Thinking of purchasing your first car insurance policy? First, gloss over these numbers to know why you need to have one at the earliest!

In the calendar year 2018, the Indian states and Union Territories reported a total of 4,67,044 road accidents. Even though India is a signatory of the Brasilia Declaration, wherein it intends to bring down the numbers by 50% within 2022, it remains a far-fetched objective.

To account for it, however, the Indian government has amended the Motor Vehicles Act, 1988. According to this amendment, traffic fines on all traffic violations have been hiked. The revised challan rate on uninsured vehicles is Rs. 2,000.

Now that you are aware of its necessity, let us walk you through some tips which are imperative for every first-time insuree.

Tips to Follow Before Securing Your First Car Insurance Policy

When you are purchasing your first vehicle insurance policy, it is crucial that you go through the points which are discussed below. These are the following:

1. Choose Which Type of Car Insurance Policy You Want for Yourself

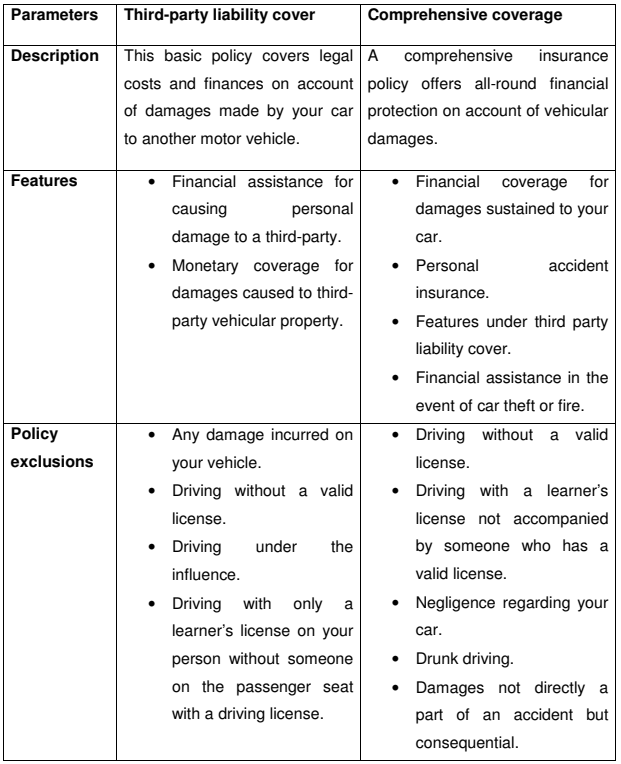

The first step is to learn about the different car insurance policies available in the market. There are majorly 2 types of car insurance present in India – a) Comprehensive Car Insurance & b) Third Party Car Insurance.

Know more about the difference between both the types in the table below with their specific features.

You can also opt for add-ons over and above your preferred car insurance policy. These include –

- Zero depreciation cover.

- Consumable cover.

- Tyre protection cover.

- Return to invoice cover.

- Breakdown assistance.

2. Look for Different Car Insurance Providers and Their Service Feedbacks

After you have decided which insurance policy you want to purchase, it is time for you to choose an insurer. You can find about their service promptness and how convenient their service is through social media comments, Google reviews, etc.

3. Check Out the Buying and Claiming Process of Car Insurance Policies with Different Insurers

Seek insurers that have a hassle-free along with fast purchase and claim settlement facilities. It is best to have an insurance policy as early as possible to ensure you can take your car out for a drive and not wait for a prolonged period for your insurance policy to be activated. Also, a hassle-free and fast claim settlement process would allow you to avail financial assistance at the earliest in the event of an accident.

4. Learn about the Claim Settlement Ratio of Different Insurance Providers

A substantial ground on which you can make your decision about an insurance provider is their claim settlement ratio. It is the ratio of the number of claims they have settled, and the number of claims reported to them.

5. Find out about NCB Policies of Various Insurers

What is No Claim Bonus (NCB) ?

NCB or no claim bonus is the discount you receive on premiums for a year if you do not make any claims in its preceding year. Although it will not be applicable on your first premium, it is necessary to know the NCB rates of different insurers beforehand to make the most out of your car insurance policy.

6. Look for Premiums as Per Your Affordability

Premiums are what you need to pay every year to keep your insurance policy activated. Check the premium of third party or comprehensive or zero depreciation car insurance offered by various insurance providers and check for the discounts they are providing on those premiums. Always choose the car insurance based on your premium affordability and coverage provided by the insurer so that it does not burn a hole in your pocket.

7. Check for Policies with High IDVs

What is meant by IDV?

IDV stands for Insured Declared Value, which is the highest sum assured by an insurance company as compensation in the event of theft or complete damage due to an accident. Look for policies that offer high IDVs and options to customise such value to maximise your benefits.

In addition to these, if you want to maximise your benefits from an insurance policy, check network garages and voluntary deductibles under an insurance policy before purchasing.