Snapdeal, India’s largest online marketplace reported that the deployment of its in-house hybrid cloud solution Snapdeal Cirrus, has led to a massive impact on cost and business optimization – the headline being a whopping 75% drop in its monthly infrastructure costs.

Snapdeal Cirrus is built entirely using open source platforms like Openstack with a home grown layer of infrastructure-as-code built on top of it, making it not just an industry-first in India, but also one of the largest deployments of a hybrid cloud anywhere in the world.

Since its launch in last September, Snapdeal has migrated over 300 micro-services and 200 data-stores onto Cirrus, without any downtime required. During this massive live migration, it built the capabilities to orchestrate any micro-service at will on their own private cloud or any of the public clouds like AWS, Azure or Google Cloud Platform.

Rajiv Mangla, Chief Technology Officer, Snapdeal said

Since the launch of Snapdeal Cirrus our monthly burn on public cloud has been cut down to one-fourth. When we decided to build a hybrid solution, our infrastructure needs were growing exponentially and in a short span of 10 months we have built an extremely reliable and scalable platform, with a small but extremely talented team.

The addition of Snapdeal Cirrus to Snapdeal’s innovative technology platform, has led to massive cost savings, but has also lead to exponential performance gains across its applications, providing a consistently more reliable and frictionless experience to customers across India.

About Snapdeal

Snapdeal’s vision is to create India’s most reliable and frictionless commerce ecosystem that creates life-changing experiences for buyers and sellers. In February 2010, Kunal Bahl along with Rohit Bansal, started Snapdeal. Today Snapdeal is India’s largest online marketplace, with the widest assortment of 50 million plus products across 800 plus diverse categories from over 125,000 regional, national, and international brands and retailers. In its journey till now, Snapdeal has partnered with several global marquee investors and individuals such as SoftBank, BlackRock, Temasek, Foxconn, Alibaba, eBay Inc., Premji Invest, Intel Capital, Bessemer Venture Partners, Mr. Ratan Tata, among others. For further information, please visit Snapdeal

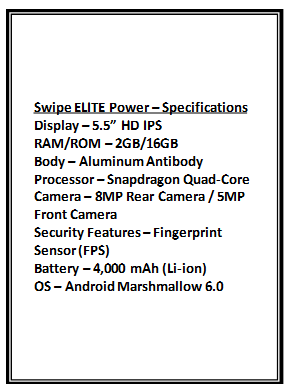

display, every picture, every color and every detail comes alive to give a great visual experience. Powered by 2GB RAM, ELITE Power is a powerhouse of performance, making multi-tasking a way of life while helping gamers to play graphic-heavy games without any lag. ELITE Power comes with an internal memory of 16GB, which is expandable up to 32GB for users to store all the pictures, videos, music and more.

display, every picture, every color and every detail comes alive to give a great visual experience. Powered by 2GB RAM, ELITE Power is a powerhouse of performance, making multi-tasking a way of life while helping gamers to play graphic-heavy games without any lag. ELITE Power comes with an internal memory of 16GB, which is expandable up to 32GB for users to store all the pictures, videos, music and more.

CASHe, India’s fastest loan giving app for young salaried professionals has entered into a strategic sales partnership with India’s largest financial distributor,

CASHe, India’s fastest loan giving app for young salaried professionals has entered into a strategic sales partnership with India’s largest financial distributor,