With the compulsion of third-party insurance for your two-wheeler, we are sure you are probably scurrying around last minute to do so. Covering your bike with two-wheeler insurance not only keeps you on the right track but also financially provides for you in times of mishaps. However, failure to comply with the rules of the Motor Vehicles Act, 1988, leads to hefty penalties.

So take a look at these procedures of a two-wheeler insurance third party procedures in order to fasten your purchase:

Why should you invest in a Third-party two wheeler insurance?

Typically, third-party insurance safeguards the riders from any kind of physical damage caused to the third party. However, it does not cover any damages either caused to you or your vehicle. Depending upon the insurance company, third party insurance is based on a majority of aspects that a customer should be aware of. Therefore, go through these factors for a better understanding of the insurance policy

- Coverage

- Premium

- Vehicle

- Engine capacity

- City of registration

Apart from the only advantages of the liability, third-party two wheeler insurance provides its customers with multiple other benefits. These benefits allowed by third-party insurance ensure the right protection during the times of calamities. Go through these few of the most common benefits given by a majority of insurance companies

- Offers coverage for the third party damages or injuries as well as for long term coverage for a period of 5 years.

- If a personal accident cover is obtained, only then does it cover the disability or the death of a rider.

- Includes low rate of premiums as compared to other insurance policies.

- It is not only easy to buy but also requires a very little hassle of paperwork.

What is the process of renewal of Third-party insurance?

The best time for third party two wheeler insurance renewal is a day prior to the expiry date. It is your responsibility to keep a constant check on the expiry date. Keeping a tab on the actual date of expiry of your policy will eventually help you to prevent inspection charges. Additionally, it is also essential to run a check on rebates before renewing your policy. Hence, opt for two wheeler insurance online while renewing. Consider the following things before you opt for the renewal procedure:

- Keep your ongoing policy handy for reference.

- Use your debit card or net banking details for the renewal.

- Make use of your certificate of registration of the insured vehicle.

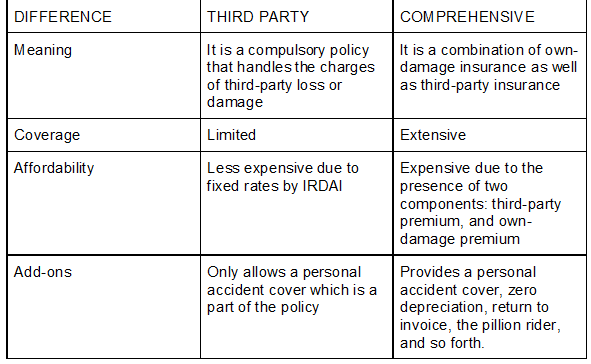

What is the difference between Third-party insurance and comprehensive insurance?

When it comes to two-wheeler insurance, it comprises of two types of policies. While the first type is third-party insurance, the second type is comprehensive insurance. Both these policies are absolutely different in not only their approaches but also their meaning. Therefore, go through the differences between both of these policies in order to avoid confusion at the time of purchase

Now that you know everything before purchasing third-party insurance, when are you planning to invest? If you are skeptical about its process and the policies, then the best way is to compare multiple policies on the websites of the general insurance companies. It will provide you with a certain clarification about the availability of different policies or you can easily contact any expert for professional help.