If you are using a two-wheeler, it is of utmost importance that you avail two-wheeler insurance to stay on the right side of law. When you choose an extensive two-wheeler insurance policy akin to the ones offered by Bajaj Allianz General Insurance, it will also cover you financially against a variety of mishaps. Such mishaps could include anything from a theft of the two-wheeler to an accident or even calamities.

There are two types of insurance policies that you can choose for your two-wheeler. Let us learn more about them.

Understand the Difference

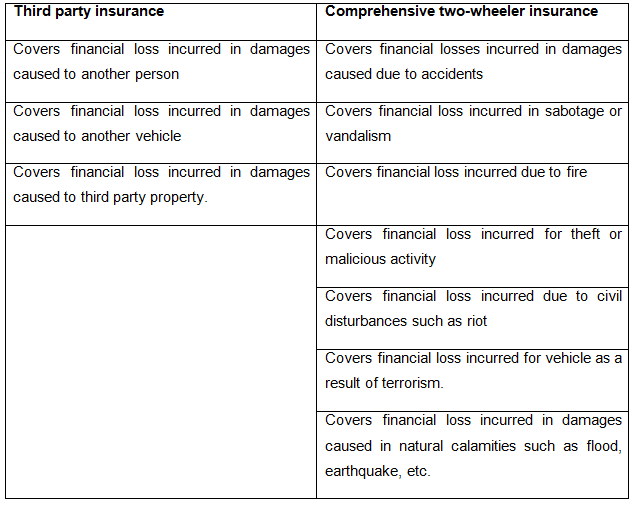

The first is the third party insurance for bike which is a mandatory policy according to the Motor Vehicles Act of 1988. It will cover for the financial losses suffered for injuries of another person, vehicle or property. The second type is the comprehensive insurance for Two-wheeler which is an amalgamation of third party and own liability. This means that it will not only financially cover you for the damages sustained on the third party but also for your own losses.

This policy extends financial support for all damages caused to your vehicle and third party vehicle. It is important that you are made aware of the inclusions and exclusions that both entail and also the benefits attached to each.

Table of Inclusion

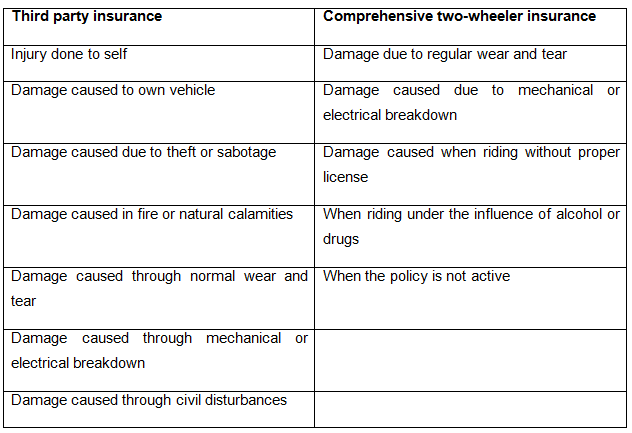

Table of Exclusion

Identify the Benefits

The benefits of third party insurance are as follows

- Covers third party damages to property and life

- Covers driver disability or death

- Comparatively lower premium than other policies

- Easy procedure for documentation

Benefits of comprehensive two wheeler insurance are

- Restoration and maintenance of vehicle after mishap

- Protection against rider disability or death

- Protection against third party damages to property

- Medical expenses of injured rider covered

Two-Wheeler Insurance Calculator

You must know that it is now easier than ever before to calculate your two wheeler insurance premium using the bike insurance calculator at Bajaj Allianz General Insurance. All you have to do is enter your bike’s registration number and request quotes on the various insurance policies that are available at your disposal. You can read all about the privacy policies that we have and rest assured that your private information will never be shared with a third party.