Insured Declared Value is the current market value of your vehicle, which is calculated after deducting the depreciation amount. It is the maximum sum assured by an insurer on theft or total loss of two wheeler in the event of an accident. The insurer uses the “Insured Declared Value” [IDV] to calculate the premium of your bike. It is a vital component of a two wheeler insurance policy as it determines the amount of compensation.

To protect your two wheeler completely, you can opt for a comprehensive two wheeler insurance policy. Because it provides complete financial protection against own damages and also third party loss or damages caused due to the insured vehicle. In case if your two wheeler gets stolen, a comprehensive policy also covers bike theft. Whereas, Third party liability only insurance is mandatory in India as per the law. This policy also covers damages or loss caused by the insured bike to the third party or property. However, it does not cover for any loss, damages incurred or theft of the insured bike. The insurer uses “Insured Declared Value” [IDV] for calculation of the premium, whereas the third party premium is calculated as per the vehicle category and is not related to the IDV of the vehicle.

Inflation rates escalate the premiums. If you do not make any claim throughout the year then you will be eligible for no claim bonus benefits. No claim bonus can come in the form of deduction in premium rates or additional coverage. It is important to know that about the IDV value of your vehicle.

The IDV calculation for a two wheeler is based on the manufacturer’s listed selling price for the two wheeler proposed for insurance either at the start of the insurance policy or during policy renewal as the case may be, and then adjusted for depreciation. You can easily calculate the rate of your premium with the two wheeler insurance premium calculator online.

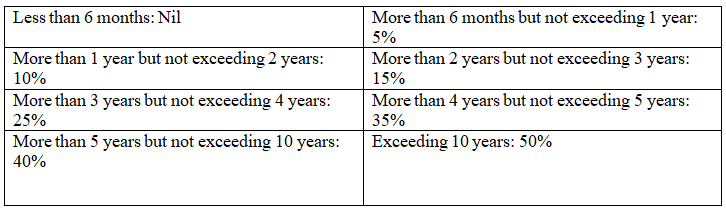

Every vehicle depreciates with time. The age of the car also contributes to its depreciation value along with the wear and tear.

The rate of depreciation considered to be effective across the motor insurance industry is as explained in the table below:

Age of the car % depreciation [for calculation of IDV]

When the cost of retrieval/repair exceeds 75% of its IDV, then that particular vehicle is tagged as a constructive total loss.

When the IDV is calculated [at first purchase or during two wheeler insurance renewal], the current selling price of the model and brand is considered rather than the price at the time of purchase. So during your two wheeler insurance renewal, make sure to check whether the premium you are paying for your two wheeler insurance is justifiable as per the IDV of the vehicle.