Intel Security have released findings from its new study Digital Detox – Unplugging on Vacation. This was conducted to better understand the ways consumers stay digitally connected while travelling and to highlight the ways in which they may unknowingly be putting their personal identity and devices at risk.

Study findings indicated that India defines being unplugged as having ‘no electronics usage at all (39%). While almost two thirds of Indians (65%) claimed to have gone on vacation in the past year with the intention to be unplugged.

Vacations are full of distraction and opportunity, and savvy criminals have learned how to capitalise on these moments. Travellers can be targets for cyber-criminals who count on human and device vulnerabilities to provide them with a point of access to consumers’ data and devices. They can gain access to sensitive information via unsecured smartphones, laptops and even wearables, while also collecting data from social channels.

Venkat Krishnapur, Head of R&D Operations for Intel Security’s India Development Centre said

Findings from the survey indicate that a huge majority of Indians (84%) connect to the internet while on vacation. While doing so, they often access and share sensitive information without considering the potential cyber risks of divulging credit cards details, works mails and personal information on unsecured public Wi-Fi.

Through this survey, we wanted to raise awareness about the need to adopt safe digital habits and share security measures to prevent personal information from being compromised while travelling.

Findings from the survey indicate that more than one of three Indians (38%) who went on the vacation with the intent to unplug were not successful in doing so. As cyber-criminals are on the lookout for such opportunities, consumers need to be vigilant and take precautionary security measures to prevent exploitation of their personal information.

Major findings from the India

- 84% of Indians connect to the internet while they are on vacation

- Almost three out of four Indians (74%) say that they would want to be unplugged on a week-long vacation if work obligations were not a factor.

- Majority of Indians (54%) are not willing to leave their smartphone at home while on vacation and Indians fared second worst globally (only Singapore was ahead at 42%) in being able to abstain from social media while on vacation at 43%.

- Communication with the family (57%) or being available in case of emergencies (46%) are the main reasons that end up keeping people from being unplugged during vacations

Indians need to be vigilant

- Indians (31%) that travel, access or share sensitive information while using public Wi-Fi, which is highest amongst the 14 countries surveyed.

Mexico (19%), Brazil (18%), Spain (17%), Singapore (16%), US (15%), Italy (15%), Canada (11%), France (11%), Germany (11%), Australia (10%), Japan (10 %), UK (10%), and Netherlands (09%)

- Indians lead their global counterparts in willingly sharing personal information such as credit card number or log in name/password. More than one out of three Indians (36%) shared their personal data even when they realize that this will make them vulnerable, which is highest amongst the 14 countries surveyed

US (21%), Brazil (20%), Spain (15%), Germany (13%), Italy (13%), UK (13%), France (12%), Australia (12%), Mexico (12%), Singapore (12%), Canada (10%), Japan (09%), and Netherlands (09%)

- 37% of Indians could not last a day on vacation without checking social media This is second only to Japan (45%) when compared globally

Tips to Minimize Your Travel Security Risks

Create Social Walls : Waiting in airports can be quite boring and often this can lead to posting updates from mobile device. Whether it’s your location or that selfie where your hair looks just right, criminals are more able to monitor your whereabouts via social activity and take advantage of you when you have the weakest protection.

Be Careful When You Share : We love to share our experiences with friends and family via social media, but it’s important to not indicate publicly where or when you’ll be taking that relaxing vacation. Wait until you return home before posting all about it; otherwise, you could leave yourself open to would-be thieves who want to know when your home will be vacant.

Limit Wi-Fi and Bluetooth Use : Data can be expensive but switching on Bluetooth and Wi-Fi when out and about can be a recipe for disaster. Connecting to unprotected Wi-Fi and Bluetooth devices can expose your personal information to a cyber-criminal. You should be especially careful when exchanging payment information. With this in mind, make sure to update your Bluetooth and Wi-Fi history by removing previously ‘remembered’ wireless networks like ‘cafewifi.’

Check and Monitor Your Accounts : Keep an eye out for suspicious activity in your bank account history. If you aren’t meticulous about monitoring your activity, a criminal could have access to your accounts for quite some time before you are aware.

Find more information, please visit Blog post from Gary Davis

Study Methodology

The research was conducted between 18th–29th March, 2016 by MSI via an online questionnaire to 1,423 people in India, age 21-54. Global study was conducted across 13,960 consumers between the ages of 21 to 54, evenly split by gender.

600 phones (about 15%) were broken while the user was clicking a selfie. The data also showed that about 2400 people (about 60%) comprised female users out of which a majority (about 70%) were in the age bracket of 18 to 25 years.

600 phones (about 15%) were broken while the user was clicking a selfie. The data also showed that about 2400 people (about 60%) comprised female users out of which a majority (about 70%) were in the age bracket of 18 to 25 years.

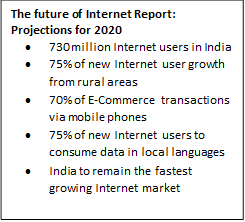

The National Association of Software & Services Companies [NASSCOM]

The National Association of Software & Services Companies [NASSCOM]