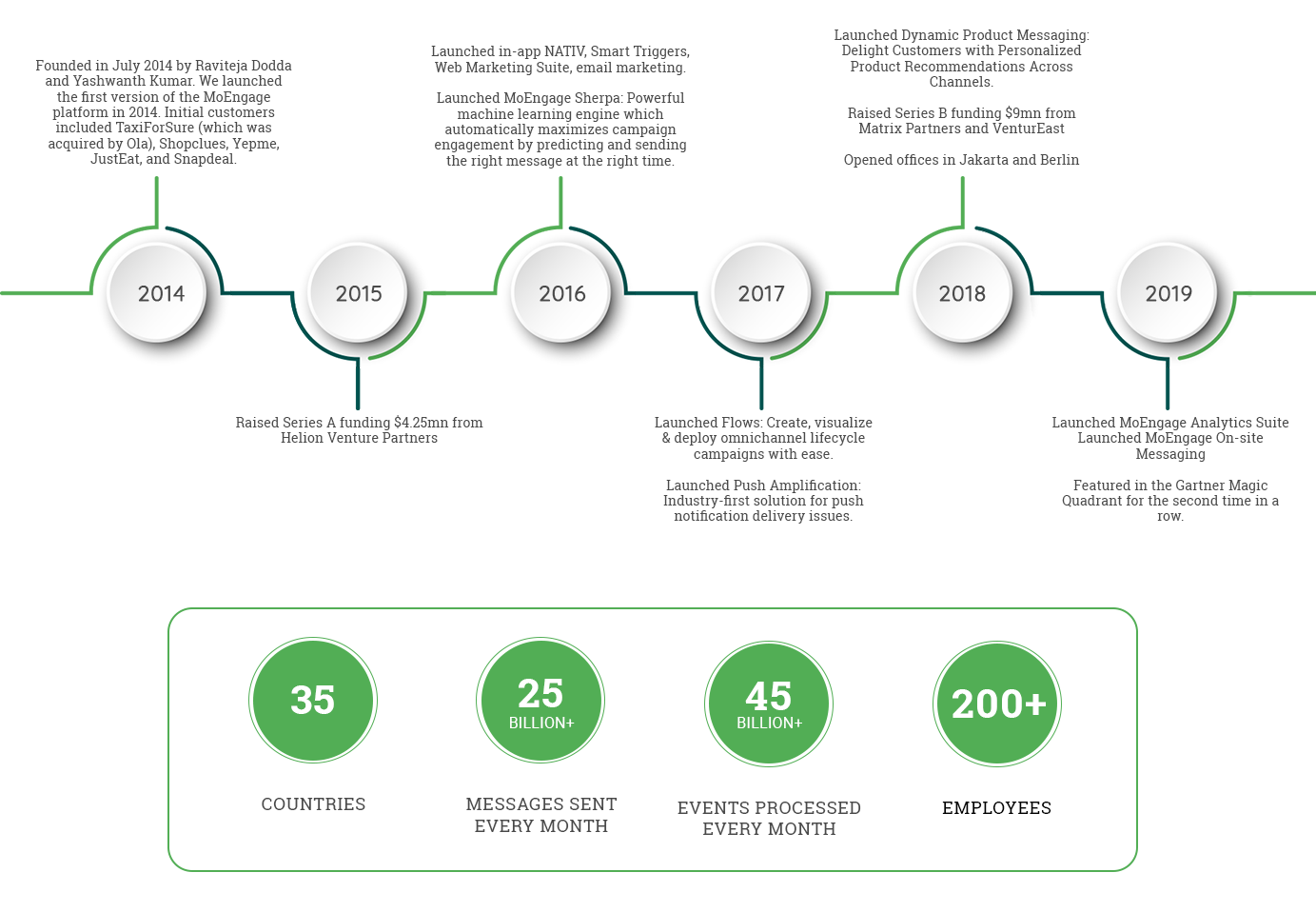

Five years ago, MoEngage was an idea in the minds of founders Raviteja Dodda and Yashwant Kumar; a design to transform user experience and help internet companies retain customers. Today, the startup counts five of the Fortune 500 brands as its customers along with internet biggies such as OYO, Gaana, Tokopedia, and Traveloka among several others.

Here’s the story of MoEngage – APAC’s fastest-growing customer engagement and analytics platform.

Raviteja Dodda and Yashwant Kumar, both alumni of IIT – Kharagpur, having co-founded DelightCircle app – a leading offers network in India, had first-hand experienced the profits of using technology to engage and retain users. They joined hands to build a prototype in early 2014. The product was ready six months later with a few customers willing to try out. Among other things, the cloud-based product created a unified view of the users’ multi-point interactions with a brand and start using this data to personalize communication with these users.

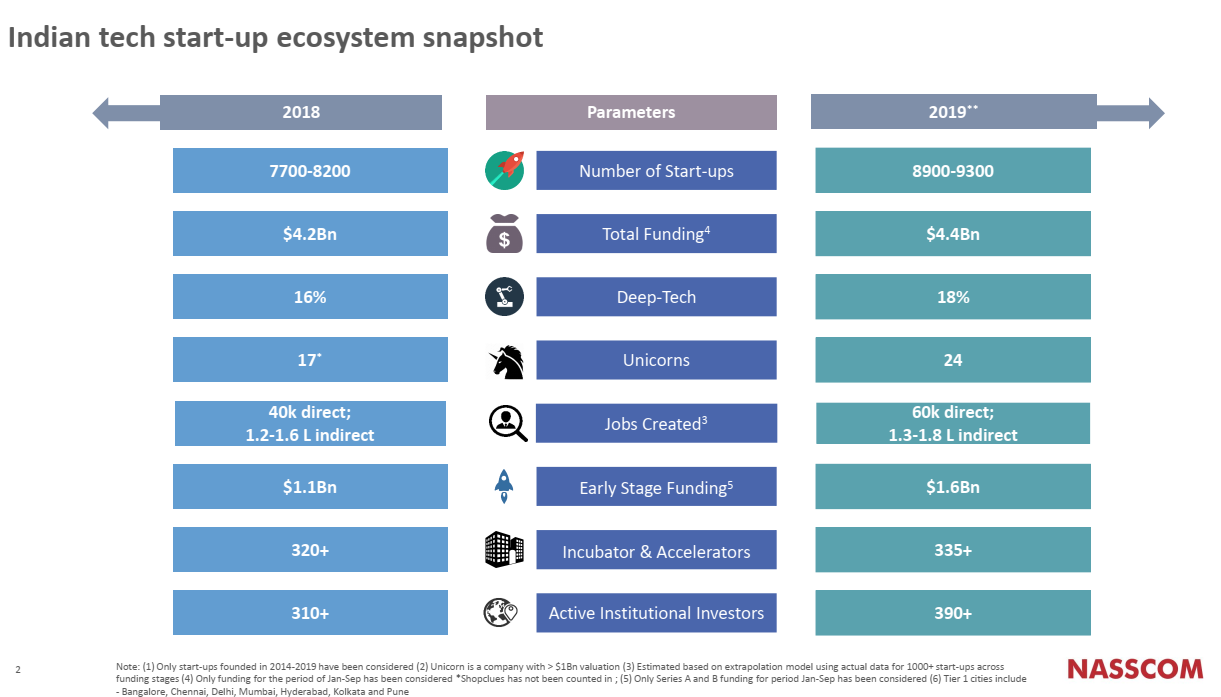

Today, MoEngage has emerged a purpose-built mobile marketing platform suitable for enterprises in Asia, the U.S., and Europe. Over 50% of the company’s revenue now comes from enterprise clients – an indication of the widespread adoption and maturity of the product. The company grew 200% in the last financial year and is now targeting a revenue of $25MM by 2020. It has raised $14.5 million in funding from marquee investors – Matrix Partners, Ventureast, Helion VC, and Exfinity Ventures. More importantly, the company today has over 500 clients in over 35 countries.

MoEngage is a company who planned to reach $25mn in 2020.Unlike most saas startups who focus on established categories like CRM, ERP, Cloud, etc. MoEngage decided to start off as a cross-channel customer engagement platform by creating a category itself. The business & Marketing operations was focused to initiate a product-feature led growth model primarily targeting enterprise as a category whereas others target SMBs. Asia and SEA markets were chosen for business operations vs companies who typically target the West for such growth.

MoEngage was also recently included in the 2019 Gartner Magic Quadrant for Mobile Marketing Platforms – for the second time in a row and believes it (inclusion) is a validation of its image as a complete marketing automation platform for digital enterprises. It is also the only mobile marketing platform from APAC to have featured in the Gartner Magic Quadrant for two consecutive years.

As the company marks its fifth anniversary, Raviteja Dodda, CEO and Co-founder, MoEngage, says

Building a global business requires a relentless focus on the product and the people. We have created a company that is driven by values that encourage freedom, ownership, and leadership. The results of which, is seen in the traction for our product and the positive feedback from our customers. The company is 200+ strong and has offices in Bengaluru, Jakarta, London, Berlin, and San Fransisco.

MoEngage’s phenomenal five-year journey is also a strong counter to those who claim B2B businesses can’t be built in India and to those who typically focus B2B selling toward the West. “We developed an East-first approach to our product. Large consumer base who are increasingly getting on the internet to get things done, rapid adoption of smartphones, its unique technology & cultural challenges, and rise in disposable income made East a perfect fit for our product,” said Raviteja Dodda, Co-founder and CEO, MoEngage.

The customer continues to be at the heart of MoEngage’s growth. Case in point, MoEngage Sherpa, a set of machine-learning algorithms that auto-optimizes the content and timing of the messages delivered to users. This saves MoEngage customers countless hours and dollars spent on experimenting with marketing campaigns. Another example is the proprietary Push Amplification Platform.

It effectively solves a problem marketers all over the world have been grappling with, high failure rates on push notification delivery. Recently, MoEngage consolidated its customer-focused approach with yet another thought-leading product, Dynamic Product Messaging. DPM enables companies to make highly personalized recommendations to their customers, dramatically transforming the user experience.

About the future, this is what Raviteja has to say

It’s gratifying to know that we have been able to register such strong growth and establish a strong brand identity in these last five years, merely on the strength of our superior technology and relentless focus on customers. We want to continue doing that and work towards our vision of creating the world’s most trusted marketing cloud out of India.

About MoEngage

MoEngage is an intelligent customer engagement platform, built for the mobile-first world. With AI-powered automation, optimization capabilities, and in-built analytics MoEngage enables hyper-personalization at scale across multiple channels like mobile push, email, in-app, web push, On-site messages, and SMS. Fortune 500 brands across 35+ countries such as McAfee, Samsung, Hearst, and Deutsche Telekom use MoEngage to orchestrate their omnichannel campaigns. MoEngage has been featured on Gartner’s Magic Quadrant and is the youngest company on the list. For more information, please visit MoEngage.