Photos have become an integral part of our lives since there are so many memories attached to photos. Though cameras in today’s smartphones come loaded with different camera sensors, multiple camera setup so that you can beautifully capture the moment, and different filters to edit the photos; there will always be a requirement for third-party photo editors to edit photos. There are a number of photo editors available for Android and the only factor that can keep the user hooked to one particular Photo Editor application is ‘Features Offered’.

You can obviously edit photos captured using your smartphone by downloading on your machine and editing those photos using photo editing software like GIMP, Adobe Photoshop, etc. but that requires patience & expertise. If you are looking for photo editors on Android that use Artificial Intelligence [AI] and go an extra mile beyond editing photos, you should definitely have a look at Cut Cut – Cutout & Photo Background Editor by Barrier Reef Team. Cut Cut aims to Make Every Moment Count.

Cut Cut Features Set

As the name suggests, Cut Cut photo editing app makes editing photos simple, fun, and memorable. Below are some of the salient features of the Cut Cut app

- You can edit existing photos which are in your gallery or you can edit while capturing the photo by hitting the Capture button in the app.

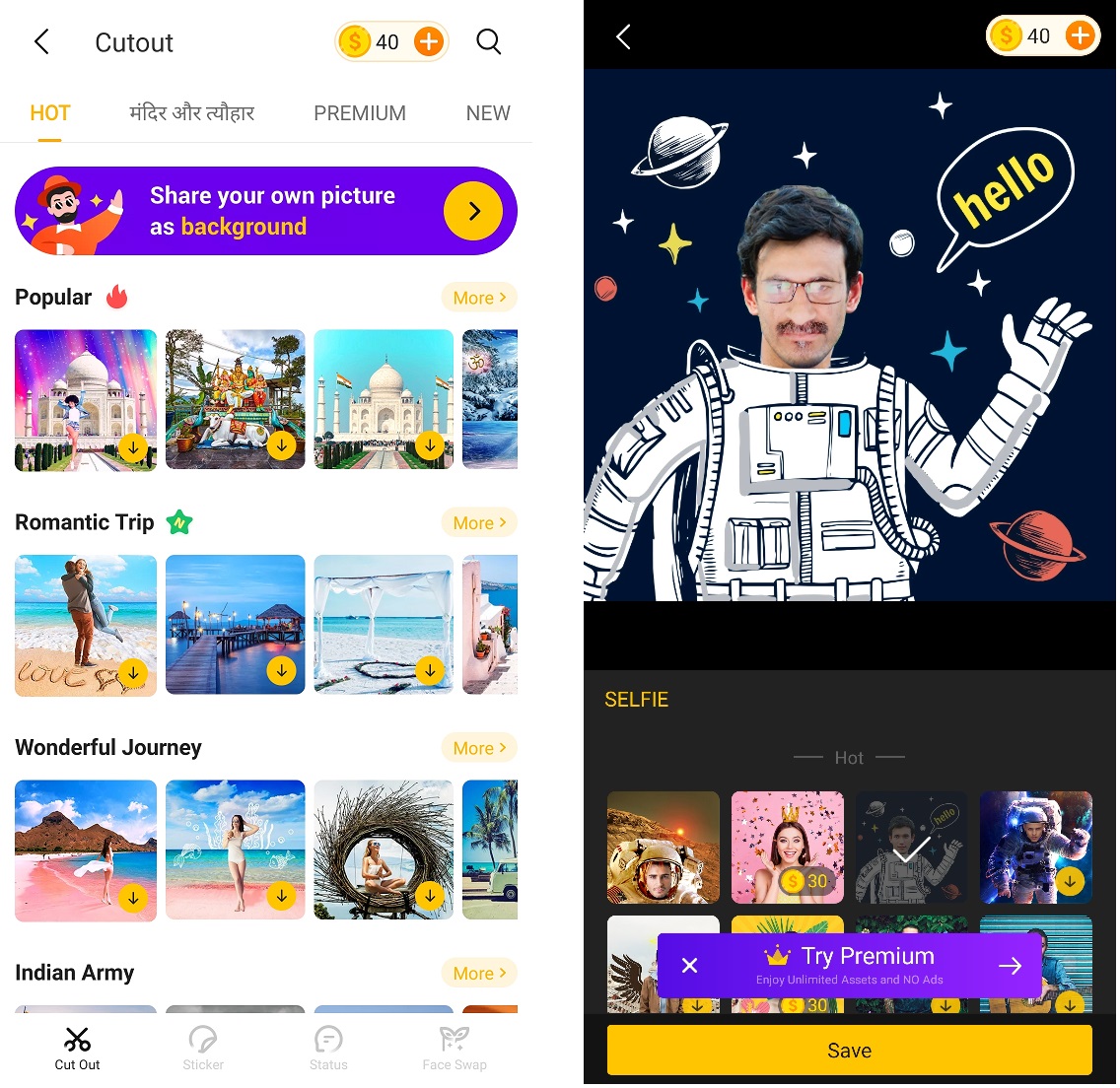

- Cut Cut makes photo editing fun and interesting by providing users flexibility to cut photos and embed them in a different photo or background.

- Cut Cut has a wide range of ‘background templates’ that are neatly separated in different categories like Travel, Festivals, Luxury, Nature, Romantic, Trends, etc. The free version has a good number of backgrounds that can keep you hooked on to the app.

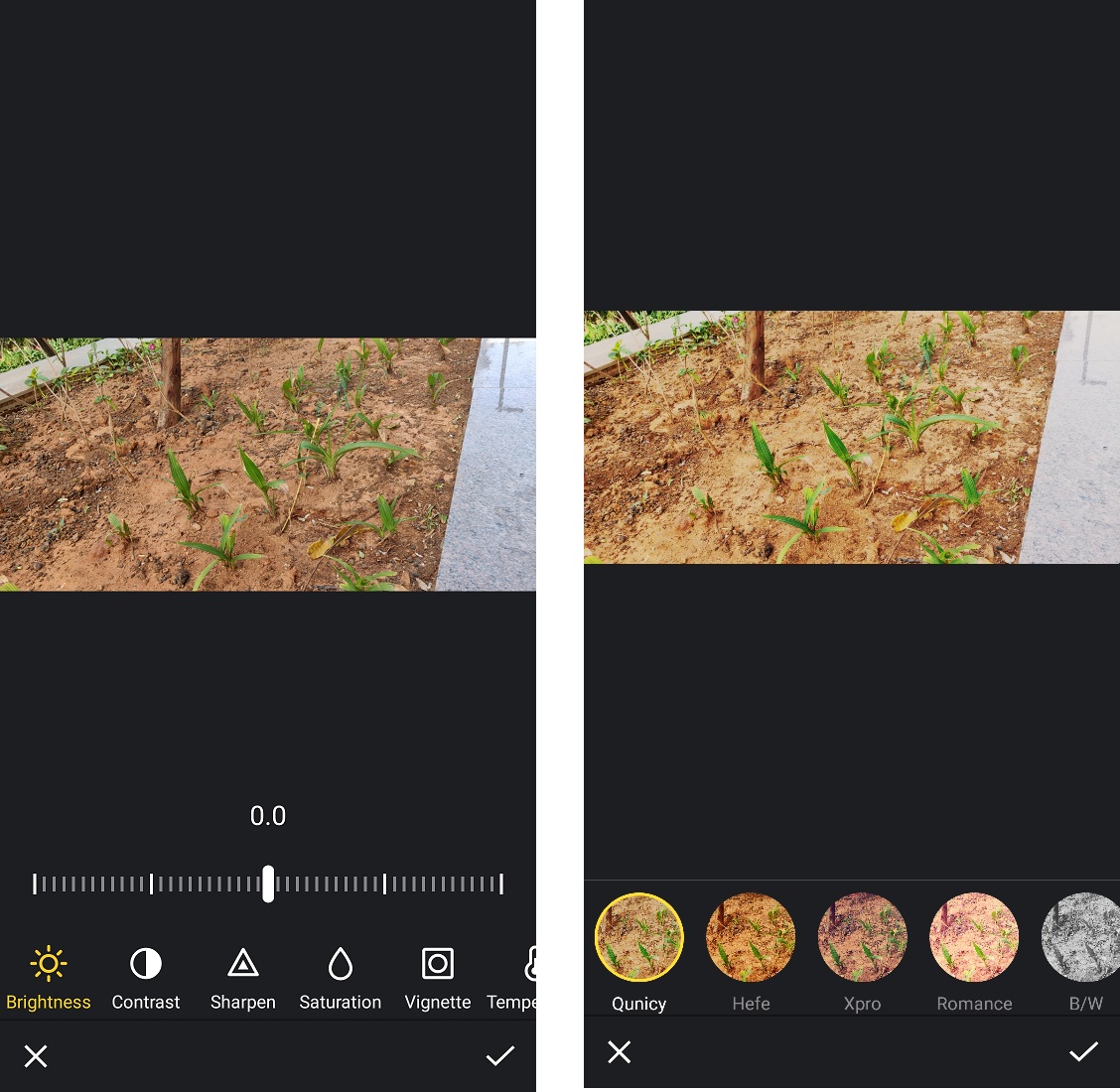

- Cut Cut has a number of filters & photo editing tools that can make your smartphone camera smarter.

- Cut Cut has a number of camera modes like Qunicy, Original, Hefe, Xpro, Romance, B/W, Inkwell, Pixar, etc. Using Face Swap feature you can digitally swap the faces with the subject and create a humorous effect.

- Cut Cut follows the freemium model, there are a good number of features in the free version of the app. It is ad-supported hence, you can expect advertisements being displayed at strategic locations in the app.

Cut Cut detailed app review

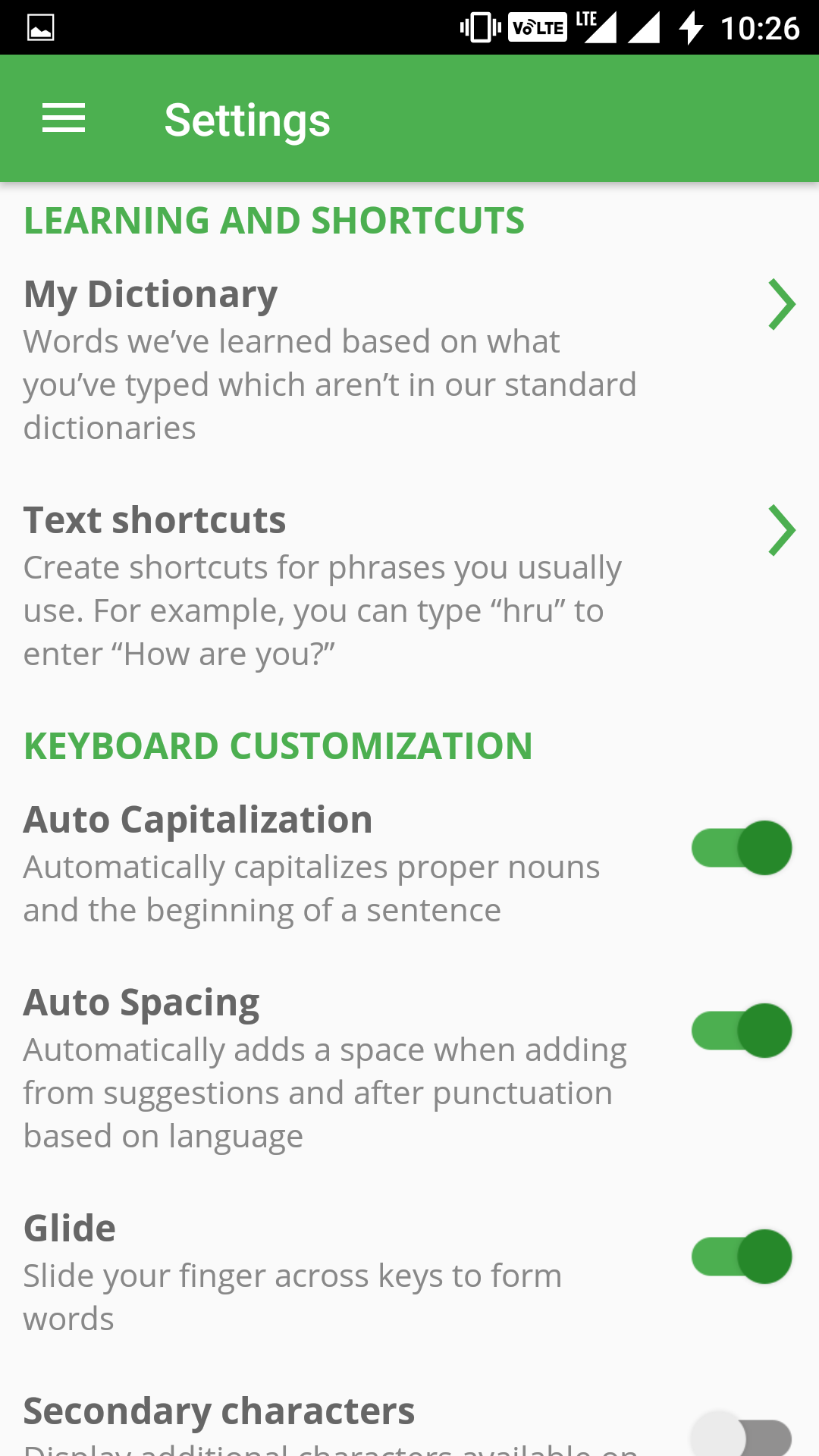

In order to get started, you should download the Cut Cut app from the PlayStore from here. Once installed, the app runs in the background and the editing window would pop-up as soon as you capture photos using your native camera on your smartphone. We observed that there was not much increase in the overall CPU consumption even when it was executing in the background.

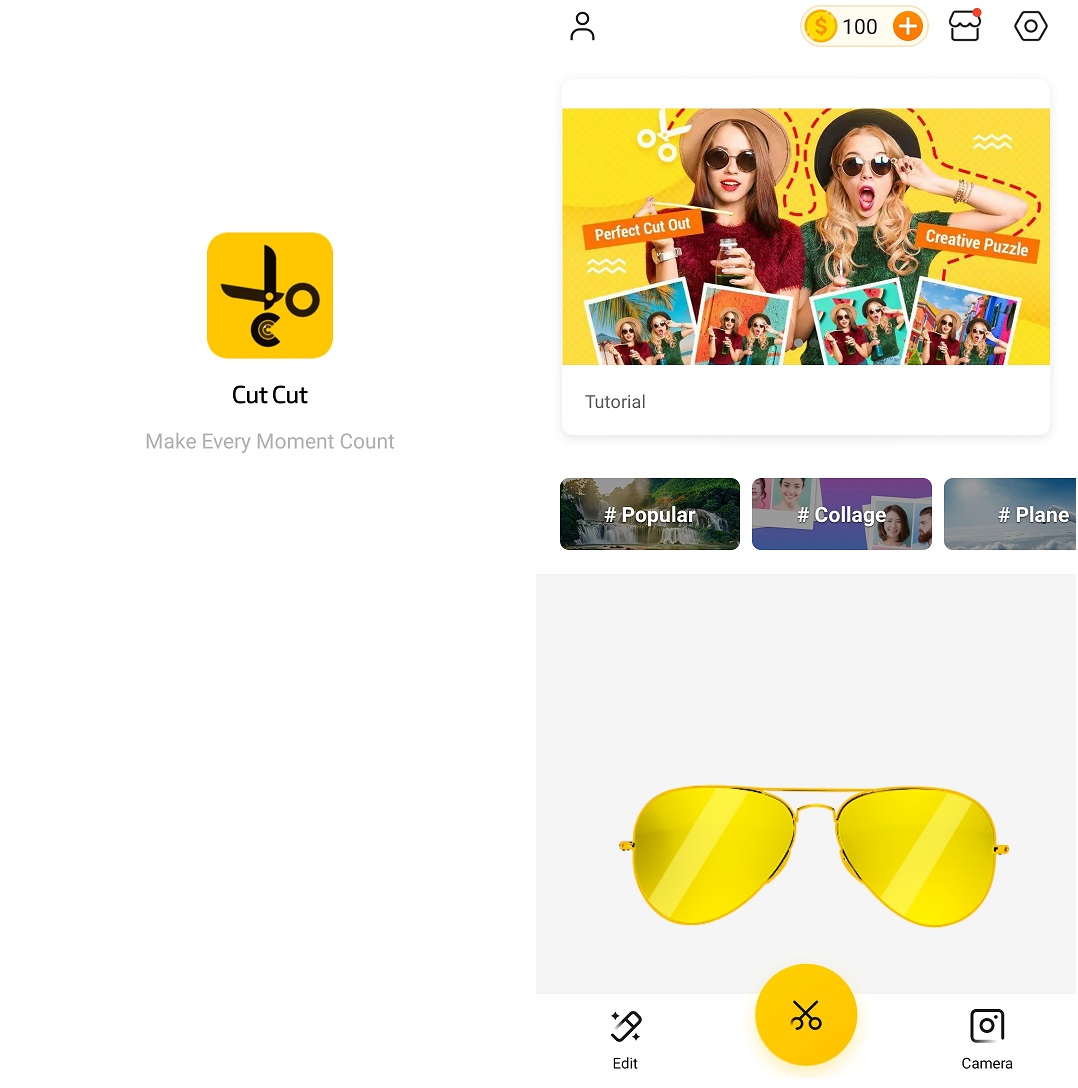

Once you open the Cut Cut app, along with the three major options – Edit, Cut Cut, Camera; there is a list of the popular designs so that you need not spend much time in exploring the designs. There is a larger placeholder that contains the link to the Cut Cut Tutorial and explains the app usage in a crisp manner

- Step 1 – Choose your favourite background.

- Step 2 – Use the Lasso Tool

- Step 3 – Create Mirror Effects

- Step 4 – Add Filter Effects

It would have been better if there was an option to mark ‘Tutorial section as Read‘ since it may not be useful for Cut Cut superstar users since they are already well-versed with the app. A better approach would have been to have another Card that showcases the latest features in the Cut Cut app since that would be helpful to all categories of users [pros, newbies, etc.].

The home screen is simple since three major options [already described above] are displayed upfront. Using the Edit option, you can Edit the existing photos and apply different filters, backgrounds on the photo. The Cut Cut option contains three major sub-options – Photos, Portrait, and Albums. The camera option lets you capture photos and edit them right in the Cut Cut app itself. Hence, you no longer need to leave the Cut Cut app to edit the photos.

There are different options for editing namely Adjust, Rotate, Text addition, Filter addition, Blur effect, etc. Using the Sticker feature, you can create funny stickers from your photos. You can directly upload the captured photographs to your social media and social messaging platforms.

Cut Cut Review – Pros & Improvements

Below are some of the positive points of Cut Cut photo editing app when compared to similar apps available in the market.

- Cut Cut app is an easy to use photo editing tool. The app makes extensive use of AI to suggest backgrounds that can enhance the beauty of the selected photographs and portion of the photo that you should edit so that the elegance of the photograph is still retained.

- If you are a good photographer, you can even submit your work (Background) to Cut Cut team and if shortlisted, your photos are added to the Backgrounds Gallery of the app. This is an excellent manner to build a quality database of backgrounds by involving the community.

- You can add Watermark to your photos and using the Screenshot Window setting in the app, you can edit screenshots with a single click.

- By default the Cut Cut app runs in the background [with minimal impact on the battery], Quick Edit opens up each time you click a photograph. This reduces the overall time spent in editing the photos.

Below are some of the improvements as far as the Cut Cut app is concerned

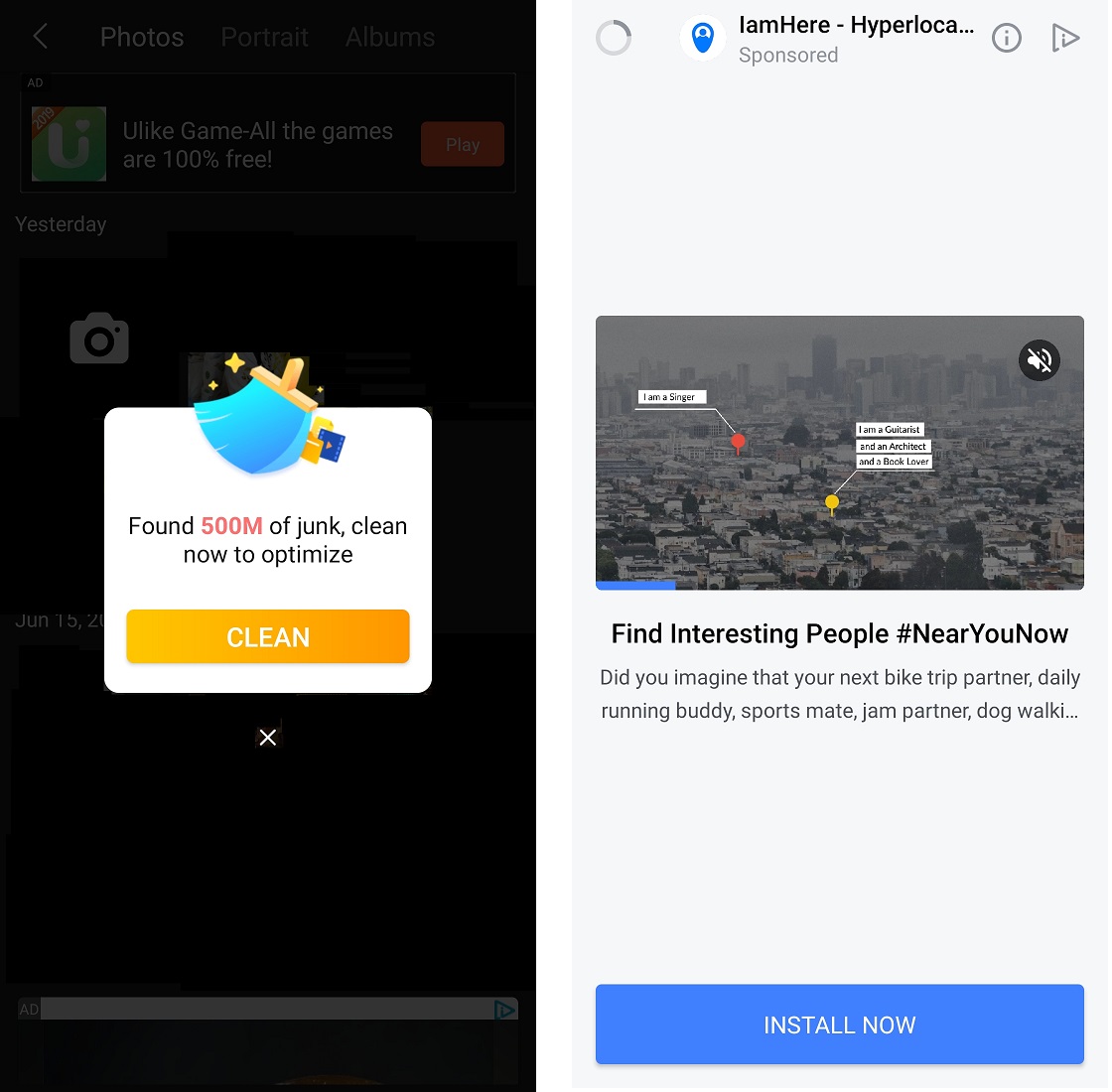

- Needless to mention that the free version of the app uses advertisements [ads] for monetization. However, there are scenarios where a full-screen ad pops up after photo editing is done. We found a few cases where it prompted us to install other apps e.g. Memory cleaner app and such ads ruin the entire user experience. The Cut Cut app is developed by China-based Apus Group which has developed apps like Apus Browser, Apus Launcher, etc. Instead of ads on the home screen of the app, a better approach would be to feature other apps developed by the Apus Group in a card format. Though it is important that the app generates revenue, it should not come at the cost of usability.

- The Premium version of Cut Cut app which is ad-free is not very costly – Rs. 70.70 for 6 months, Rs. 42 for 3 months, and Rs. 20.70 for 1 month. Users of the premium version can cancel the subscription anytime. Though there is a recurring billing option, it would have been better if they also added a one-time subscription model for regular user-base of the app.

- Though you can connect the app to Instagram, there should have been a feature where users can upload the photos edited/clicked via Cut Cut app to the cloud. It could be Google Cloud for non-Chinese users and Apus Cloud for global users [including users in China] of the app.

- The size of the app is around 180 MB which might be a bit heavy for smartphone users with limited internal memory. A Cut Cut lite app would have been an ideal app for users that have smartphones with powerful cameras but limited capacity.

Conclusion

Cut Cut is a good app for editing photos. Since the app is simple to use, it requires a minimal learning curve. In order to penetrate the mass market, app usability is of primary importance and annoying ads at random places in the app ruins the entire experience. The product & engineering teams at Barrier Reef Team need to put user experience first (especially in some sections of the app) and limit the number of ads to enhance the overall experience. The app does have stickiness and since the premium version is not so costly, regular Cut Cut app users would definitely migrate to the premium version sooner or later. You can download Cut Cut Photo Editor for Android from here.

If you have used the Cut Cut app on Android, do leave your experience or suggestions in the comments section…