The Deloitte Global RPA Survey 2018 provides clear indication regarding the significance of RPA benefits: payback was reported at less than 12 months, with an average 20% of full-time equivalent [FTE] capacity provided by software robots.

Adopters’ expectations have been exceeded with respect to improving compliance [92%], quality and accuracy [90%], or productivity [86%], to mention a few. This is the case cross-industry, but we should not forget that banks are pioneers of digital transformation simply because automation technology serves them so well.

A simple reason for this is that Robotic Process Automation [RPA] can assist in dealing with some of the main current challenges in banking, i.e. the need to improve customer service to live up to the standards of a growing number of tech-savvy clients, who expect very precise and rapid processes.

Some of the effects of delegating the responsibility for mundane processes to bots are faster outcomes, not marred by errors, or optimised advisory services.

Robotic Process Automation can streamline banking operations, making them more efficient and simultaneously lowering costs. According to UiPath, by automating the trade settlement in a global investment bank, the Average Handling Time [AHT] to process trades was reduced from 40 minutes to 3 minutes, with an expected effort benefit of 444 hours per year.

Robotic process automation [RPA] in banking in 2020

Saying that RPA will revolutionise banking in 2020 is a strong statement indeed. What can we expect to happen automation-wise during 2020 in the banking sector?

Orchestrated use of other tools and technologies [e.g. the cloud], more premises for higher-value jobs, improved employee and customer satisfaction, enhanced human-robot collaboration, to name but a few.

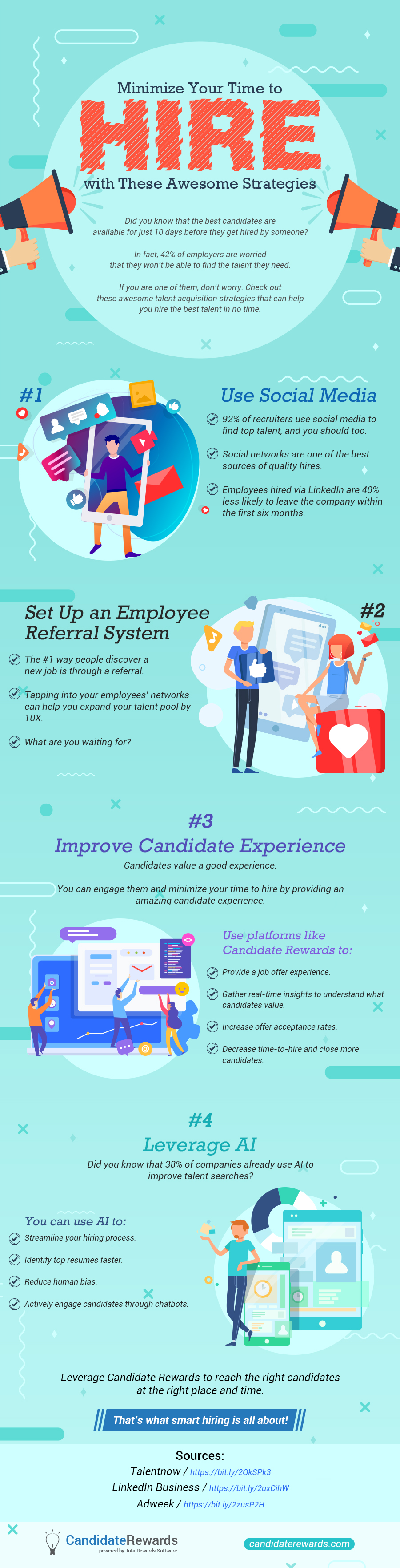

We believe the most important development is that robotic process automation adoption is set to become mainstream. This should be easier to understand if you consider that some leading RPA service providers will begin to broaden their reach to small and medium-sized businesses too.

What are the benefits of RPA in banking, the gains that you can reasonably expect to enjoy throughout the current year? In the first place, automation doesn’t require significant change in your IT department because implementation is just like adding another low-cost layer to the banking applications already in use.

The launch can be quick, since software robots can be tested in short cycle iterations. Then, employees can be trained to handle the bots themselves, without having to wait for help from the IT team. The significant reduction in AHT cited above is easy to understand if you consider software robots‘ scalability potential and their capacity to work around the clock, 365 days/year. Moreover, bots remove the burden of menial tasks from employees’ workload, thereby increasing the likelihood that they be satisfied with their jobs.

Let’s now see more concretely how Robotic Process Automation is likely to address some challenges the banking industry may face in 2020. Before diving into specific processes, let’s take a look at the general guidelines for selecting high impact application areas.

You should look for repetitive, mature and stable, rule-based, high frequency processes, with a low rate of variable outcomes and with readable inputs. We also recommend to start automating activities with measurable savings, in order to grant objective outcome evaluation and goal achievement. Here are 7 such examples.

1. Credit underwriting

This complex process can be broken down into retail credit assessment, and retail fraud prevention. The problem is that insufficient resources, particularly workforce resources, can weigh heavily on the staff when they have to carry out these tasks.

You’ll better grasp the size of this challenge if you consider the requirement to access multiple internal and external applications in order to bring to completion the two subprocesses of credit underwriting. But software robots’ integrative capacity allows them to access and process data fast and accurately. They can easily check relevant information, including scanning for suspicious activity about the credit applicant across different databases.

Bots can accurately predict the customer risk of fraudulent activity based on analysing these data patterns. They can then gather all the information needed for credit assessment and fraud prevention in a single report to be presented to the human credit analyst. The analyst is thus freed from the painstaking task of carefully tracking bank account and credit card activity, and can make a good decision based on the bot’s assessment.

A case study from UiPath provides an illustration of this scenario, where bots performed these activities in 5 minutes with exceptional accuracy [as opposed to one hour for manual processing].

2. Trade financing

This process calls for collection of documents in various formats, such as purchase orders, bills, or invoices. Software robots can easily parse through this variety of documents in order to capture, classify, and extract the relevant information.

Furthermore, they can also handle the matching and validation tasks. The outcome can then be delivered to the document management systems as a simple Excel spreadsheet.

3. Corporate loan processing

This activity requires, in the first place, collecting application forms and supporting documents from multiple sources, such as fax machines, printers, or email folders. Bots are not at all bothered by the need to check multiple sources. They scan the documents, categorize and extract the needed data, and export it to an Excel spreadsheet, which is part of the document repository.

4. Account opening

A whitepaper from Tata Consultancy Services named ‘Why Banks Must Bank on RPA’ gives the example of a global bank using software robots to pick out information from input forms, and deliver it to various host applications.

By so doing, the bank was able to avoid the daunts of manual processing, such as high rates of error and increased processing time. The outcome was indeed satisfactory: almost a third of processing time, zero error, and cost reduction of $50.000/year.

5. Customer service

RPA can easily handle customers’ low priority queries on its own, while allowing the human minds to concentrate on the high priority ones, which require more complex and intense processing [and offer correspondingly higher job satisfaction].

Software bots can verify faster and more accurately customer details from different sources, and consequently onboard them in a timely manner. The resulting capacity to reduce waiting times contributes significantly to the bank’s improved relations with customers and consequently, to their higher satisfaction with the bank.

6. Know Your Customer [KYC] processes

KYC is an essential compliance process for all banks. It is underpinned by activities such as customer data collection, screening, and validation. Given the software robots’ ability for fast and accurate data processing, they are prime candidates to take over these repetitive tasks.

7. Processing credit card applications

RPA software streamlines document gathering, making credit and background checks, and finally, deciding customer eligibility for credit card based on clearly set parameters. This results in substantial reduction of waiting times for credit card applications, thereby addressing an important challenge in banking.

Conclusion

Competition in the banking sector is fierce. Banks must use all resources to meet customer expectations, optimize costs, and react appropriately to FinTech players’ counter competition. They must do so in conditions of rising workforce costs and scarcity of skilled resources.

Simultaneously, the competitive atmosphere demands increased productivity. As you may notice, there are a lot of imperatives involved. They all call for leveraging robotic process automation in banking in order to successfully attain business targets such as cost effectively transforming the backend, decreased processing times, increased accuracy, overall efficiency, and quicker time-to-market.

It comes as no surprise then that RPA in the banking sector provides a good example of why automation is a noteworthy competitive advantage.

About the author

Daniel Pullen is General Manager at CiGen, one of the first dedicated Robotic Process Automation companies based in Australia. He is passionate about intelligent automation, robotics automation consulting and bringing the benefits of digital robotics into the workplace. You can find more about him here.