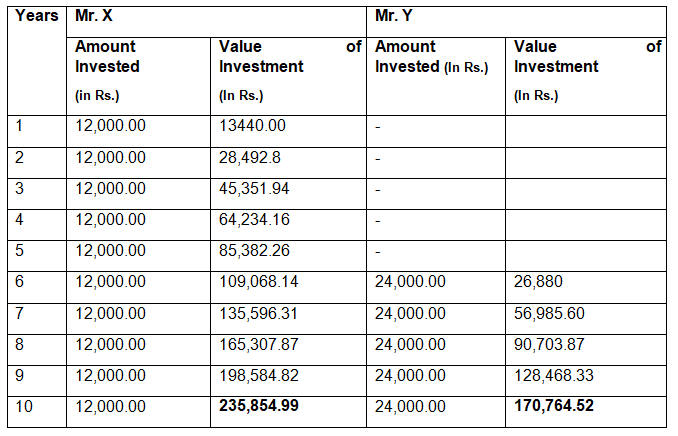

Let’s look at the example below to understand the importance and benefit of starting your investments early.

Mr. X started investing Rs 1,000/month for 10 years and Mr. Y started investing double the amount of Mr. X i.e. Rs 2000/month after 5 years [assuming growth at the rate of 12%].

From the above table we can see that even though Mr. Y’s monthly investments were double than that of Mr. X’s, but Mr. Y’s corpus was still not as large as that of Mr. X. This is because of the power of compounding where time horizon plays an important role. Power of compounding is nothing but the growth of your principal amount by adding the previous year’s returns to it.

This highlights the importance of starting early and staying invested for a longer time to reap the benefits of reinvesting the amount earned over and above the principal amount. This is how Mr. X has built a larger corpus because of the reinvestment of his earnings over a long period of time.

Now let’s look at some tips to smartly invest your first salary

Create a budget

Since budgeting helps you to plan your saving and spending pattern, it will ensure you always have enough money to meet your expenses after saving. The thumb rule for saving is to save a minimum of 20% of your salary. Do not spend before saving, always save and then spend. Certain expenses like electricity bill, loan repayment, grocery bills, etc. cannot be avoided. Make provisions for such expenses and then plan your savings structure.

Decide your financial goal

Having a financial goal is important as it gives you direction to save wisely, in terms of the investment amount and tenure required to reach that financial goal. Marking your financial goals as short, medium or long term, and taking inflation into account will help you arrive at a target for each of your financial goals. Based on these targets, you can then start planning your investments more efficiently.

Start a Monthly SIP

A Systematic Investment Plan (SIP) helps you start your investment with an amount as small as Rs 500. That way an investor need not have a large disposable income to develop a discipline-based investing habit. Through an SIP, you invest a predetermined amount periodically at a date specified by you. An investor need not worry about timing the market either as the SIP helps in lowering the overall cost of investment by investing at different stages of market movement.

Buy an Insurance

Insurance planning is also an important part of life planning, be it medical or life insurance. Buying an insurance plan at a young age leads to lower premiums with substantial life cover. Being insured ensures financial well-being of your family even in your absence.

Invest in ELSS to plan your taxes

An investor should look at financial planning and tax planning as a combined activity. An Equity Linked Saving Scheme (ELSS) helps an investor save taxes under section 80C of Income Tax Act by investing an amount of up to Rs 1.5 lakh in the scheme. Investors can then claim this investment as deduction from the total taxable income. When compared with other tax saving instruments, an investment in an ELSS fund has the lowest lock-in period of three years and also has the potential to generate wealth in the long run as it invests in the equity market.

As they say, the early bird gets the worm. Similarly, the earlier you start investing, the better it is as your risk-taking capacity is higher when you are younger. Also, the sooner you begin, the smaller is your investing capital, which gets compounded over a long period of time. So start your financial planning at the earliest as this would also help make investing a part of your lifestyle and help plan a better financial future.