What is one thing that comes to our minds when we refer the term banking? An immediate picture that we visualize is about customers lined up in different queues for getting their banking work done – a brick and mortar banking experience where long waits are normal to get queries sorted and numerous follow-ups and visits to the bank branches for document submission, etc. are regular features. The list can be endless but the picture being portrayed may not be relevant to the Banks of today since Digital Banking is changing the face of banking.

Now touch a button and you would come to know whether you are eligible to apply for a home-loan of ‘x’ amount or what should be your ideal investment approach to save taxes. Though there are some banks that like to reinvent the technological wheel, banks like HDFC Bank have pioneered to transform into a Digital Bank via partnerships, in-house innovations, and building products with a customer-centric approach. HDFC Bank is India’s largest private-sector bank and a bank that it too big to fail as per the Reserve Bank of India [RBI].

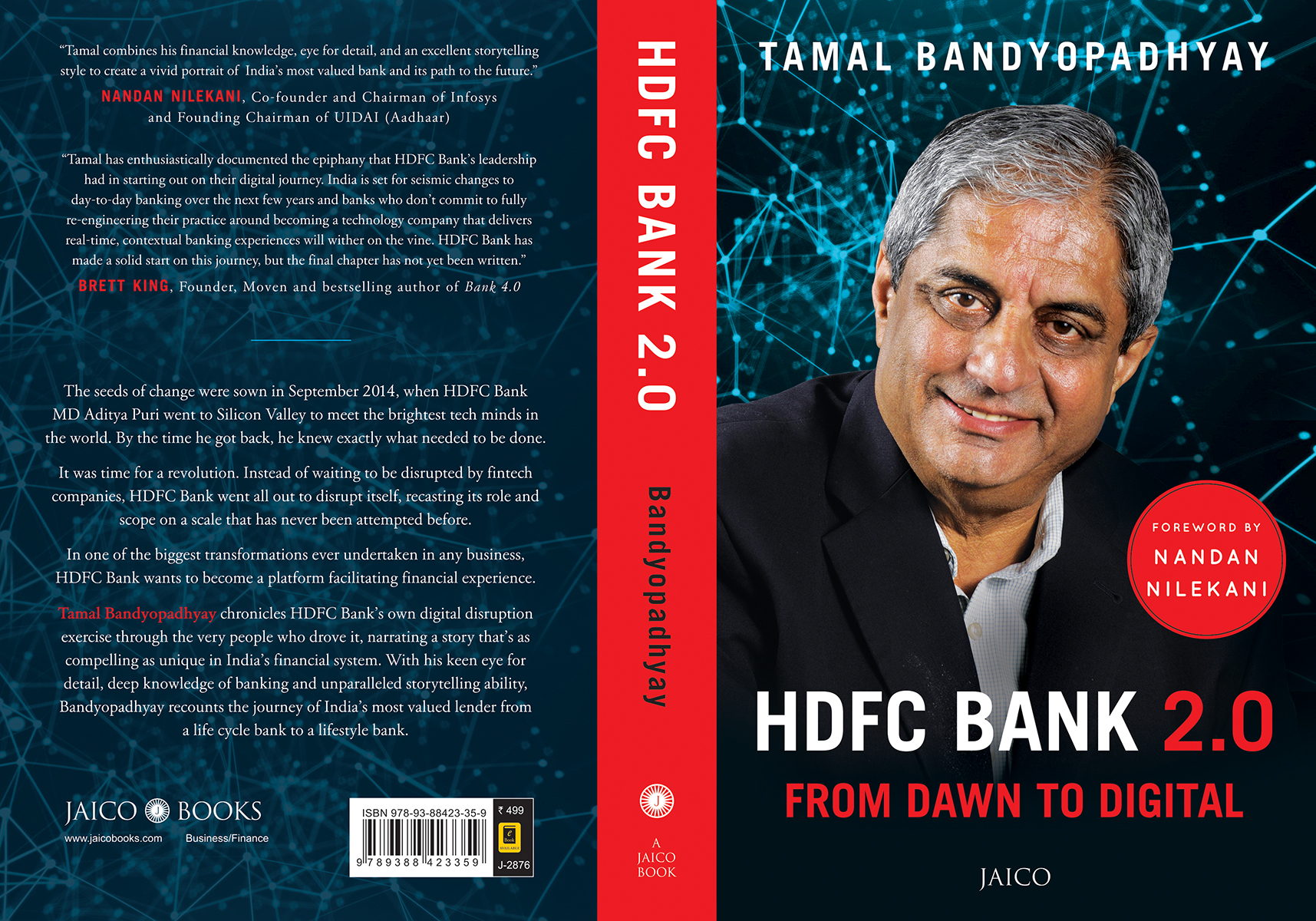

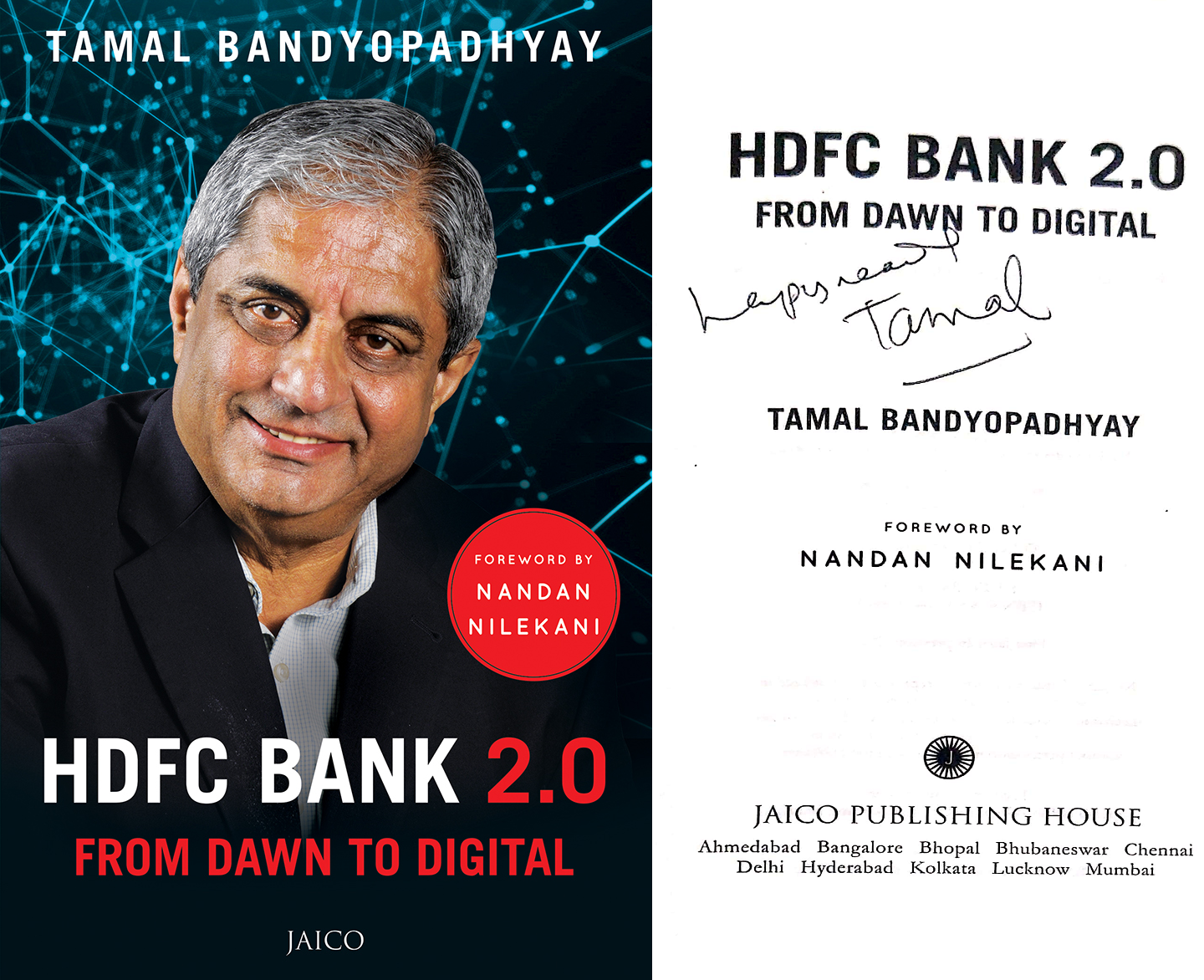

How did HDFC bank manage to transform itself from a Lifecycle bank to a Lifestyle bank? How did the bank shape its digital journey? What are some of the innovations from the largest bank in India by market capitalization? If you are curious to know the behind the scene transformation story, you must grab a copy of HDFC Bank 2.0: From Dawn to Digital by renowned journalist Tamal Bandyopadhyay.

Aditya Puri, the MD of HDFC Bank also considered as Bachchan of Indian banking is one man who led this transform from forefront. He has been at the helm for 25 years; his journey in HDFC Bank started way back in 1994 when he joined as India’s Chief. The book captures the bank’s journey under the leadership of Aditya Puri. Tamal Bandyopadhyay combines his financial knowledge, eye for detail, and excellent storytelling style to create a vivid portrait of India’s most valuable bank and its path to the future.

The book is divided into three sections

- The Digital Journey

- The Flashback

- The Puri Legacy

In the year 2015, dramatic changes were happening in the financial services sector due to simultaneous trends in technology, regulation, and markets. The rise of the smartphone, India’s unique ID system Aadhar, and payment innovations like Unified Payment’s Interface [UPI] were creating a branchless distribution channel. This was the time when the Reserve Bank of India [RBI] issued license to many new banks dedicated to payments to bring in fresh, technology-savvy competition. It is around the same time i.e. September 2014 when seeds of transformation were sowed in HDFC Bank. It was time to be disrupted or become a disruptor!

Aditya Puri had made a trip to the Silicon Valley, a year earlier in September 2014, to have a bird’s-eye view of the innovations and developments in the Valley. The idea was to gauge the kind of impact technology has on the finance and banking sector. The lesson learned was that the team at HDFC Bank had to roll-up their sleeves to lead the digital disruption in India. The top-guns in the bank were convinced that to shape the ideas at a lightning-fast speed, they had to act and execute like a startup.

They worked on a series of strategies to reduce the turn-around time involved in core banking systems like loan processing/approval, a recommendation of useful products based on customer’s profile, accelerated funds transfer, mobile banking, shopping, etc. Digitization would not only enhance the overall customer experience but it would also reduce the operating costs.

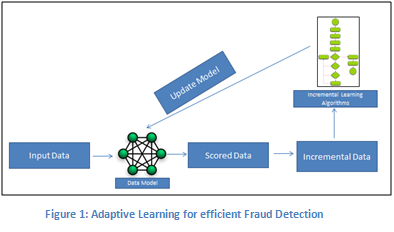

It is important to note that before leveraging digital technologies, HDFC Bank came up with the idea of ‘missed call banking’ in the year 2013. Though HDFC Bank was not the inventor of the technology, it was the first to implement it at scale! The strategy ahead was to provide speed, use technology to do credit & risk management at scale, improve customer experience using Artificial Intelligence [AI] & Machine Learning [ML], leverage the power of Aadhar [eKYC, UPI, etc.] and other elements of the India Stack.

This led to the development of products like Chillr [money transfer over the phone using an App], EVA [Electronic Virtual Assistant]; a chatbot to handle queries from customers, migration from internal systems of record to platforms so that the bank can provide API [Application Programming Interface]. series of innovations enabled the bank to launch new products in the consumer banking & loans category for both urban & rural customers.

HDFC bank also came up with the idea of SmartBuy where everything [traveling, shopping, etc.] was available at one place. The bank did not charge a commission from their sellers since the intent was to increase the overall customer base and provide a gamut of services to its customers.

The book touches upon many such innovations, some of them were developed in-house and many were developed by partnering with start-ups & leading companies in banking & finance software. This might be of huge interest to entrepreneurs, management professionals, CEOs as well as engineers who want to execute things at scale. It also walks us through the leadership style of Aditya Puri, his customer engagement skills [even at a grassroots level], his Lucky-13 team that built the bank and, finally, how a big organization [like HDFC Bank] can achieve wonders by becoming agile in changing the business environment.

The Flashback section also talks about the initial days of the formation of the bank, how Deepak Parekh hand-picked Aditya Puri for the important job, and more.

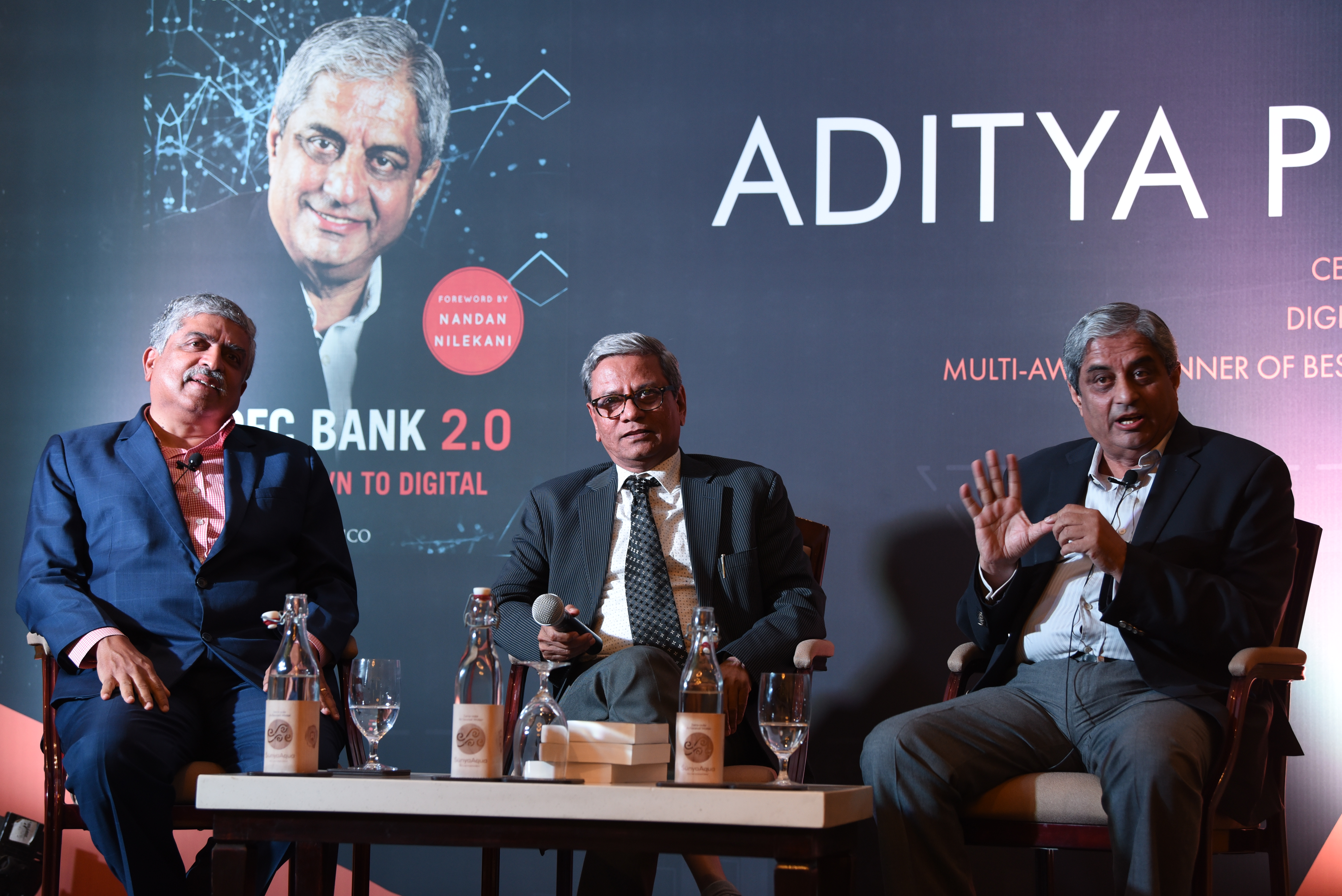

We had an opportunity to attend the launch event of the book in Bengaluru where the author, Aditya Puri, and Nandan Nilekani were present. Aditya Puri shed some light on his personal life as well and how he manages to have work-life balance even at his position. It was fun as well as insightful to attend the event. Along with the knowledge that we gained, we also got a signed copy of the book!

Have you read the book ‘HDFC Bank 2.0 – From Dawn to Digital‘; do leave your biggest learning from this immersive read.