You must have heard stories about people who hastily chose a home loan which eventually become a financial burden. A home loan is a long-term commitment, which has a significant influence on your finances. Thus, as a home loan buyer, you should be a lot careful throughout the process.

Here are the factors you must consider in order to choose the home loan that suits you the best.

Selection of the interest rates

The interest rates on home loans are influenced by several factors namely, loan amount, credit score, tenure, etc. you must consider home loan interest rates before applying for a loan as they directly affect EMIs and total payable interest. There are two types of interest rates available,

- Fixed interest rates – They remain the same throughout the tenure.

- Floating interest rates – They change according to the market fluctuations.

In India, banks follow the Marginal Cost of funds based Lending Rates [MCLR] regime to decide interest rates. This system is designed to give the benefit of changing interest rates to the borrowers.

Tenure of the Loan

There is a straightforward relation between tenure and EMIs, the more the years you chose to repay your home loan, the lower will be EMIs; however, the higher will be total payable interest.

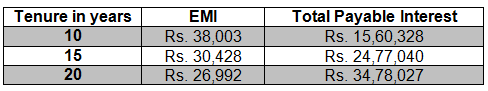

For example, Mr. Shardul has borrowed Rs. 30,00,000 as a home loan with an interest rate of 9%, then, the EMI will be different for different tenures. Take a look

As you can see, as the tenure increases, the EMIs decrease, thereby increasing the total payable interest. The best choice will be selecting the tenure in such a way that paying EMIs will not be a financial burden for you. Selecting a longer tenure is perfectly fine when EMIs won’t be stressing your monthly budget.

Loan processing time

It is the period between approval of home loan application and disbursal of loans amount. Every lending institution has different guidelines to decide the loan processing time. So, you have to choose the lender based on your urgency for a home loan.

Home Loan Processing Fees

It is a fee that lenders charge you to work on your case as well as process your files. Generally, processing fees are fixed that is most lenders charge 0.50% to 1.50% of the total home loan amount. The home loan processing fees are non-refundable, and they do not confirm the sanctioning of the home loan application. So, you should opt for a bank that charge lesser processing fees in comparison with others.

Repayment Conditions

Every lender has their terms and conditions about home loan repayment. It is essential to understand them before taking a home loan. Having a comprehensive knowledge about late payment charges, CERSAI charges or loan transfer charges, etc. is crucial before taking a loan.

Prepayment or Part Payment options

Prepayment and part payment, both are the facilities given by lenders to their customers. As per these facilities, you can pay a lump sum amount over and above the EMIs against your loan. These facilities help you to reduce the payable interest by repaying the loan ahead of time. Many lenders do not charge you for these facilities; however, some lenders could charge pre-payment penalties to their customers who wish to pay off their loan before time. So, you need to confirm about these before finalizing your lender.

Affordable Housing

The Indian Government has introduced subsidized home loans under Pradhan Mantri Awas Yojana [PMAY] to provide financial aid to the low and middle-income households. This scheme was incorporated to encourage all Indians to buy their home.

Considering all the above factors and make a calculated decision based on them. This would make it easier for you to choose the home loan that suits you the best.