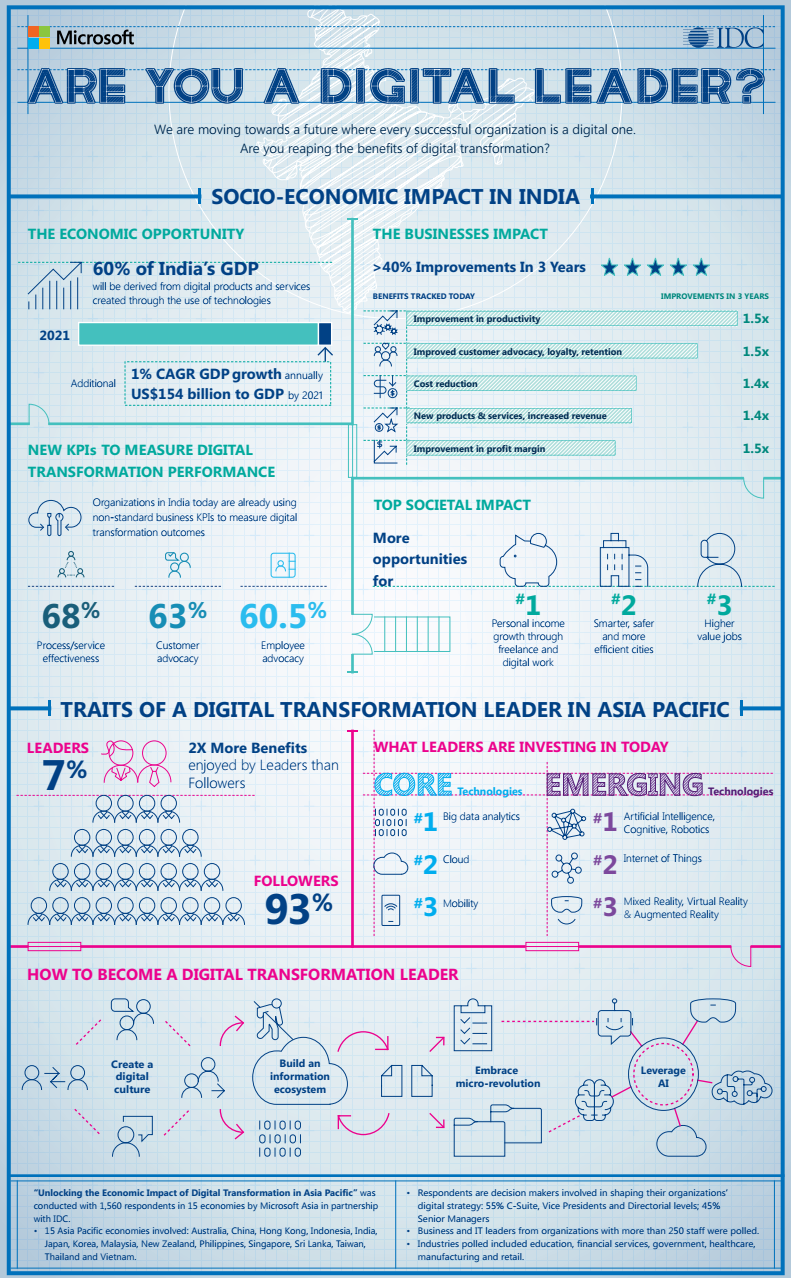

By 2021, digital transformation will add an estimated US$154 billion to India’s GDP, and increase the growth rate by 1.0% annually, according to a new business study Unlocking the Economic Impact of Digital Transformation in Asia Pacific. The research was produced by Microsoft in partnership with IDC Asia/Pacific.

The study predicts a dramatic acceleration in the pace of digital transformation across India and Asia Pacific’s economies. In 2017, about 4% of India’s GDP was derived from digital products and services created directly through the use of digital technologies, such as mobility, cloud, Internet of Things [IoT], and artificial intelligence [AI].

Anant Maheshwari, President, Microsoft India, said

India is clearly on the digital transformation fast track. Within the next four years, it is estimated that nearly 60% of India’s GDP will have a strong connection to the digital transformation trends. Organizations are increasingly deploying emerging technologies such as artificial intelligence, and that will accelerate digital transformation led growth even further.

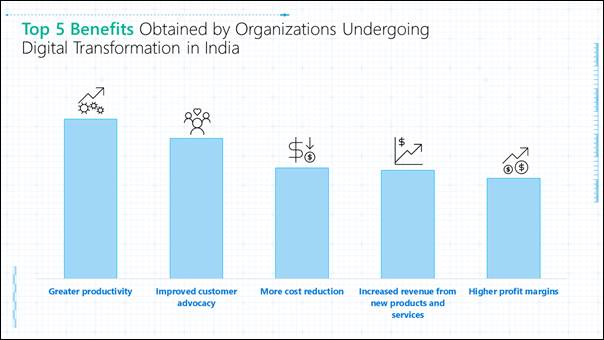

The survey conducted with 1,560 business decision makers in mid and large-sized organizations across 15 economies in the region highlights the rapid impact and widespread disruption that digital transformation is having on traditional business models. The study identified five key benefits from digital transformation.

According to the research findings, organizations are seeing significant and tangible improvements from their digital transformation efforts across these benefits in the range of 11% to 14% today. Business leaders expect to see more than 40% improvements in those key areas by 2020, with the biggest jump expected in productivity, customer advocacy as well as profit margin.

Digital Leaders in India to Gain Lion’s Share of Economic Opportunities

The study indicates that while 90% of organizations in India are in the midst of their digital transformation journey, only 7% in the entire region can be classified as Leaders. These are organizations that have full or progressing digital transformation strategies, with at least a third of their revenue derived from digital products and services. In addition, these companies are seeing between 20 – 30% improvements in benefits across various business areas from their initiatives.

The study indicates that Leaders experience double the benefits of Followers, and these improvements will be more pronounced by 2020. Almost half of Leaders [48%] have a full digital transformation strategy in place.

Sangita Reddy, Joint Managing Director, Apollo Hospitals Enterprise Ltd., one of India’s Leaders in Digital Transformation, said

Apollo Hospitals recognized the potential of technologies like artificial intelligence, machine learning and data analytics in providing high quality preventive healthcare services, very early on. With data being generated at an exponential proportion, technology is helping us derive insights to predict and suggest preventive steps with utmost accuracy. Our partnership with Microsoft bring us to the forefront of this remarkable metamorphosis that is allowing us to meet healthcare demand and maintain service excellence regardless of geography.

The Study identified key differences between Leaders and Followers, which contribute to the improvements tracked:

- Leaders are more concerned about competitors and emergence of disruptive technologies – The digital economy has also given rise to new types of competitors, as well as emerging technologies such as AI that have contributed to the disruption of business models.

- Business agility and culture of innovation are key goals – When addressing business concerns, Leaders are focused on creating a culture of agility and innovation to counter competition. Followers, on the other hand, are more focused on improving employee productivity and profitability.

- Measuring digital transformation successes – Organizations across Asia Pacific are starting to adopt new Key Performance Indicators [KPI] to better measure their digital transformation initiatives, such as effectiveness of processes, data as a capital, and customer advocacy in the form of Net Promoter Score [NPS]. As organizations realize the potential of data as the new oil for the digital economy, Leaders are much more focused on leveraging data to grow revenue and productivity, and to transform business models.

- Leaders are more aware of challenges in their digital transformation journeys – In addition to skills and cyber-security threats as key challenges, Leaders have also identified the need to bolster their data capabilities through the use of advanced analytics to develop actionable insights in fast-moving markets.

- Leaders are looking to invest in AI and Internet of Things – Emerging technologies such as AI [including cognitive services and robotics] and IoT are areas where Leaders are investing in for 2018. Besides these emerging technologies, Leaders are also more interested in investing in big data analytics to mine data for actionable insights than others.

- What sets Leaders apart from others are their ability to ride on the digital transformation wave from an organizational culture perspective. The study found that Leaders have these traits

Anil Bhansali, Managing Director, Microsoft India (R&D), said

There is a pressing need for organizations to fully capitalize on the potential value of digital transformation in the next few years. To do so, organizations need to invest in building their ecosystem, from employees, to customers, to partners, across their value chain by gaining new insights through new data sources, and incorporating digitization in their products and services.

Microsoft is uniquely positioned to help organizations in India to succeed in their digital transformation journeys today through our agile platforms and solutions that prioritize flexibility, integration and trust. We understand what organizations will need to make their journeys a successful one.

Riding the Wave of Digital Transformation

Organizations in Asia Pacific need to accelerate their digital transformation journey to reap the full benefits of their initiatives, and to address the invisible revolution brought about the mass adoption of AI. More importantly, companies need to focus on capitalizing their own data in order to gain new market insights, create new digital products and services, and monetize data through data sharing securely, and in collaboration with its ecosystem.

Daniel-Zoe Jimenez, Research Director Digital Transformation Practice Lead, IDC Asia/Pacific, said

The pace of digital transformation is accelerating, and IDC expects that by 2021, at least 60% of India’s GDP will be derived from digital products and services, with growth in every industry driven by digitally enhanced offerings, operations and relationships. The study shows Leaders seeing double the benefits of Followers, with improvements in productivity, cost reductions, and customer advocacy. To remain competitive, organizations must establish new metrics, realign organization structures, and re-architect their technology platform.

Microsoft recommends organizations to adopt the following strategies to become a digital transformation Leader

- Create a digital culture – An organization need to build a culture of collaboration where it is connected across business functions, and has a vibrant and mature ecosystem of customers and partners. Data can then be embraced across organization and functions, where better decisions can be made and ultimately serving the needs of customers and partners better.

- Build an information ecosystem – In a digital world, organizations are capture more volumes of data internally and externally. The key to becoming a Leader is for organizations to be able to convert data into capital assets, and enable data sharing and collaboration internally and externally in an open yet trusted manner. In addition, a proper data strategy will allow businesses to start their AI initiatives to identify connections, insights and trends.

- Embrace micro-revolutions – In most cases, digital transformation efforts do not start with widespread change, but a series of micro-revolutions. These are small, quick projects that deliver positive business outcomes and accrue to a bigger and bolder digital transformation initiatives.

- Develop Future Ready Skills for Individuals and Organizations – Organizations today must re-look at training and re-skilling its workforce so that workers are equipped with future ready skill sets such as complex problem solving, critical thinking and creativity for the digital economy. More importantly, they need to re-balance the workforce to attain and attract key digital talents, as well as be open in creating a flexible work source model where they tap into skills-based marketplace. From a digital skills perspective,LinkedIn’s latest study outlines the ABCs of digital talents required for future economies in the region – artificial intelligence, big data and cloud computing. In India, the top in-demand skills are big data, artificial intelligence, and cloud computing.