With technology growing at a massive scale, there is nothing you cannot do virtually. From watching movies, giving exams, shopping and working, the virtual world is all consuming. So why something as simple as health insurance should be left behind?

Almost all insurance companies now offer the easy click version to buy health insurance online. With a few standard checks, you can buy an insurance cover that fits your needs. However, it is important to look for some vital signs before you sign on the proverbial dotted lines.

Online insurance

Direct dealing

Online insurance means you cut out the middleman or agent and directly buy from the company. Since the transaction is all online, paperwork is negligible as well. This also leads to lesser health insurance premiums.

Compare health insurance

Given the number of policy comparing sites available, you can now easily weigh the pros and cons of various policies before landing on one. You should compare health insurance policies based on benefits, coverage, premium amount, claim process, documentation and renewal process. The tabular format makes it easy for viewing as well.

Reviews

Opinions fly thick and fast in the virtual world. Although it has its disadvantages, it could prove to be a boon when looking to buy health insurance. Therefore, you are advised to read all the reviews before buying the policy.

Automation

Policy holder can avail a host of benefits if planning to go online. You can download brochures, look up your premium paid statements, research on new policies, access your policy anytime without having to safeguard a piece of paper. You can also pay premium online in a jiffy.

Promptness

Since not everyone will be comfortable transacting online or making payments without a physical acknowledgement, companies give you a virtual friend who can answer queries. You could also chat online with an executive or call for a more personal touch. It’s all about making a smooth transaction.

Medical check-up

You can ask for a free medical check-up which will be done as per your convenience

Bonus & Discounts

The online passbook of sorts shows you how much bonus has been accumulated and what discounts you could avail if you opt for a family health insurance.

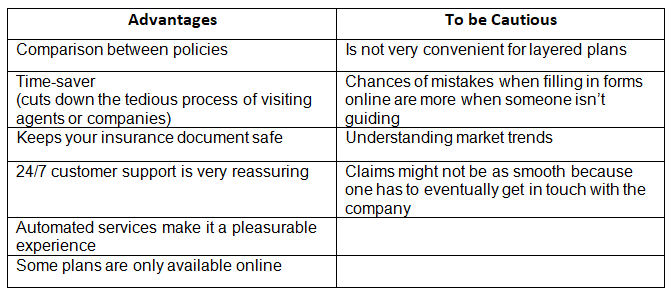

To give you a more comprehensive idea, here’s a table listing all the advantages and some things to look out for

Add on benefits are:

- Maternity benefits

- Hospitalization charges

- Bonuses

- Lifetime renewal

- Medical check-up

As you can see the pros definitely outweigh the cons. Of course like all systems, it could do with a few tweaks, but nothing to beat the convenience of an online transaction.

Bajaj Allianz General Insurance is a company that is old and trusted in the market. The no hidden-cost benefits, transparent charges, quick settlements, fast resolutions and variety of policies offered makes us a consumer favourite. The Brand offers both online and offline policies to cater to its wide clientele. If you are a novice, feel free to get in touch with us for a detailed review and we’ll be more than happy to help you. Bajaj Allianz General Insurance is your friend in need.