MoneyTap, India’s first app-based credit line, has crossed 1,00,000 app installs in three months since launch, becoming the fastest app-based lending start-up to achieve the feat. The company has also lowered minimum salary eligibility to INR 20,000 per month and made the service available to consumers living in shared accommodation.

Since lowering the entry barrier late December 2016, MoneyTap has seen a huge demand from consumers in the lower-middle income group, with average salaries of around INR 22,000 per month and or living with their friends in shared housing.

In the last 20 days, more than 25% consumers who have applied for MoneyTap are in this category. This new category of young consumers, working in public, private or multinational companies in Tier-1 and Tier-2 cities are underserved by the financial institutions and are usually shunned in the absence of credible credit history. MoneyTap realised the need to tap this segment and provide credit line to the eligible shared accommodation dwellers with credible KYC. This is a significant number of potential customers for MoneyTap.

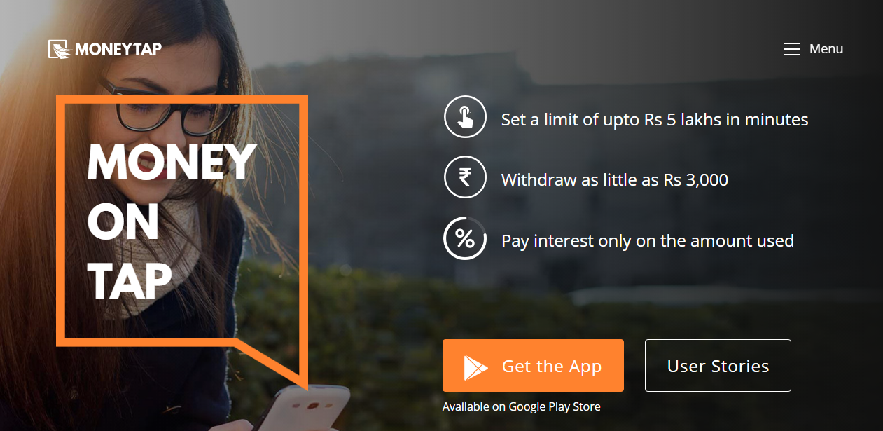

MoneyTap introduced the concept of a Credit Line [personal line of credit for consumers] for the first time in India when it launched in end of September 2016. “Credit Line” means that the bank will issue a limit of up to INR 5 lakhs, without any collateral or charging any interest.

The credit limit could range from INR 25,000 to INR 5 Lakhs depending on individual credit history. With a patent-pending chat interface, the free app rapidly evaluates the user’s credit in 7-minutes and tells them right then and there the amount they are eligible for. Against this limit, using the MoneyTap app, consumers can borrow as little as INR 3000 or as much as INR 5 lakhs and repay it as EMIs from 2 months to 3 years. Interest is paid only on the amount borrowed and rates can be as low as 1.25% per month. Credit limit also gets automatically topped up as soon as EMIs are paid back.

MoneyTap launched the product in September end with its first banking partner, The RBL Bank. RBL’s technology enables MoneyTap to provide instant decision and instant access to money, 24/7, irrespective of holidays. Though all actions are initiated on the MoneyTap app, per RBI guidelines, all financial transactions such as billing, repayment or withdrawals are directly dealt with the bank using secure APIs. Consumers do not have to hold a bank account or any other account with the partner bank to avail MoneyTap. As an added convenience for shopping needs, a MoneyTap RBL Credit Card is also provided to the user. This is a regular MasterCard Credit Card that is accepted at all locations and for all card purchases – offline and online.

The MoneyTap app is available on Android Playstore to all salaried employees, living in Ahmedabad, Vadodara, Delhi NCR, Mumbai, Bangalore, Pune, Hyderabad & Chennai. The company is continuously expanding across India and will soon be announcing other cities. Qualified customers, after completing the KYC [right from the app with no paperwork involved], will pay a one-time Line setup fee of INR 499 + tax in their first month e-settlement. This includes the cost of issuing the limit for the customer, a free MoneyTap RBL MasterCard and a slew of other benefits. There are no hidden fees or charges and every time the customer chooses to take an EMI, they will be shown the interest & any other applicable charges and the customer will be required to provide explicit consent before borrowing.

Bala Parthasarathy, Co-founder, MoneyTap says

We are humbled by the feedback we have received from our customers and are happy that we have been able to reach a large number of them. Since its inception, MoneyTap’s focus has been to enable easy access to small credit needs. The lower-middle income group in India is largely underserved by financial institutions. It is also a segment which is expanding and in need of credit. With the proliferation of smartphones in every nook & corner of the country, an expanding middle-income group and increasing ability to earn and spend, it will be interesting to see how access to a Credit Line will change their lives.

About MoneyTap

MoneyTap is a Bengaluru-based