When you are purchasing property, you are required to pay certain charges which are not covered in your home loan amount. Along with home loan fees and charges, stamp duty and registration charges are two of such charges that you need to pay in order to acquire the ownership of the property.

What is Stamp Duty?

Stamp Duty is a non-refundable charge levied by the state government to validate the registration of property in your name. By paying stamp duty charges, you legalize the ownership document of your property. If you refuse to pay stamp duty, then you are not considered as a legal owner of the property you purchased.

Stamp duty is not included in the home loan fees and charges lieved by banks or financial institutions. This is the over and above expense that you as a buyer need to pay in order to complete the purchase of the property. Although stamp duty charges state to state, there are several factors that commonly influence the amount of it. These factors are as follows,

- Age of the property

- Owner’s Gender: Female owners get concession in some states

- Location of the property

- Type of property

- Owner’s age: Senior citizens get concessions in some states

- Usage of property i.e. commercial or residential

How Stamp Duty is calculated?

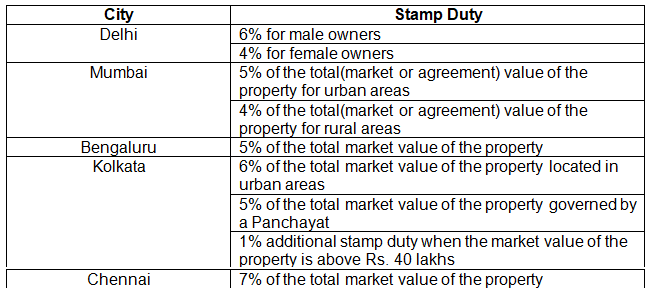

Generally, the stamp duty is 5% to 7% of the total market value of the property, whereas the registration charges are 1% of the property value. Here are the stamp duty charges in the main cities of India

You can use various online calculators to know the exact amount of stamp duty you are required to pay while purchasing a property. Moreover, according to Section 80C of the Income Tax Act, you can claim a tax deduction up to Rs. 1,50,00 on stamp duty.

Why paying stamp duty is important?

As mentioned earlier, stamp duty legalizes the newly brought property on your name. It is crucial for your property insurance as well as any future disputes. You cannot acquire the coverage amount of property insurance if the property is not registered on your name.

Many people show undervalued property price in order to reduce their stamp duty. It is considered a legal offence. Any individual who does that get penalized for stamp duty evasion. The penalty can be 8% to 20% of actual stamp duty with imprisonment for certain time.