Intel Security have released its McAfee Labs Threats Report: March 2016, which assesses the attitudes of 500 cyber-security professionals toward Cyber Threat Intelligence [CTI] sharing, examines the inner workings of the Adwind Remote Administration Tool [RAT], and details surges in ransom-ware, mobile malware and overall malware in Q4 2015.

In 2015, Intel Security interviewed 500 security professionals in a wide variety of industries across North America, Asia Pacific and Europe to gauge awareness of CTI, its perceived value in enterprise security and which factors may stand in the way of greater implementation of CTI into security strategies. Respondents provided a valuable illustration of the present state of and potential opportunities for CTI in the enterprise:

- Value perception and adoption – Of the 42 percent of respondents who report using shared threat intelligence, 97 percent believe that it enables them to provide better protection for their company. Of those participating respondents, 59 percent find such sharing to be “very valuable” to their organizations, while 38 percent find sharing to be “somewhat valuable”.

- Industry-specific intelligence – A near unanimous 91 percent of respondents voice interest in industry-specific cyber threat intelligence, with 54 percent responding “very interested” and 37 percent responding “somewhat interested.” Sectors such as financial services and critical infrastructure stand to benefit most from such industry-specific CTI given the highly specialized nature of threats McAfee Labs has monitored in these two mission-critical industries.

- Willingness to share – Sixty-three percent of respondents indicate they may be willing to go beyond just receiving shared CTI to actually contributing their own data, as long as it can be shared within a secure and private platform. However, the idea of sharing their own information is met with varying degrees of enthusiasm, with 24 percent responding they are “very likely” to share while 39 percent are “somewhat likely” to share.

- Types of data to share – When asked what types of threat data they are willing to share, respondents say behavior of Malware [72 percent], followed by URL reputations [58 percent], external IP address reputations [54 percent], certificate reputations [43 percent] & file reputations [37 percent].

- Barriers to CTI – When asked why they have not implemented shared CTI in their enterprises, 54 percent of respondents identify corporate policy as the reason, followed by industry regulations [24 percent]. The remainder of respondents whose organizations do not share data report being interested but need more information [24 percent], or are concerned shared data would be linked back to their firms or themselves as individuals [21 percent]. These findings suggest a lack of experience with, or knowledge of, the varieties of CTI integration options available to the industry, as well as a lack of understanding of the legal implications of sharing CTI.

McAfee Labs Threats Report (March 2016) also assesses the Adwind Remote Administration Tool [RAT], a Java -based backdoor Trojan that targets various platforms supporting Java files. Adwind is typically propagated through spam campaigns that employ malware-laden email attachments, compromised web pages and drive-by downloads. The McAfee Labs Report depicts a rapid increase in the number of .jar file samples identified by McAfee Labs researchers as Adwind, with 7,295 in Q4 2015, a leap of 426 percent from 1,388 in Q1 2015.

Q4 2015 Threat Statistics

- Ransomware accelerates again – After slowing slightly midyear, new ransom-ware regained its rapid growth rate, with a 26 percent quarter-over-quarter increase in Q4 2015. Open-source ransom-ware code and ransom-ware-as-a-service continue to make it simpler to launch attacks, the Teslacrypt and CryptoWall 3 campaigns continue to extend their reach, and ransom-ware campaigns continue to be financially lucrative. An October 2015 analysis of the CryptoWall 3 ransom-ware hinted at the financial scale of such campaigns, when McAfee Labs researchers linked just one campaign’s operations to $325 million in victim ransom payments.

- Mobile malware jumps – The fourth quarter of 2015 saw a 72 percent quarter-over-quarter increase in new mobile malware samples, as malware authors appear to have produced new malware faster.

- Rootkit malware collapses – The number of new rootkit malware samples dropped precipitously in Q4, continuing a long-term downward trend in this type of attack. McAfee Labs attributes some of this decline, which began in Q3 2011, to ongoing customer adoption of 64-bit Intel processors coupled with 64-bit Microsoft Windows. These technologies include such features as Kernel Patch Protection and Secure Boot, which together help better protect against threats such as rootkit malware.

- Malware rebounds – After three quarters of decline, the total number of new malware samples resumed its ascent in Q4, with 42 million new malicious hashes discovered, 10 percent more than in Q3 and the second highest count ever recorded by McAfee Labs. In part, the growth in Q4 was driven by 2.3 million new mobile malware samples or one million more than in Q3.

- Malicious signed binaries decline – The number of new malicious signed binaries has dropped each quarter for the past year, in Q4 2015 reaching the lowest level since Q2 2013. McAfee Labs believes the decline can be attributed in part to older certificates with significant presence in the dark market are either expiring or being revoked as businesses migrate to stronger hashing functions. Also, technologies such as Smart Screen represent additional tests of trust which might make the signing of malicious binaries less beneficial to malware authors.

For more information on these focus topics or more threat landscape statistics, Please visit March2016ThreatsReport for the full report. For online safety tips on how consumers can protect themselves from the threats mentioned in this report, visit Consumer Safety Tips Blog.

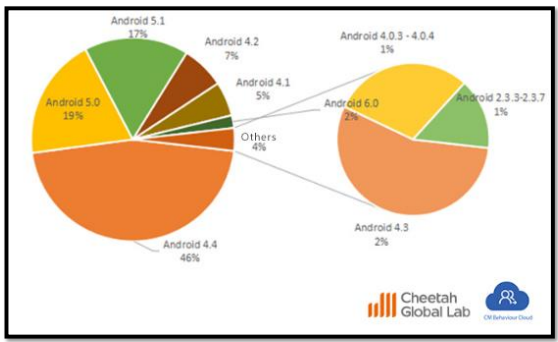

The above chart demonstrates the percentage of different Android versions which have been loaded with Clean Master. As can be seen, Android 4.4 accounts for 46%, which is about half of the total number. Android 5.0 and 5.1 rank the second and third. While Android 6.0 only makes up 2%.

The above chart demonstrates the percentage of different Android versions which have been loaded with Clean Master. As can be seen, Android 4.4 accounts for 46%, which is about half of the total number. Android 5.0 and 5.1 rank the second and third. While Android 6.0 only makes up 2%.