There are many traits that differ from one person to another, investing is one of them. There is a famous saying which mentions that ‘Risks and Rewards are two sides of the same coin’. It can be said that ‘Greater the risk, higher is the probability of making rewards’. Not every investor can afford that route since investing depends heavily on factors like investor’s age, present portfolio, ability to take risks, current assets & liabilities, etc.

As famous American investor Peter Lynch says ‘Do your homework’ and the same sentiment is echoed by legendary investor Warrant Buffet who says ‘Be selective’ i.e. Once you get a hang of investing money & have a well-balanced portfolio, narrow down those investments so that it reflects your goals. Goals would again vary from one person to another, some examples of goals are

- Enjoying an early retirement.

- Purchasing a flat/house within a specific span of time.

- Plan higher education of your children, etc.

Goals have to be more realistic in nature so that you plan your investments in such a manner that each step takes you close to your goal. This could be termed as goal-based investing. Goals could either be a short-term goal or a long-term goal. In order to have a balanced portfolio, many investors follow a mix of ‘conservative + aggressive’ approach to investing.

Investment Options for ‘All types of Investors’

Investments in Fixed Deposits [FD], Recurring Deposits [RD], Public Provident Fund [PPF], Post-Office schemes, etc. are some of the common instruments in which conservative investors invest their money. Though different banks have different rates to offer for RD/FD, the average rate of interest for Fixed Deposit [FD] is close to 5.75% [maximum being 6.25%] and the average rate of interest for Recurring Deposit [RD] is close to 4% [maximum being 8%]. The interest rates might vary from one bank to another and the rates also keep fluctuating. ‘Rate of inflation’ is one of the major factors that can influence the banks to either increase/decrease Fixed Deposit rates. FD’s & RD’s offer the best combination of attractive interest rates, safety of capital, good returns [without much risk on investor’s part], and liquidity.

Even though you are a conservative investor, there is a high possibility that you would have opted for an insurance policy of any nature. There are different types of life insurance policies, namely Endowment plans, Term plans, and Money back plans. Term Plans provide only life-covers and are available at affordable premiums. ‘Term Plans’ are the best ways in which you ensure that your family members do not have to suffer in case any untoward incident happens to you. Many people who take home-loans opt for a ‘Term Plan’ from the bank that issued the loan; other investors choose the Money back plan or Endowment plan depending on his profile. Irrespective of your risk appetite & investment portfolio, it is recommended to always have at least one Term Insurance plan. Before taking a term insurance plan, always have a look at how much term-insurance coverage you need.

Systematic Investment Plan [SIP] – Good Returns with Marginal Risk

System Investment Plan [SIP] is another popular investment vehicle that yields good returns. A popular study shows that 51% of parents in India yield their children to be highly successful in life. This also means that you need to provide best-quality education so that your child can become educated and pursue a better career. Investing in ‘low-risk investment options’ [which were discussed before] would not yield great returns, hence it becomes necessary to invest in other options like SIP which can bring returns which can beat the ‘rising inflation’. It is suited for both low-risk & high-risk investors.

Investing in Mutual Funds via SIP’s is a good investment option where you can invest a fixed sum of your preference at regular intervals. This can be instrumental to achieve short-term, as well as long-term goals e.g. Goal of financing your child’s higher education, planning for retirement, etc. Investment in Equity Funds can offer returns at around 10~15% pa. Investment in SIPs is the ideal approach to long-term investing.

Let’s take a hypothetical example of two people ‘Ramesh’ & ‘Suresh’ who are near the same age, earn almost the same, but follow different investment ideologies. Ramesh invests close to Rs. 10,000 per month in a SIP, starting from the age of 30. At 15% annualized rate of return, he would have a corpus of Rs. 7 crore by the age of 60. Suresh, on the other hand, realizes the importance of investing in SIP at a later stage in his career and starts investing in SIP at the age of 40. The investment amount is Rs. 12,000. By the age of 60, Suresh would have a corpus amount of Rs. 1.8 crore, which is way lesser than what his colleague Ramesh could accumulate.

By looking at some of the investment options available for different categories of investors [Conservative + Aggressive], one thing that can be concluded is that ‘safest investment options’ [like Fixed Deposits, Recurring Deposits, etc.] can be common in their portfolio. No one would want to put all their eggs i.e. money in one ‘type of basket’ since that would be a very risky game.

This is where the product named FD Xtra by ICICI Bank can be a big boon for investors since it is not a normal FD/RD. There are many added advantages and this is why it has a ‘market-fit’ in today’s changing times.

FD Xtra – Fixed Deposits & Recurring Deposits with many ‘investment advantages’

Before we have a look at the features of this innovative product by ICICI Bank, we should have a look at some of the important points that were discussed in the ‘interim union budget’ that was announced a few weeks back. This year’s interim budget brought lot of cheer for the ‘middle-class’ & ‘working class’. The government has proposed to increase the TDS [tax deducted at source] threshold on Post Office Savings and Bank Deposits.to Rs. 40,000 from Rs 10,000.

The increase in the TDS limit for FD & RD is a welcome move since it would encourage more number of investors to invest in these financial instruments. What if the investor who invests in FD/RD also gets a free term-insurance/option to invest in SIPs/investing to make your ‘goals’ a reality? This is where FD Xtra from ICICI Bank could be a game-changer as it packs the features of a safe investment option like FD/RD and also offers investors to generate more wealth by providing a ‘gamut of services’ like investing in SIP’s, etc.

This product serves two advantages

- Offers safety of traditional investment options like FD, RD

- Offers an option to invest in other high-growth financial instruments like SIP. Many investors in this category are still not aware of the importance of having a term-insurance, the advantages of having SIP, etc.

Let’s have a look at some of the investment schemes in FD Xtra

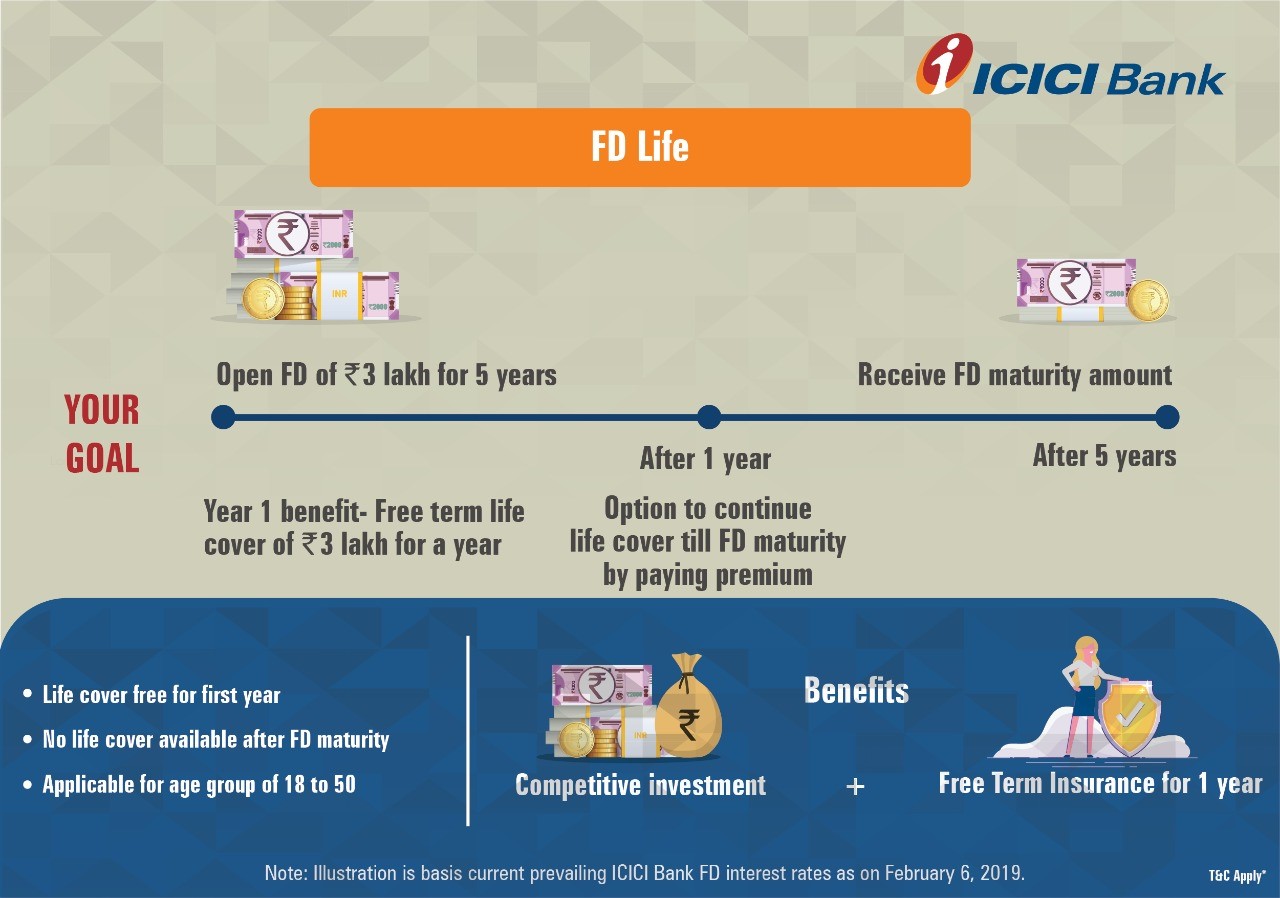

FD Life

This product offers customers a complimentary term life insurance cover of Rs. 3 lakh for one year by opening a Fixed Deposit of minimum value of Rs. 3 lakh and tenure 2 years and above.

Example – Akshay, 32 years, is recently blessed with a child. He opens a Fixed Deposit of Rs. 3 lakh for her education in five years. With ICICI Bank FD Life, he gets a free term life insurance cover of Rs. 3 lakh for a year. [He can renew it next year, if he chooses to]. This will financially secure his loved ones from any eventuality.

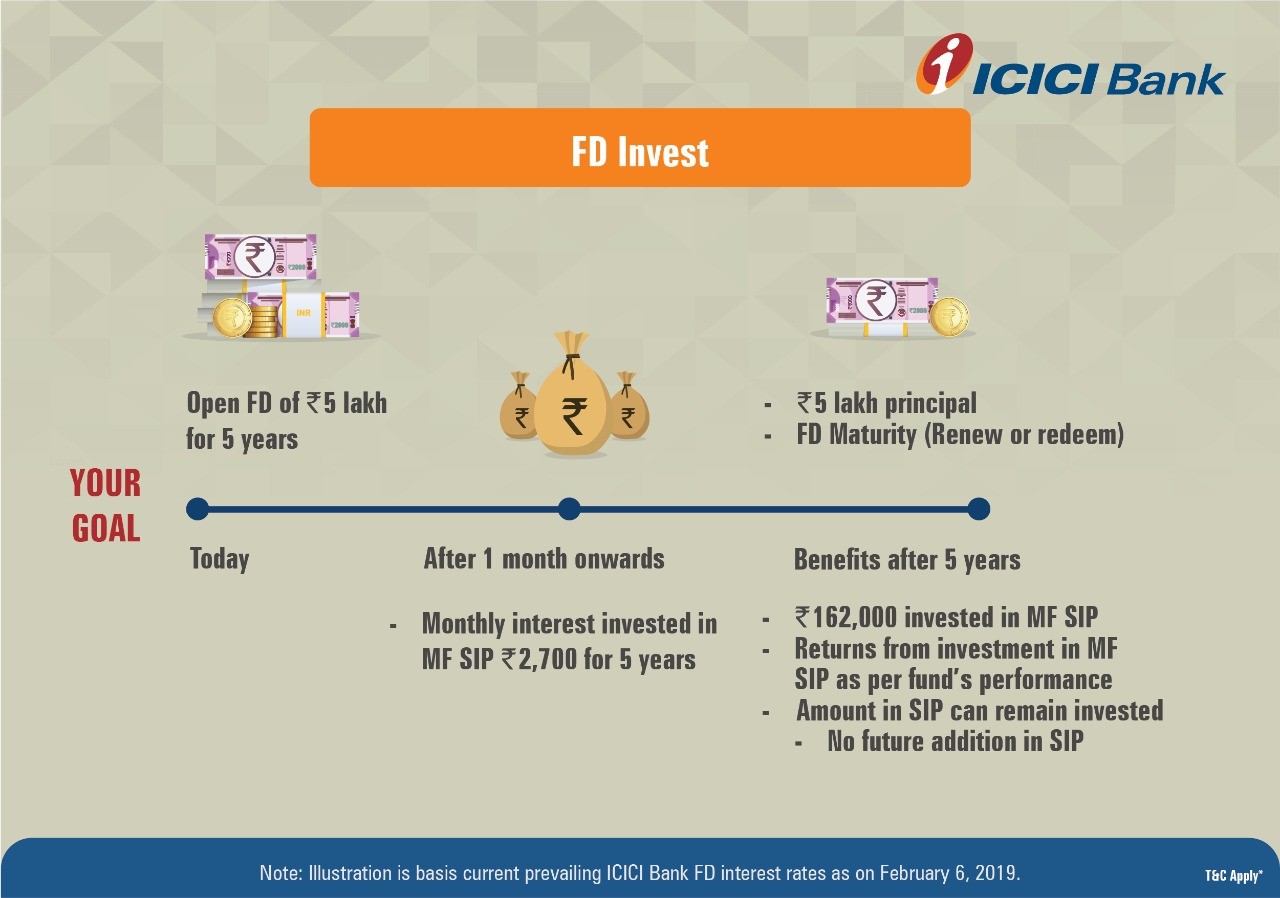

FD Invest

It is a unique product that offers customers the safety of a FD and returns of a Mutual Fund. This proposition enables customers earn monthly interest on principal invested. This interest is in turn invested in a Mutual Fund via monthly SIP.

Example – Neha, a working woman, is a conservative investor who doesn’t like to expose her hard earned money to volatility of equity markets. At the same time, she feels she is missing on the higher returns associated with equity markets. She opens a FD Invest of Rs. 5 lakh for tenure of 5 years. This will protect her principal invested and offer monthly interest of Rs. 2,702 post tax. Neha decides to put Rs. 2,700 in a Mutual Fund SIP. So her total investment in SIP for 5 years will be Rs. 162,000, while her principal invested is safe.

FD Income with Monthly Income

This facility enables customers to receive the maturity amount of the deposit as a monthly income for a tenure of their choice. The service is designed specially for meeting life stage needs like retirement among others.

Example – Raman, a private sector employee, has received a significant retirement corpus. FD Xtra can help him in getting a regular monthly income. For example, he invests Rs. 5 lakh in FD with Monthly Income for a tenure of 2 years as the FD investment phase. Post the investment phase, he will receive a monthly income (before TDS) of Rs. 25,911 for 2 years. He has the option of selecting the FD investment phase and the payout phase in any combination upto an aggregate of 10 years.

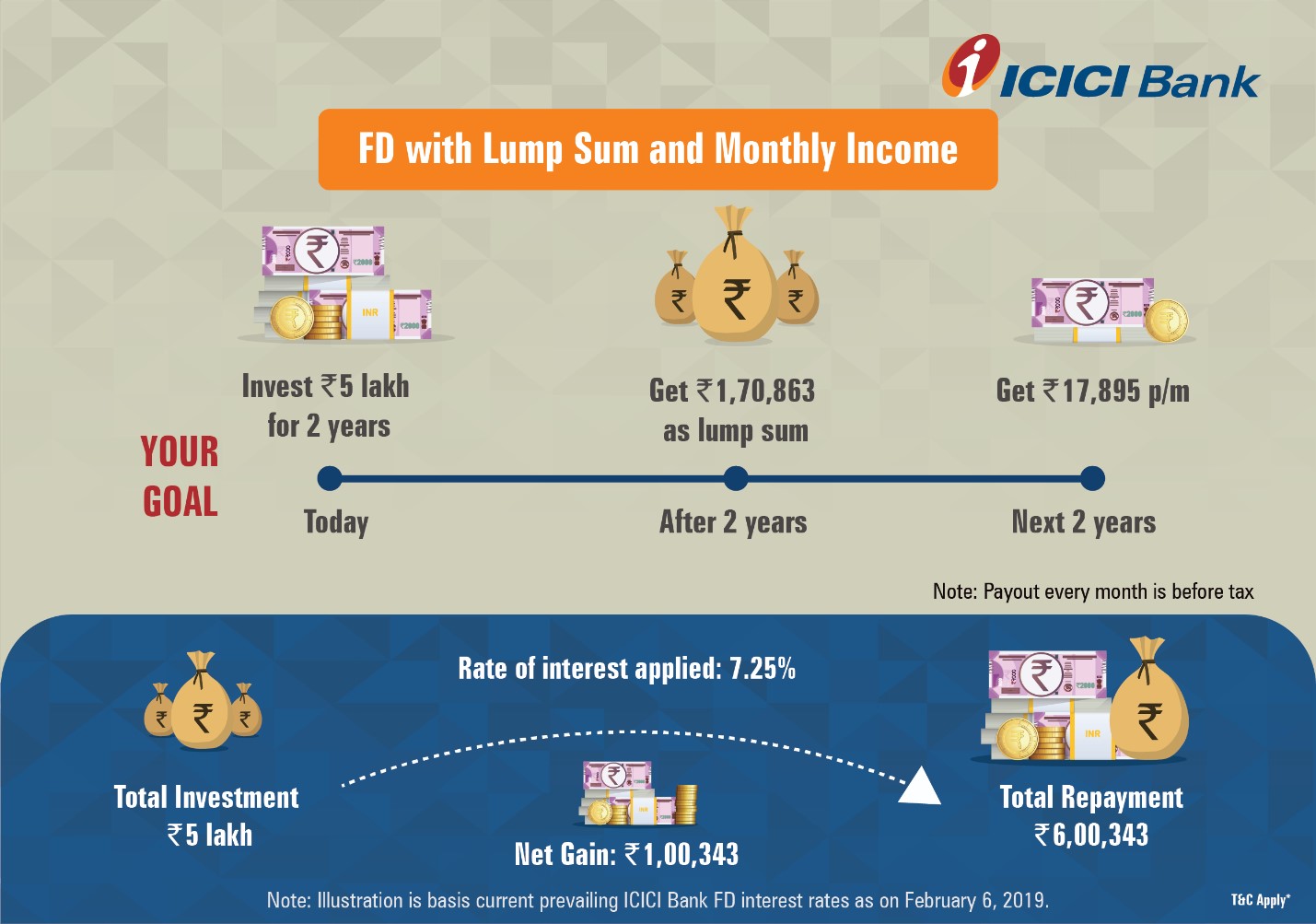

FD with Lump Sum and Monthly Income

This service enables customers to receive a lump sum amount at the end of the investment phase. The rest of the amount is available every month in the payout phase.

Example – Kalpana, a homemaker, wishes to enroll herself into a patisserie course and take her family out on a holiday. Kalpana has Rs. 5 lakh, which she invests in FD with lump sum and monthly income. Post the completion of the investment phase of 2 years, she will receive Rs. 170,863 as lump sum amount and Rs. 17,895 as a monthly income in the payout phase for the next 2 years. This will help Kalpana in going on her dream holiday and pursuing the patisserie course.

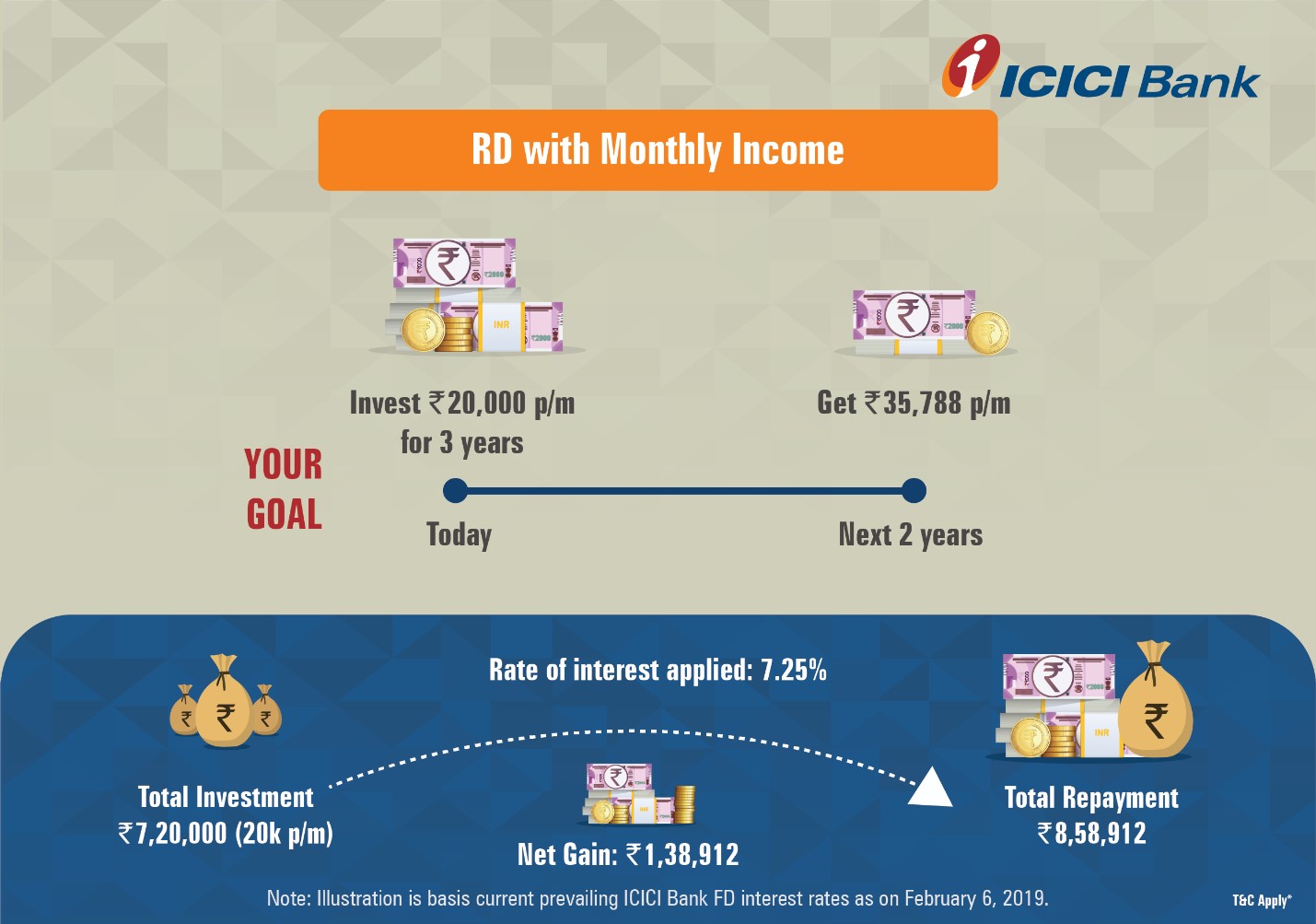

RD with Monthly Income

Designed on the similar lines of FD with monthly income, this service enables customers to meet their life stage goals by saving systematically and gaining returns as a monthly income.

Example – Satish, an HoD in a renowned college, with over 25 years of work experience is planning for his retirement. He wishes to save for post-retirement expenses and daughter’s higher education. With a steady income, Satish decides to invest Rs. 20,000 every month in RD with monthly income for a period of 3 years as the investment phase. His total investment in 3 years will be Rs. 7.2 lakh. Post the investment phase, he will receive a monthly income (before TDS) of Rs. 35,788 for 2 years, which is the payout phase. This will help him sort his finances post retirement.

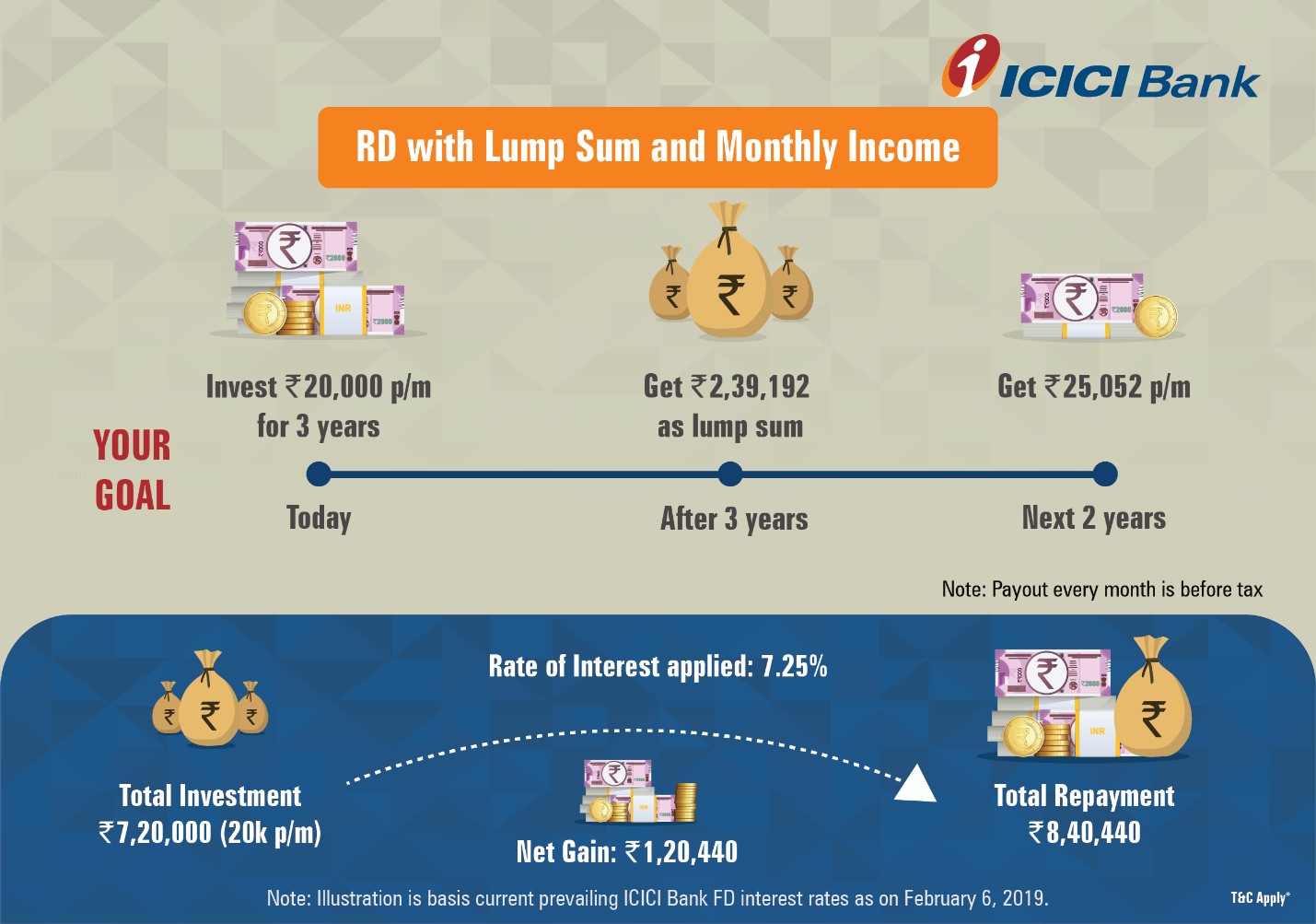

RD with Lump Sum and Monthly Income

The service enables customers to receive a lump sum amount at the end of their investment tenure and the remaining amount as a monthly income during the payout tenure.

Example – Amit works in a renowned MNC and wishes to buy his dream car in the coming years. With a steady income, he decides to save Rs. 20,000 every month for a period of 3 years using the RD with lump sum and monthly income facility. He will save Rs. 7.2 lakh during the investment period of 3 years. Post the completion of this period, he will receive a lump sum amount of Rs. 239,192 which will assist him with the down payment for the car. After which, he will receive Rs. 25,052 as a monthly income for 2 years during the payout phase. This will in turn assist him in paying the EMI for his car.

With so many investment options with FD Xtra, investors who are not comfortable with investment in SIPs, Mutual Funds, etc. can learn the tricks of the game and shift from investing in traditional options like FD & RD. The other intent behind investing in something like FD Xtra is that you can take advantage of India’s Growth Story which is currently on an upward trend.

As an investor, what are your thoughts about investing in 2019 and how a product like FD Xtra by ICICI Bank fits into your bigger investment plan? Would like to your comments…

* References – 1