Few days back, a reader commented on an article where we reviewed the performance of a company that was listed on BSE and why it was a good buy in the current scenario. The comment read – Wish I had stumbled upon this article sooner. This stock is trading at double of 250. On further discussion with the reader, it was learnt that he was a newbie in trading and was used to less risky investment options. Every investor is different and their asset allocation strategy primarily depends on factors like age, net worth, financial goals, existing portfolio and most important of them all is Risk Appetite.

There is a very famous saying – ‘Don’t put all your eggs in the same basket’ which means that it is very important to have a balanced investment portfolio. It becomes to important to create a checklist of what has helped you make money and loose money. Though in today’s digital era, market information like Stock information, Mutual Fund performance, etc. is readily available, keeping a constant check on it becomes impossible. Hence, irrespective of whether you are a novice or seasoned investor, having an ideal asset allocation strategy by considering all the factors discussed above is critical to maximise returns (by taking calculated risks).

Asset allocation funds follow either fixed asset allocation or dynamic asset allocation strategy. Since investor needs as well as market changes are dynamic in nature, following fixed allocation strategy may not work! Dynamic allocation fund fits the needs of the investors (novice as well as seasoned) since the investor’s money is invested as a mix of Debt & Equity and is an ideal investment option for long-term wealth creation.

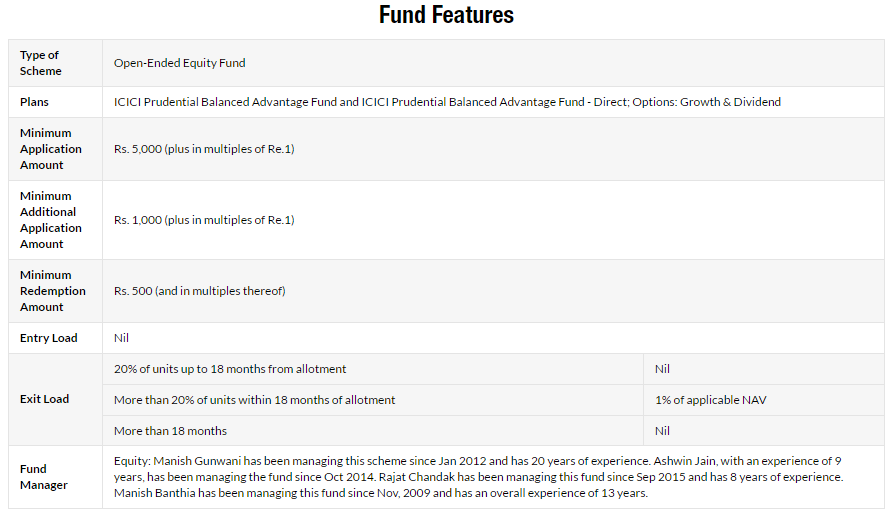

One such investment fund is from ICICI Prudential – ICICI Prudential Balanced Advantage Fund. ICICI Prudential Balanced Advantage Fund is an open-ended equity oriented fund that brings multiple benefits to your investments. It strives for growth by investing in equity markets, while providing relative safety through investments in debt instruments. As famous investor Warren Buffet says- When the amount to be invested is small,then it is better to run a concentrated portfolio and this fund can be a beginning for an investor to create a diversified portfolio.

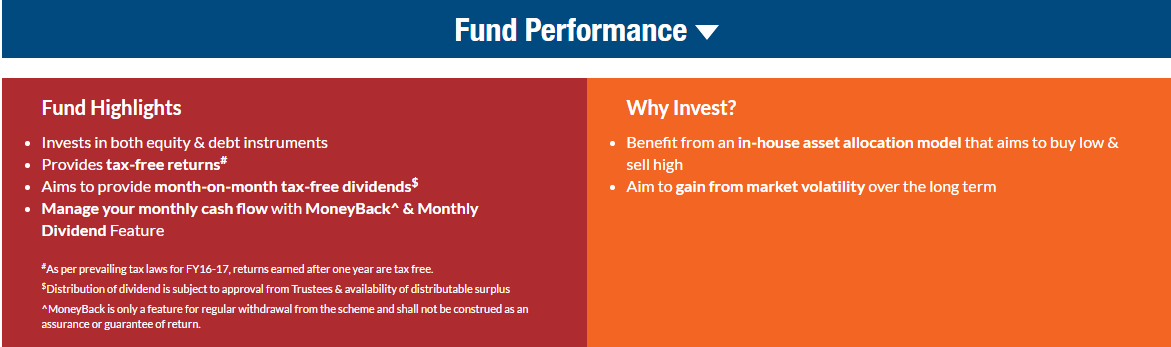

As seen in the ICICI Prudential Balanced Advantage Fund factsheet, the fund caters to spectrum of investors who have low/mid/high risk appetite. The Riskometer makes it very easy for investors to invest their buck at the right place 🙂 One of the primary reasons to invest in them is their fund performance and their investment strategy (as seen in the snapshot below)

Though the returns can vary, the Absolute Returns (%) on investment (ending June 30, 2016) are much better than the returns offered by much safer investment vehicles like FD/RD/Post, etc. The fund is ideal for investors who are looking at short-term, mid-term or long-term wealth creation! It also comes with options like MoneyBack & Monthly Dividend Feature.

So, irrespective of whether you are a novice/seasoned investor or have idea about MF/Stock Market, ICICI Prudential Balanced Advantage Fund can be an ideal investment option since it brings in mix of investment in Debt & Equity Markets. Since income doesn’t have holidays, ensure that your money is invested in the right place at the right time! We sign-off with this famous quote

Money is always made by the people who go against the cycle, never go with the cycle.

If you have invested in ICICI Prudential Balanced Advantage Fund, please leave your feedback on the fund in the comments section…

Disclaimer – Mutual Fund investments are subject to market risks, read all scheme related documents carefully

![]()