MobiKwik, India’s leading FinTech Company has announced that it has emerged as the market leader among all the digital payment players [wallets, banks, payment banks] in the IMPS* fund transfer category in the month of May 2019 by clocking Rs. 362 crores in GTV [Gross Transaction Value]. The company has seen a 400% growth in its Funds Transfer Business in the last one year with GTV of Rs. 4,344 crores.

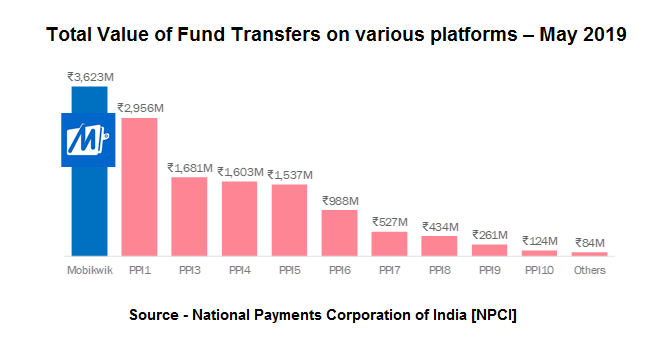

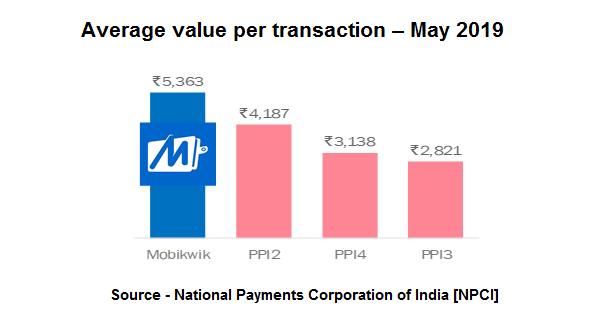

According to NPCI [National Payments Corporation of India] data, MobiKwik commands over 26% market share and has clocked Rs. 362 crores in terms of value of total funds transferred from its wallet to bank, ahead of all major digital payment companies in India. The company has also recorded the highest average value per transaction Rs. 5,363 which represents MobiKwik’s pole position in the segment with genuine use case driven transactions.

Consumer Payments in India is driven by four large use cases: 1. Bill Payments 2. Merchant Payments 3. Funds Transfer and 4. UPI. Funds Transfer is an important category because it commands the highest average transaction value and MobiKwik being ahead of all players in this category clearly indicates the high degree of trust it enjoys with its users.

The ‘wallet to bank’ feature allows users to instantly transfer money to any bank account through the digital wallet. The service is used by small merchants who accept payments via MobiKwik as well as by users who have taken digital loans in their wallets. Unlike NEFT and RTGS, the service managed by NPCI is available 24/7/365 days, including on bank holiday.

Unlike NEFT and RTGS, the service managed by NPCI is available 24/7/365 days, including on bank holiday. Speaking on the achievement, Upasana Taku, Co-Founder, MobiKwik, said

Speaking on the achievement, Upasana Taku, Co-Founder, MobiKwik, said

We are thrilled to see our leadership position in the IMPS Funds Transfer business ahead of all banks, payment banks and wallets in India. This clearly shows that our efforts to build a secure fintech platform are being appreciated by users. We are now targeting INR 10,000 crores in IMPS GTV and 20+ Million users to use our IMPS service in FY20.

MobiKwik is now the first Indian owned company to have successfully launched and enrolled customers under its full stack of financial services – digital wallet, lending, insurance, investments in Mutual Funds and gold and payment gateway. It’s user base comprises over 107 Mn users, 3 million merchants, and 200+ billers.

Founded in 2009 by Bipin Preet Singh and Upasana Taku, MobiKwik has raised four rounds of funding from investors including Sequoia Capital, American Express, and Net1 of close to $120 Million.