As the earnings of any person increases, it becomes very important to plan the investments also carefully. In fact, with exponential earnings, investments in terms of “Life Insurance” becomes very critical. To give an example, when I had taken a Home Loan, the returns [every 4 years] of a “Cash Back Life-Insurance” policy came in very handy irrespective of the size of amount. Just like a dialogue in the movie Spider-man “With great power, comes great responsibility”, the analogue of that in insurance terms would be “More earnings means investments should be thought-off, planned & should provide good insurance cover” !!!

It becomes critical that you choose the right company, right policy that reaps the best returns…

Overview of Life-Insurance

Life insurance or life assurance is a contract between the policy owner and the insurer, where the insurer agrees to pay a sum of money upon the occurrence of the policy owner’s death. In return, the policy owner agrees to pay a stipulated amount called a premium at regular intervals. From an investor’s point of view, an investment can play two roles – asset appreciation or asset protection.

The core benefit of life insurance is that the financial interests of one’s family remain protected from circumstances such as loss of income due to critical illness or death of the policyholder. Simultaneously, insurance products also have a strong inbuilt wealth creation proposition.

Benefits of Life-Insurance

Life insurance allows long term savings to be made in a relatively painless manner because of the low and convenient investments made through premiums. More investment options make your money work harder, but there are no substitutes to the life insurance. Because only a life insurance gives you both – risk cover against your life as well as returns on your money invested like a “Money Back Policy”. Amongst the most known benefits of Life Insurance is the savings on your income taxes. So, a life insurance policy is an ideal tool to gain security and ensure savings. If you require loans, say for building a house, it can be easily obtained against a life insurance policy which was there in my case !!!

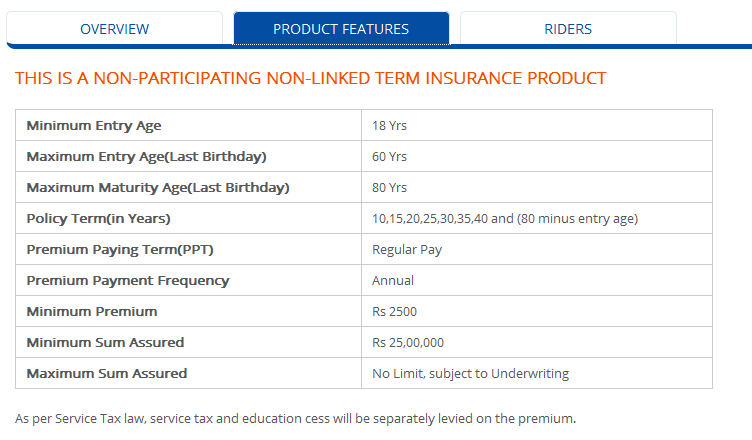

Edelweiss tokio Life – MyLife+

When it comes to Insurance, there are many options that are available to the customers, however from an investment perspective & life-cover, Edelweiss tokio Life MyLife+ insurance policy provides both the benefits.

Some of the key-features of the product are below:

- Flexibility of payout options

- Cover up to the age of 80 years

- Low Cost Term Assurance Plan

- Tax benefits for premium and claim amount

- Comprehensive Cover Through Riders

- Low Cost Term Assurance Plan

Source – Edelweiss Tokyo Life MyLife+

Source – Edelweiss Tokyo Life MyLife+- Choice of payout options i.e. monthly, annual or combination of both.

- Term period of 80 years which is highest in the industry.

- HDFC Life Click 2 Protect

- Aviva i-Life Term Plan

- ICICI Prudential Icare Term Plan

Given that the policy-holder has options to pay the insurance amount & the way that Edelweiss Tokio Life MyLife+ is tailor-made to handle different kind of customers [as mentioned above], it definitely has a winning-edge over it’s competitors !!!

If you have taken the MyLife+ policy & want to share your experience, please leave a comment…

Image Credit – Edelweiss Tokio Life – MyLife+

![]()