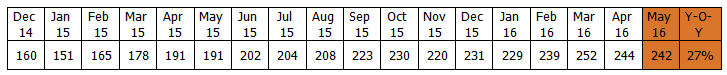

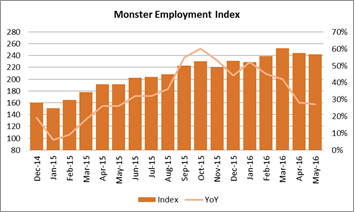

At a year on year growth rate of 27 percent in May 2016 the online recruitment activities saw a decline of 25 percentage points from a robust 52 percent in January 2016 according to the latest Monster Employment Index. A marginal drop from the year on year growth of 28 percent in April 2016.

At a year on year growth rate of 27 percent in May 2016 the online recruitment activities saw a decline of 25 percentage points from a robust 52 percent in January 2016 according to the latest Monster Employment Index. A marginal drop from the year on year growth of 28 percent in April 2016.

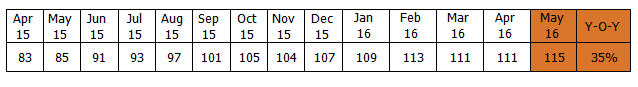

A noteworthy observation in the month of May was seen in the much publicized industry, e-commerce. Monster Employment Index [MEI] for May 2016 shows that the sector which is currently under economic scrutiny, witnessed a 35 percent year-on-year growth; one percentage point higher than in April 2016. Clearly, the sector is moving in a positive direction with steady increase in hiring activity over the months.

The online demand for Engineering professionals surged this month as well. The year-on-year growth rate paced up from 39 percent in April 2016 to 47 percent in May 2016. Charting the highest growth figures, Printing and Packaging industry is leading the rung with 67 percent growth from year-ago. The sector has been witnessing a steep double-digit annual growth rates since February 2016.

Commenting on the latest trends and developments in various sectors, Sanjay Modi, MD, Monster.com said

The MEI reveals that the online hiring sentiments is onto a slow paced growth. This hiring downturn can be attributed to domino effect caused by a global slowdown. However, the growth of the manufacturing sector in India at 7.1 percent from last year’s 5.3 percent year has had a significant bearing on the year on year spike in the online recruitment in the production and manufacturing sector. With a positive outlook for the sector that is expected to see the number of online shoppers in India grow to 175 million and Gross Merchandise value to reach $60 million by 2020, the e-commerce sector also registered a double digit year-on-year growth of 35 percent.

Monster Employment Index India results for the past 18 months are as follows

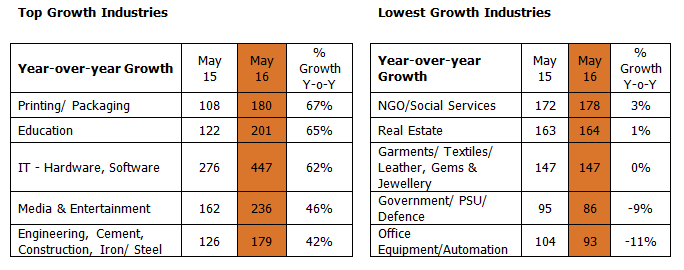

Industry Year-over-year Trends

Of the 27 industry sectors monitored by the Index 24 industry sector registered increased e-recruitment activity.

- Printing/ Packaging sector has moved up the ladder to lead all monitored industry sectors on a year-on-year basis. This month (May 2016) the sector has registered a 67 percent growth from the year-ago; the sector has been charting steep double-digit annual growth rates since February 2016. The six-month growth rate reveals, e-recruitment activity in the sector has increased by 34 percent between November 2015 and May 2016. Month-on-month, there has been an 11 percent growth in opportunities as well.

- Education (up 65 percent) sector is next in the rung. Online recruitment activity in the sector has been exhibiting uninterrupted positive growth on an annual basis since July 2015. It is notable that this is the only sector to have recorded positive month-on-month growth rate consistently since September 2015. Online hiring in the sector logged a seven percent growth on the month in May 2016.

- Online recruitment activity in IT – Hardware, Software (up 62 percent) continued to exhibit diminishing yet robust growth. For the second month in a row the sector witnessed no growth in short-term (month-on-month). Likewise, pace of growth (year-on-year) in the BPO/ITES moderated further from 20 percent in April 2016 to 18 percent in May 2016.

- Having slowed in the past months, the year-on-year growth momentum in Production and Manufacturing (up 35 percent) as well as Automotive/ Ancillaries /Tyres (up 36 percent) sector paced up in May 2016; up from 15 percent and 17 percent in April 2016 respectively. The month-on-month growth registered was also the steepest among all sectors; Automotive/ Ancillaries /Tyres (up 16 percent) and Production and Manufacturing (up 14 percent). The related Logistics, Courier/ Freight/ Transportation sector continued to growth at a steady rate of 15 percent year-on-year.

- Engineering, Cement, Construction, Iron/Steel registered a 42 percent growth from the year-ago; up from 24 percent in April 2016. In the related Real Estate sector, on the other hand, the year-on-year growth momentum eased further from four percent in April 2016 to one percent in May 2016.

- Healthcare, Bio Technology & Life Sciences, Pharmaceuticals exceeded the corresponding period a year-ago by 40 percent maintaining a steady pace. Month-on-month, there has been no growth in online hiring.

- Among all monitored sectors, online recruitment activity eased the most in Office Equipment/Automation (down 11 percent) sector on an annual basis.

E-Commerce

E-commerce sector registered a 35 percent growth from the year ago; one percentage point higher than in April 2016. Month-on-month, the sector has seen an increased demand of four percent. This month the six-month growth rate has also improved from six percent in April 2016 to 11 percent in May 2016. The growth pattern has exhibited no significant fluctuations in the past months.

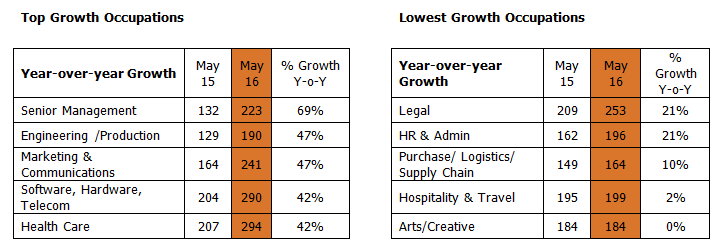

Occupation Year-over-year Trends

Online demand increased for 12 occupation groups out of the 13 monitored by the Index.

- The year-on-year growth rate moderated further for professionals at the Senior Management level; down from 79 percent in April 2016 to 69 percent in May 2016. Yet the figures portray a positive outlook owing to a significant jump since April 2015.

- Online demand for Engineering/Production surged this month. At four percent, the group registered the steepest month-on-month growth among all monitored job roles. The year-on-year growth rate paced up from 39 percent in April 2016 to 47 percent in May 2016.

- Year-on-year, Marketing & Communications (up 47 percent); Software, Hardware, Telecom (up 42 percent); Health Care (up 42 percent); Sales & Business Development (up 34 percent) are among the top in-demand job roles. The long-term growth rate moderated the most for Purchase/Logistics/Supply Chain (up 10 percent); down 27 percentage points.

- Online demand for Hospitality & Travel (up two percent) continues to decline progressively; the year-on-year growth momentum eased further by two points. The group also witnessed online opportunities slip below the three-month and six-month level by six percent and one percent respectively.

- Online demand for Arts/Creative matched the year-ago level. Year-on-year growth rate for the group has been declining progressively starting November 2015 and has a exhibited the most restrictive online demand this month.

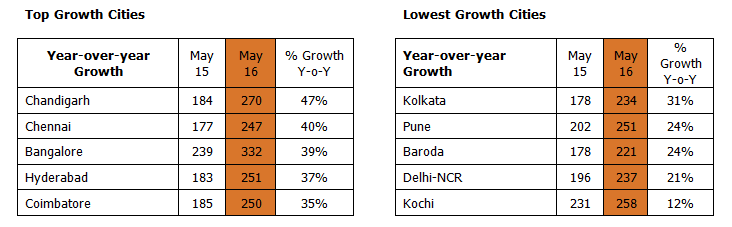

Geographic year-over-year Trends

E-recruitment activity increased in all 13 cities monitored by the Index.

- Chandigarh (up 47 percent) led all monitored cities charting the steepest growth year-on-year even this month. The rate of growth, nevertheless, moderated from 53 percent in April 2016 to 47 percent in May 2016. There were fewer opportunities on the month; down by two percent.

- Among tier I cities, Chennai (up 40 percent) followed by Bangalore (up 39 percent) and Hyderabad (up 37 percent) registered the steepest growth from the year-ago and also ranked among the top growth cities. The growth momentum slowed in Bangalore from 47 percent in April 2016. Delhi-NCR (up 21 percent) also witnessed a slowdown in the annual growth rate by two points between April and May 2016.

- The annual growth momentum improved in Kochi; from four percent in April 2016 to 12 percent in May 2016. Nevertheless, Kochi continues to exhibit the most controlled annual growth percentage among all monitored cities. Both three-month and six-month growth rate are still negative for the city; down three percent each.

About the Monster Employment Index

Launched in May 2010 with data collected since October 2009, the Monster Employment Index is a broad and comprehensive monthly analysis of online job posting activity in India conducted by Monster India. Based on a real-time review of millions of employer job opportunities culled from a large, representative selection of online career outlets, including Monster India, the MEI presents a snapshot of employer online recruitment activity nationwide.

MEI’s underlying data is validated for accuracy by Research America, Inc.-an independent, third-party auditing firm – to ensure that measured national online job recruitment activity is within a margin of error of +/- 1.05%. For more information, please visit Monster Employment Index