We all know the importance of an insurance plan in this fast paced life. We insure our cars, house, bike, life and even mobile phones these days. Most of us have also insured our health by buying a health insurance plan but is it sufficient? In today’s fast paced life, life has become un-certain since we never know when a mishap can happen, this would not only affect you but your dependents as well !!

We are all aware that ‘Predictability‘ is the most ‘Un-Predictable‘ thing in life. All of us work hard to have a better life for us as well as our loved ones. When anyone thinks about such a scenario, the thought that comes at the back of our minds is “What would happen to my parents/kids etc. when I am not with them”. You would never want them to be financially challenged. This is a very critical question and since it is critical, you would always need to a “Rock-Solid answer” to it. Life Insurance is the answer to all these ‘worrisome’ questions. Life Insurance policy can help prepare for life’s uncertainties such as creating provisions for your family and loved ones following your demise.

However, choosing the right Life Insurance policy is many-a-times (if not always :)) very difficult since you are at the hands of the Insurance Agent who would show Rosy Pictures about the coverage, returns etc.

The most critical pointers to keep in mind while choosing a policy are:

- Premium Payment

- Payment Cycle [Monthly/Quarterly/Weekly]

- Sum Insured and hidden Terms & Conditions [T&C]

- Dependents covered in the Policy

The list of questions can be endless and the probable answer to all these dangling questions is a SOLID Insurance Plan. When my family members were discussing about Insurance Plans, there was a suggestion about eSmart Term Plan. We delved a bit into the plan and liked it (as compared to traditional policies), today we have a look at some of the benefits about the plan.

What is eSmart Term Plan

eSmart Term Plan is a pure life insurance plan, that can be bought online. You have the freedom to choose the amount your family will require in an unfortunate event and this amount will be paid to them as the Sum Assured. The protection plan is available to everyone and is not limited to the banking customers of Canara, HSBC and OBC. To put in simple words, it is a traditional insurance plan without any Bonus facility.

Benefits of eSmart Plan

There are many insurance companies (which we also see in TVC) that explain the pain-point of choosing the right insurance plan, the pain claimants have to go through when their dear one’s are no more etc. eSmart Term Plan solves those pain points, let’s have a look at them:

- You get an insurance policy at a low cost

- Easy Buying via Online channel. One of the major advantages of the policy is that it can be purchased online through Online Life Insurance thus many of the hassles are removed 🙂

- There is an option to cover accidental death

- Tax benefits on Premium Payments

- Dedicated Claims Manager who would be the one-point contact for settlement of claims. This is very important since everytime you call up the call-center agent, you might talk to a new agent and appointment of Dedicated Claims manager makes the claim process less frustrating & friction-less.

OnlineLifeInsurance : Less Hassles, Faster execution

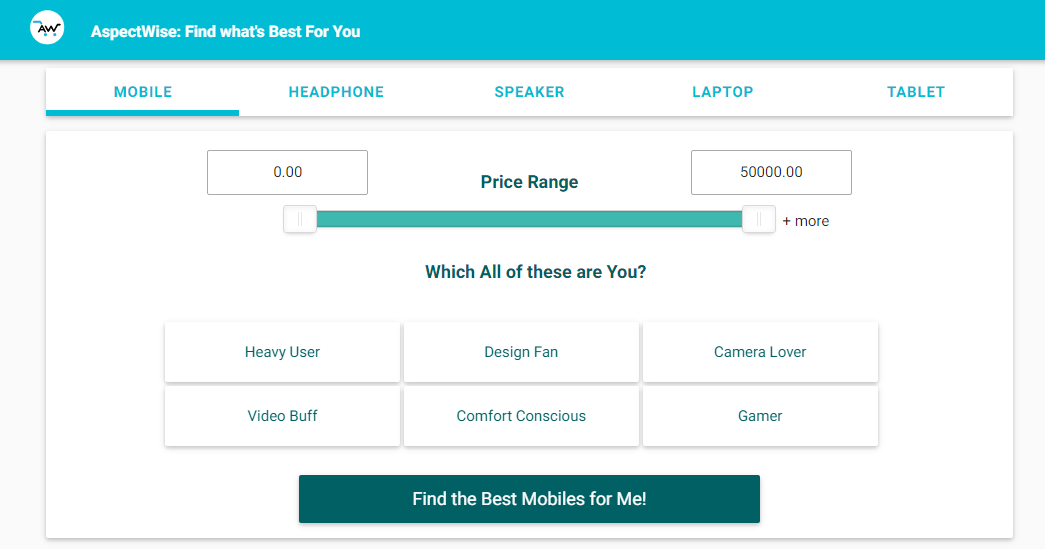

As mentioned in the previous point, the plan can be purchased online through OnlineLifeInsurance, a microsite dedicated to eSmart Term Plan. Buying Insurance plan is a simple four step process and you can get an insurance cover in less than 10 minutes. You can get a cover of Rs 50 Lakhs for as low as Rs 3878 [Please refer https://www.onlinelifeinsurance.co.in/#calculator for detailed information].

There would be many questions popping up in our minds when buying insurance – How much insurance cover do I really need ? This depends on your age, earnings, health conditions, number of dependents etc. The Insurance Calculator helps you out to zero-in your insurance cover. It is a nice tool to simplify your insurance requirements !!

Unlike the other insurance companies, where processes and calls are endless; in eSmart Plan things get done in minimal clicks 🙂 No paper-work means less pain !!!

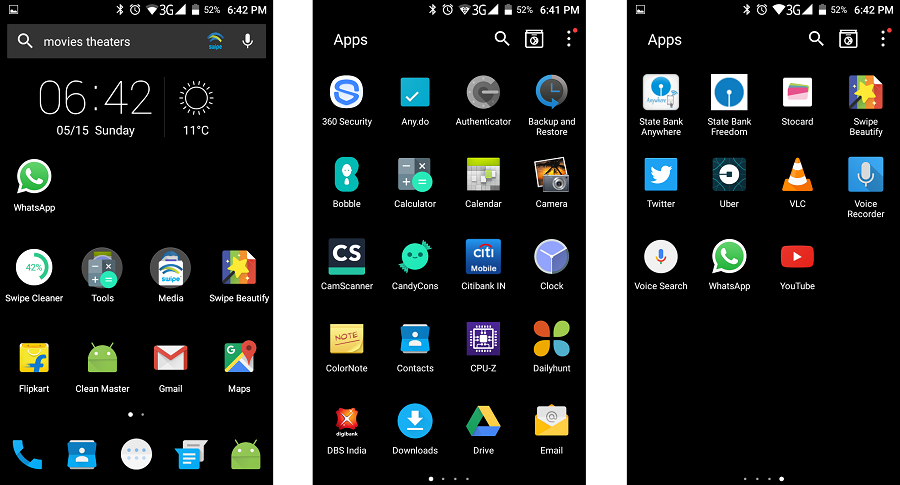

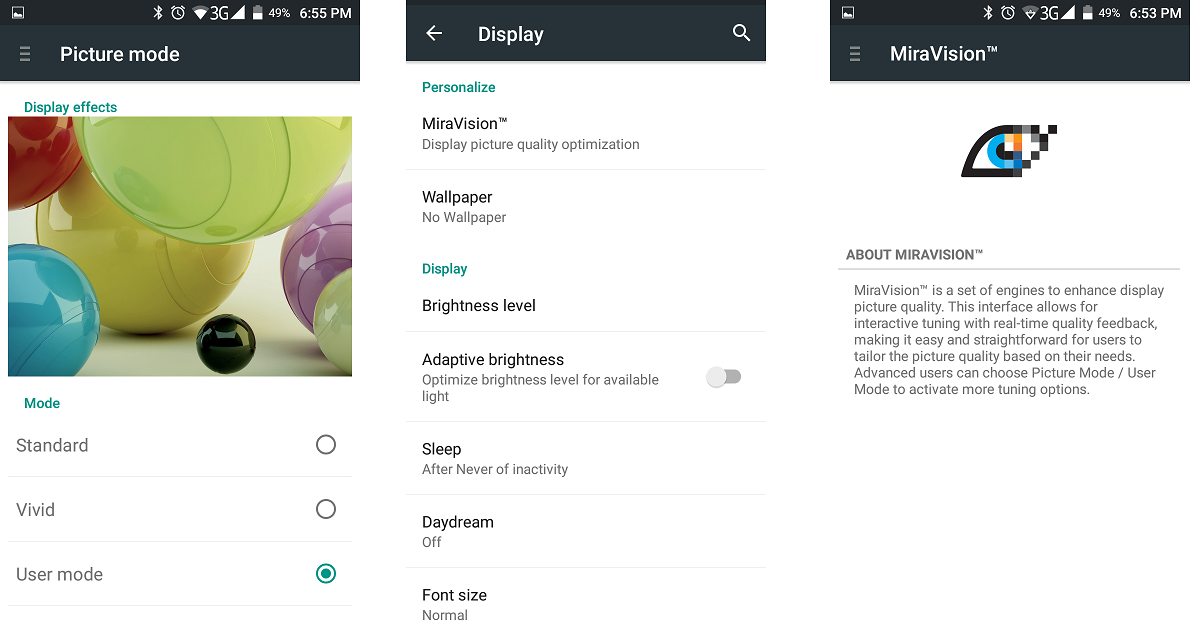

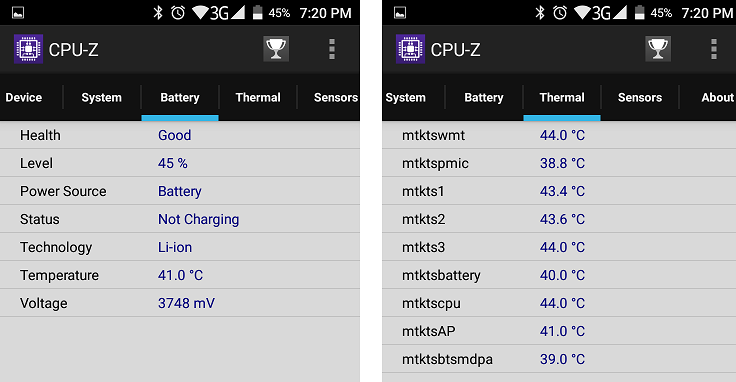

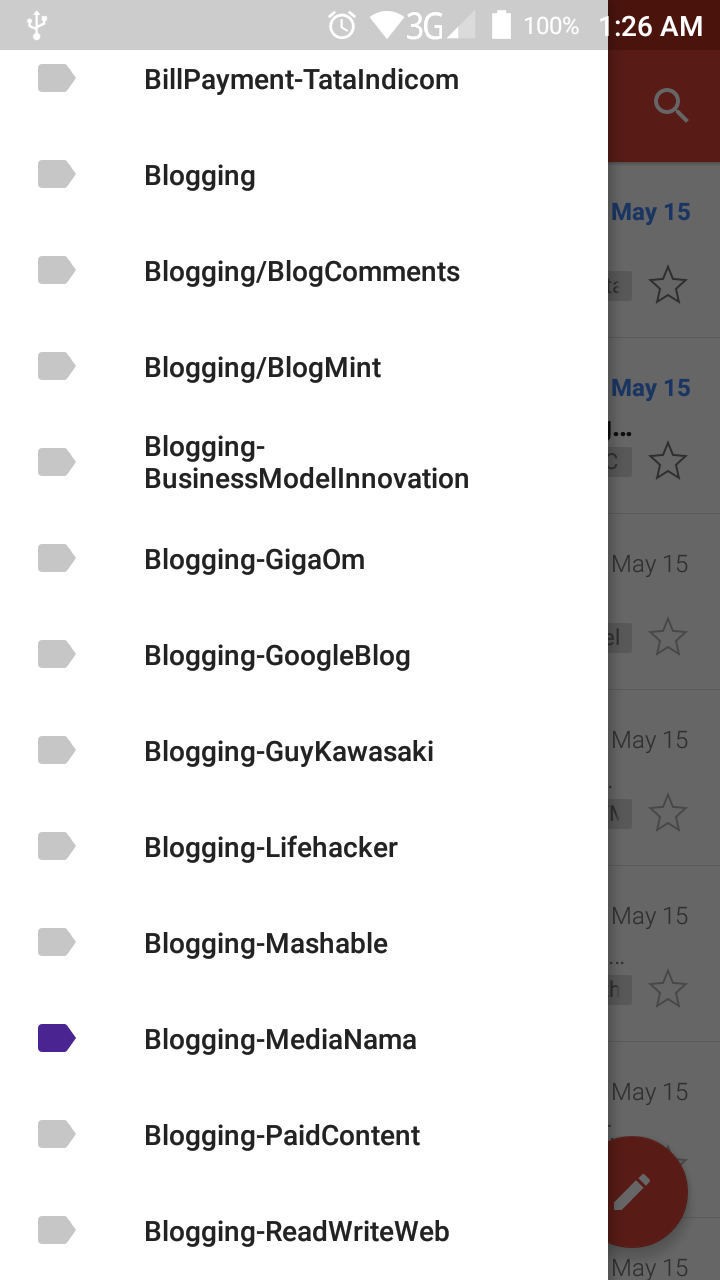

It would have been even better if there was an Android App of OnlineLifeInsurance so that they could also utilize the mobile medium (which has become much more important than desktop).

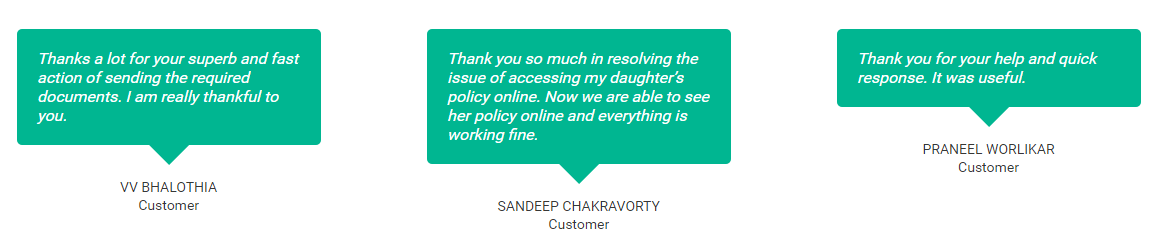

eSmart Plan : Voice of Customers

The success of any brand depends on the service that it has provided to it’s customers. Customers who have opted for eSmart Plan have found it to be beneficial which can be easily seen from the Testimonials Page

In fact, CHOICE (Canara Bank, HSBC & Oriental Bank of Commerce) won Best Brands 2016 at ET_Edge You can refer to this page for more information on CHOICE.

Strong Brand, Encouraging Customer sentiments definitely gives an upper hand when compared to it’s competitors…

eSmart Plan : Closing Thoughts

As mentioned in this article, it is very important that we follow the PSI [Protect, Save and Invest] approach so that our hard-earned money is invested in the right place. If you are planning to safeguard the future of your family members, log on to OnlineLifeInsurance and get yourself insured ….

If You Fail to Plan & You Plan to Fail

![]()