Your journey of parenthood starts from the moment you start planning on starting a family. From planning the colors of the nursery to making house baby-proof, you are required to do lot arrangements for the future of your child. However, the most important arrangement you are required to do for your child’s future is financial preparations.

In today’s world, having a firm financial support is crucial in order to survive. Your expenses simply double up when you are raising a child. Health, food and education, the expenses just go on increasing and it is always better to be prepared for them from the beginning. For this, you can take the help of mutual funds investment plans. This article will help you understand how to effectively plan your child’s financial future.

Child-birth is considered as one of the happiest times of life. That is why friends and family give gifts in the form of cash. Majority of the parents prefer to transfer to cash to their savings account or few keep them as fixed deposits. Although both of them seems like decent ways to prepare for your child’s future, the best way is to invest this money for your child’s future and let compounding do its work.

Considering the current cost of health-care services, it can be said that child-birth is a costly affair. You have to take care of the hospital bills, medical expenses and other related expenses at a time. People these days rely on the insurance that provides coverage for child-delivery. However, many of them simply underestimate the remaining expenses after child-birth. From the entire vaccination course to cultural rituals like baptism or naming ceremony, you are required to take care of many things once you become new parents.

Many experts concede that mutual funds are one of the best option for such goals. You can take the help of a child plan provided by mutual funds. These are hybrid schemes with different risk factors. The lock-in period can be a real help to you if you are a new investor. However, if you have knowledge about the market volatility, you can bet on a pure equity fund for a long period and get good results.

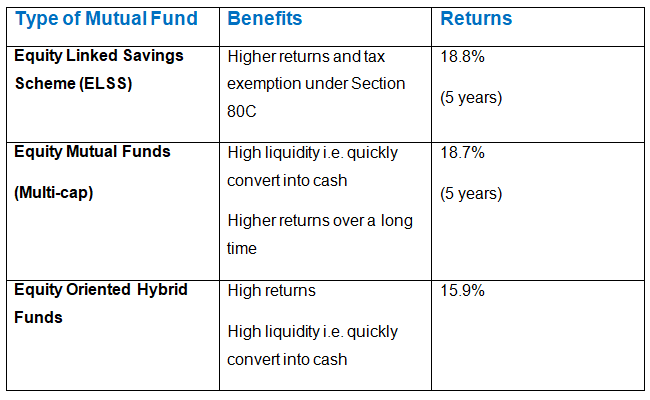

Here are the types of mutual funds and their benefits

Above are the different types of mutual funds that you can use to plan your child’s future. Many people underestimate the benefits of mutual funds due to lack of knowledge. However, in today’s world, they are one of the most helpful financial resources that you use to plan your child’s future.