Car insurance is an insurance policy which helps an individual to claim the liability arise at the time of a sudden accident. Choosing the appropriate car insurance policy is vital. Previously it was a very tedious and lengthy paperwork process for buying online.

With the rapid change in advance electronic device and high – speed internet, it has been a very easy and time-saving process. To buy car insurance online you don’t have to visit the store. It can be done simply through the mobile device staying at home.

Buying car insurance online is secured and comfortable task. Most of the companies allow their customers to quote the insurance policy online.

Do Your Homework

It is important to know the requirements before buying the insurance policy. To buy car insurance online, you need to make sound research before making the decision. Analyze the coverage offered by the policy.

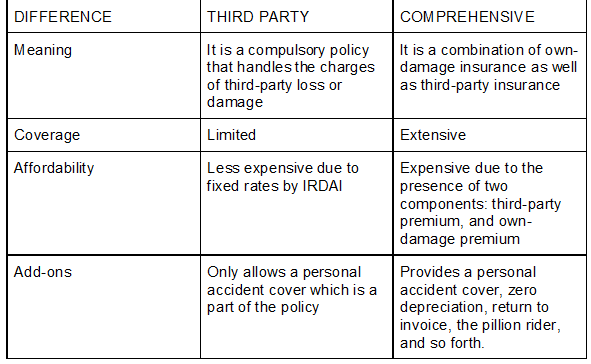

Seek for Comprehensive Coverage

The comprehensive car insurance policy covers the third party liability along with the damages caused to your car. It also protects your car against any accidental fire and thefts and other damages as per the selected plan.

Comparison

Online buying facilitates the decision making task. You can compare a number of a car insurance policy with the different insurer. Insurance company website holds in detail information about the different policy. So spending few time online can help you to choose the best plan for yourself.

Car Insurance Calculator

Car insurance calculator is an online tool which helps you to find out the price estimate of your insurance policy.

Know the right Insured Declared Value of your car

The IDV amount of your car is the maximum amount you can claim under an insurance policy. IDV is an amount you receive when your car gets stolen or suffer complete damage. A brand new car has a higher IDV as compared to the same model old car

Add-ons

Add-ons are the extra protection for your car which helps you out in any peril situation. You need to understand the things required and eventually opt for the same add-ons. Because add-ons have a cost which gets added to your insurance premium. Settle yourself with the add-ons as per your risk profile.

No Claim Bonus

No Claim Bonus [NCB] is the amount you earn during the renewal of your policy if you don’t claim your policy in the one-year period. Basically, it is like an award for you to drive safely throughout the year. You can receive a bonus of 50% at most.

Right Deductibles

Deductibles are of two types – Voluntary Deductibles and Compulsory Deductibles.

Compulsory deductible amount depends upon the cubic capacity of the car engine. While voluntary deductible is the amount you wish to pay at the time of claim settlement. It helps you to lower your car insurance premium. As you wish to share the repair cost during the claim, it lowers your car insurance premium.

Be Patient

Never rush to buy car insurance online. Compare car insurance plans offered by different insurance providers. Read the inclusions and exclusions which can be raised during the time of claim. Shortlist the insurance plans and go ahead with the car insurance which allows you the best coverage without affecting your pocket.