Denave, a global sales tech organization focused on driving revenue growth for its customers, recently unveiled its sales force automation solution DenSales. DenSales is Denave’s proprietary Sales Force Automation tool that is designed and developed to address all the existing as well as possible business challenges while implementing a feet-on-street strategy. It is a holistic solution for planning and managing the field force program, offering end-to-end visibility to all the stakeholders in the sales ecosystem.

DenSales, available in both web and mobile interfaces, has been created to address pertinent sales process issues such as inaccurate process of capturing sales data, fraudulent reporting, limited stock visibility, absence of structured communication platform, limited first-hand market insights and more.

Commenting on the product launch, Prashant Rohatgi, Global Head – Technology, Denave said

DenSales is a definitive 360-degree sales force automation solution that not only gives an absolute control of the sales process to the stakeholders thus preventing sales leakage, but it is also pivotal towards increasing the productivity of the field team. It features sales force engagement and performance, fraud prevention, on-the-go training, closed loop issue management and market intelligence. It has unique combination of mobile app and web console to capture information faster and real-time dashboards and actionable reports to disseminate seamlessly.

Sharing his views on the product’s future roadmap, Snehashish Bhattacharjee, Global CEO, Denave, said

With DenSales, we aim to make Intelligent Sales Force Automation a reality – one that is intuitive and predictive. It will eventually act as an Executive Assistant to the stakeholders where it becomes their one-stop go-to-platform for all sales force-related business decisions. Most importantly, it will be a business essential for providing that critical last mile visibility, which in the current scenario is mostly missing. The reactions of our initial customers have been very heartening, and we are confident of DenSales becoming a business-essential and a market success soon.

Denave has been enabling sales for organizations since over 19 years now and has influenced more than 5 billion USD in revenues. Denave significantly diversified its service line in 2017 and introduced Digital Marketing and Sales Analytics as new services, contributing to revenue across all industry verticals including technology, telecom, ONG, Consumer Durables, FMCG, E-commerce, mobile wallets & more.

About Denave

Denave is a global sales enablement company focused on driving revenue growth for its customers through a wide range of service offerings. The company leverages latest technology trends and disruptive approach to create effective sales engines. Denave has built multi-industry expertise partnering with global businesses and takes a solution-conscious approach to deliver best practices in sales by leveraging people, processes, technology and innovation to drive revenue. Denave has reach across 5 continents, 50+ countries and 500+ cities globally. For more information, please visit Denave

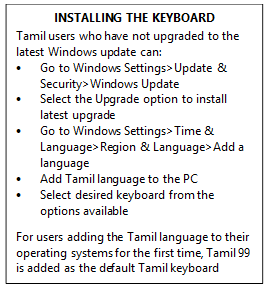

While the Tamil keyboard based on

While the Tamil keyboard based on