Earlier on this blog, we have reviewed a couple of Investment Plans, Stocks, etc. and so far we have received encouraging comments. Many of the readers touch based over Facebook and informed us that they have invested in one of the stocks that we have reviewed & have yielded excellent returns! Such news motivates us to write more about Finance 🙂

When it comes to investing, we take precautionary steps like reading review about investment plan/stock/insurance online, consult known experts in the domain, consult known people who have already invested in the same, etc. However, the problem is that there is a plethora of information available online that can really confuse an investor. Same is the case with investing in stocks.

Way back in the late-1990’s or early-2000’s, investors were heavily reliant on the brokers or sub-brokers that were present in their locality. They had a good amount of information about the markets, stocks, etc. and could guide investors in person as well. However, once the technology became a key player in the complex field of investments and stock trading, traditional brokerage houses like Indiabulls, ICICI Direct, ShareKhan, etc. became the torch-bearers of this change. A majority of these brokers, also known as full-service brokers used to charge a certain percentage from the trade amount. Fast forward now, with the evolution of Artificial Intelligence, Machine Learning, Big Data and other modern technologies, the brokerage space is also disrupted by new-age fintech startups as well as established financial institutions.

There are a number of trading platforms from the likes of Zerodha, ICICI Direct, India Infoline, Edelweiss, Angel Broking, etc. and each of them has various types of Trading accounts [Standard, Prepaid], different brokerage charges, transaction charges, demat account charges. When it comes to trading, brokerage fees, website usability, yearly maintenance fees, etc. play a vital role in the growth of the platform and customer retention. We have a look at some of the trading platforms available for investors from the perspective of account opening & maintenance charges, brokerage fees, fees of stock delivery, intraday trading, etc.

Note: Review based on usage, interaction with existing users of these trading accounts, research, and other parameters.

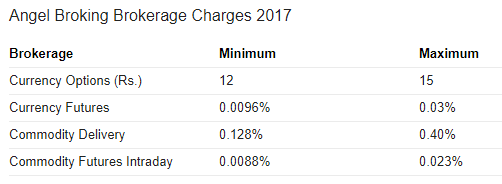

Angel Broking

Angel Broking is one of the oldest brokerage companies in the country. It is operational since 1987. They have a PAN India presence and along with technology enabled DEMAT & Trading account, they also provide offline services where investors can place orders via a phone call or by visiting their sub-brokers facility.

Account Opening Charges: No account opening charges. You can start trading in one hour.

Yearly maintenance charges: No charges levied for the first year.

Brokerage features and charges

- Access to all market segments of BSE, NSE, MCX & NCDEX

- Weekly research reports from financial experts

- Supports both browser and app-based trading. Platform is available across mobile, tablet and desktop

- Personalized customer support

- Different brokerage plans Angel Classic, Angel Preferred, Angel Elite & Angel Premium available for a different set of investors. Further details can be found here

Intraday Trading: Intraday trading, as the name suggests, is trading stocks within trading hours in a single day and investors can do intraday trading on Angel Broking platform. More details about Intraday Trading on Angel Broking can be found here

5paisa.com

5paisa.com provides a single account for all your investments. They charge a flat rate of Rs. 10 per order irrespective of the segment you trade or the value of your trade. They charge Rs. 750 as account opening fees and the annual fees [for Demat and Trading account] is Rs. 400.

Brokerage features and charges

- Access to all market segments of BSE, NSE, MCX & NCDEX

- Weekly research reports from financial experts

- Trading platform accessible across mobile, tablet and desktop

- Personalized customer support

Further details about the pricing can be found here

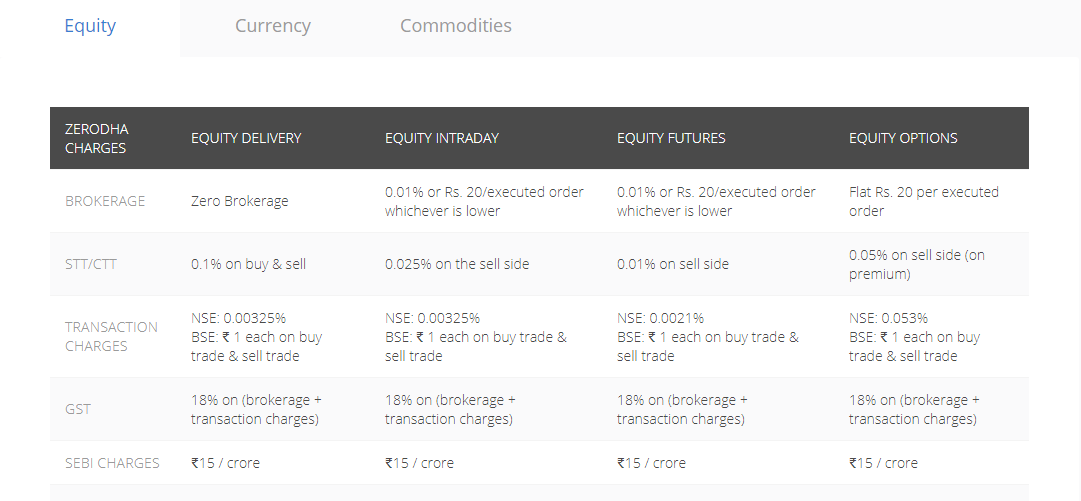

Zerodha

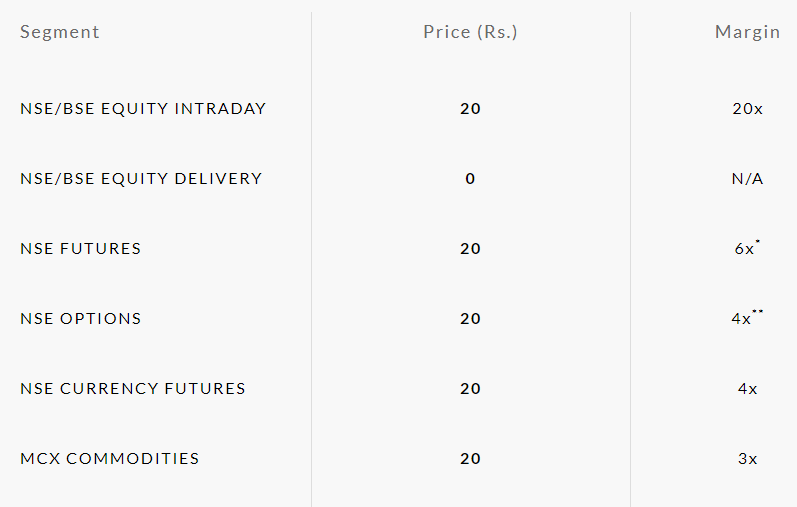

Zerodha is a Bengaluru based bootstrapped startup that has pioneered the concept of discount brokerage. With Zerodha, an investor can open an account instantly and start trading. They are also called as Flat Fee Share Broker since they charge Rs. 20 or 0.01% [whichever is lower] per executed order on intraday trades across equity, currency, and commodity trades across NSE, BSE, and MCX. They do not have any minimum brokerage.

Brokerage features and charges

- Access to all market segments of BSE, NSE, MCX, MCDEX, Mutual Funds, etc.

- All your equity delivery investments [NSE, BSE], absolutely free

- Trading platform accessible across mobile, tablet and desktop

- Customer support via email, phone, and chat

More details about the pricing can be found here

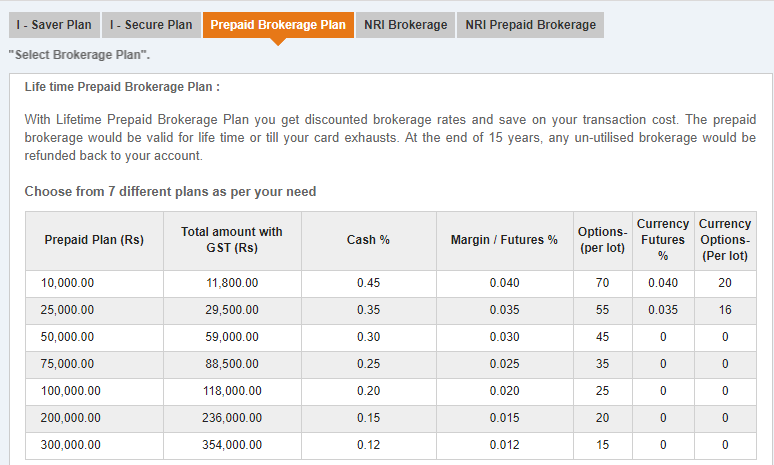

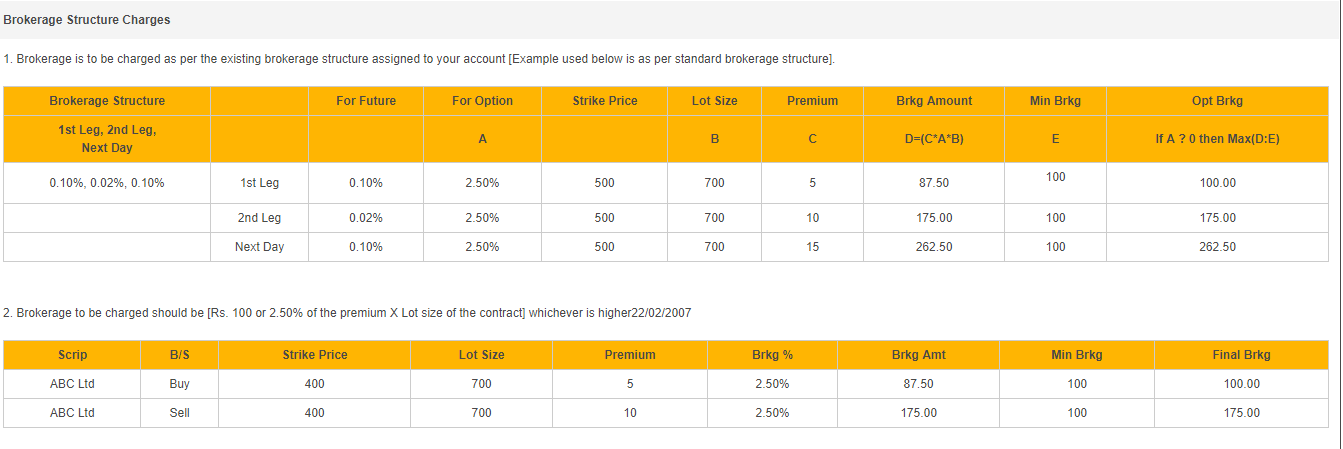

ICICI Direct

ICICI Direct from ICICI is an old and preferred broker due to its brand image. The 3-in-1 trading account gives you the convenience of opening a demat account, trading account as well as a bank account all in one go. The demat account is linked with your trading and bank accounts.

You can earn an interest of 4% on the allocated unutilized amount for trading. They have more than 150 branches which means that their services are accessible both online as well as offline. Yearly maintenance charge is Rs. 600.

Brokerage features and charges

- Access to all market segments of BSE, NSE, MCX, MCDEX, Mutual Funds, etc.

- Brokerage includes DP charges of higher of 0.04% or Rs. 25 every time shares are debited from your demat account

- Trading platform accessible across mobile, tablet and desktop

- There is call and trade facility

More details about ICICI Direct brokerage plans [Server Plan, Secure Plan & Prepaid Brokerage Plan] can be found here

UpStox

UpStox by RKSV is another popular discount broker like Zerodha. Its trading platform Upstox Pro offers zero brokerage on stock investments. With Upstox, investors can create a custom watchlist of their favorite stocks. Upstox is backed by top investors namely Ratan Tata, Kalaari Capital & GVK Davix

Brokerage features and charges

- Access to all market segments of BSE, NSE, MCX, MCDEX

- Free delivery trades. Only Rs. 20 per trade brokerage

- Trading platform accessible across mobile, tablet and desktop

Further details about UpStox Pro pricing can be found here

ShareKhan

Just like ICICI Direct, ShareKhan is one of the oldest brokerage companies in India. It was acquired by BNP Paribas in 2015. There are no account opening charges but there is a yearly maintenance charge of Rs. 500.

Brokerage features and charges

- Access to all market segments of BSE, NSE, MCX & NCDEX

- Trading platform accessible across different devices

- Detailed trading reports from financial experts

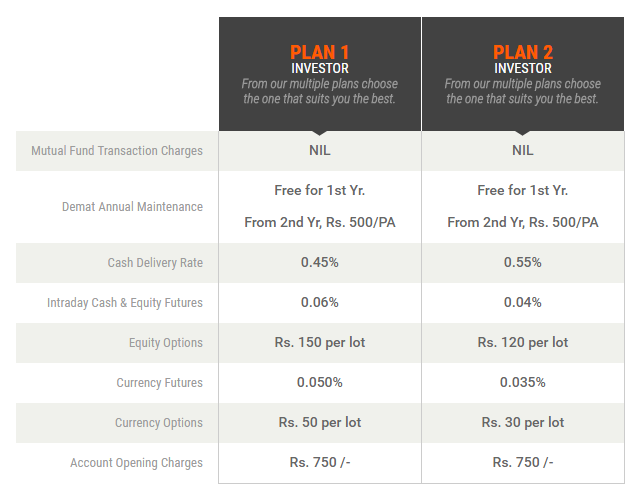

Edelweiss Broking

Edelweiss Financial Services Limited is a diversified financial services group. The firm has five major businesses, namely Capital Markets, Credit, Asset Management, Life Insurance, and Commodities. Its main focus is on credit. Edelweiss Broking was founded in the year 1995. They have different brokerage plans for different kind of investors.

Account Opening Charges: Rs. 750 is charged as opening a trading account

Yearly maintenance charges: Free for the first year, Rs. 500 for the subsequent years

Intraday Cash & Equity Futures: 0.06% [Plan 1] and 0.04% [Plan 2]

Brokerage features and charges

- Access to all the market segments of BSE, NSE, MCX & NCDEX

- Weekly research reports from financial experts with access to various finance Edelweiss platforms that solve deep-rooted customer pain-points

- Accessible across web, mobile, and tablet

Solving Investor’s Pain Points

Though there are so many trading and brokerage platforms, the real pain-point that investors/stock market traders face is that most of these platforms provide detailed analysis on stocks but all the features required by investors do not exist on a single platform, some of which are mentioned below:

Market information in a single view: Due to the huge amount of ‘scattered’ information available online, it becomes painful for traders/investors to perform ‘meaningful’ research of a particular sector or stock. For example, I use MoneyControl app to keep myself updated about the happenings in different sectors. There is no single platform that gives such kind of granular information.

In-depth Technical Analysis: In addition to the point mentioned above, there is a dearth of trading/investment platforms that also cater to technical and sentiment analysis of the market. This is a gap that needs to be filled for the investor community.

Trading Execution: When an investor is trading, he executes trades from the broker’s website [examples mentioned earlier] but the broker’s terminal is entirely different. This delay might cost dearly to the trader. Hence, when it comes to trading, execution is of top-notch priority.

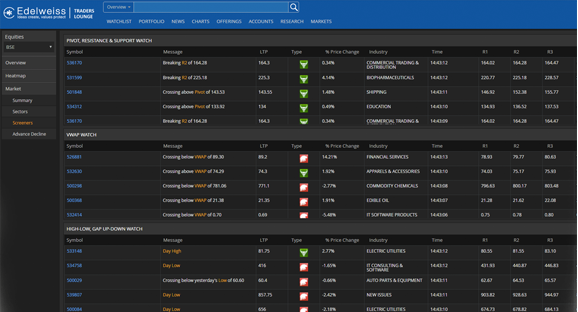

There was a requirement for a trading platform that could solve these problems for the investor community so that even novice investors in future can become seasoned investors. This is the problem that financial firm Edelweiss wants to solve via Edelweiss Traders Lounge. Let’s have a look at the features of Edelweiss Web and Edelweiss Traders Lounge.

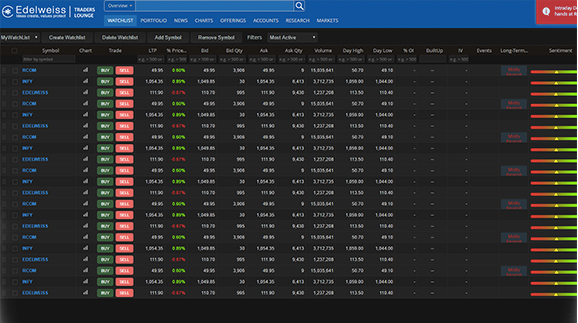

Broker’s terminal like experience: Though traders would access this platform via the web, the look & feel is similar to the broker’s terminal. The terminal supports customizable shortcuts so that you can trade faster than ever before.

Customizable watch-list combined with the power of data: In one single window, investors can get a wholesome view of the stocks that they have invested and the stocks that are on their watch-list. As mentioned earlier, the real power lies in presenting a holistic view to the traders and that is what Edelweiss Traders Lounge solves with the watch-list. It provides you with stock performance with real-time filtering & analytical parameters i.e. Sentiments, Events, Technical Alerts, etc.

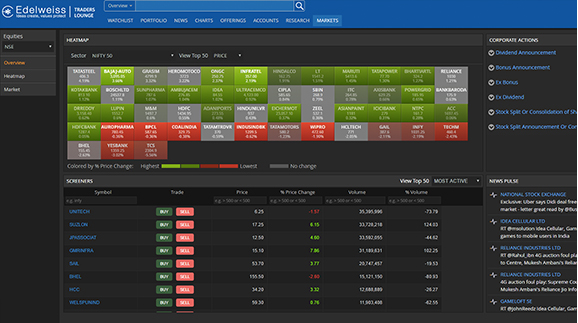

Useful information in a single-view: As mentioned earlier, investors have to scout for meaningful information like company performance, changes [if any] to the RBI monetary policy, sector performance, impact of the global economy on the stock market, etc. available on the internet and it might result in a never ending process. Edelweiss Traders Lounge solves this problem by using the power of Data Analytics.

It provides Charting, Broker calls, News/Corporate Announcements/Events, Sector-wise performance, Live OI build-up, Moving averages, etc. in a single window so that you can Buy/Sell a stock after having in-depth information about that sector and the stock.

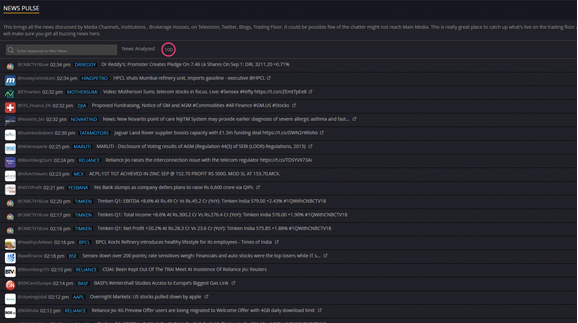

News sentiments, Broker Recommendations and Health Indicator: When it comes to investing in the stock market, it becomes primarily important to study the sector and also how various stocks are performing in that sector. With the ‘Peer Comparison‘ feature, you can compare the performance of the stocks that belong to a similar sector. With Edelweiss Traders Lounge, there is a deep level of sentiment analysis that gets done on the latest news on equities, currency & global markets, so that as an investor you can analyze the sentiment attached to the news. The expert opinions along with the sentiment analysis play a crucial role in impacting your ‘Buy/Sell behavior’.

Edelweiss is the only platform that provides in-depth information about the stocks, financial information, technical graphs/charts, detailed news related to stocks and more. This enables the investor to analyze, identify and trade on the same platform. Along with these features, the platform also gives whether a particular stock is listed as BUY [Green in color] or SELL [Red in Color] by the broker community.

If you are a heavy-duty trader and looking for an efficient desktop trading software then you should look no further than Edelweiss Xtreme Trader. It is a terminal based trading platform that is loosely based on Edelweiss Traders Lounge. The interface is highly customizable and can be changed to suit your requirements. The tool has advanced charting tools so that you can track the performance of your stocks.

The tool also has SMS and email alerts that can be customized as per the sector that you have opted for. Xtreme Trader ensures that the research calls are flashed instantly on your screen, the moment research team generates so that you do not miss out on any trading opportunity.

When it comes to brokerage charges, exchanges that are enabled, account opening costs, etc. Edelweiss Trading scores lesser than Zerodha but significantly higher than ShareKhan. However, from a usability perspective, Edelweiss trading platform scores significantly higher than the other trading platforms! The trading platform from #Edelweiss facilitates #EasyTrading, a requirement which is the need of the growing investor community!

What is the brokerage platform you use for trading, please leave the message in the comments section…