As India leaps forward to become a digitally transformed nation, the Indian technology start-up ecosystem continues to witness a significant growth trajectory on the back of rapid digitalization and tech adoption. The National Association of Software and Services Companies [NASSCOM], in partnership with Zinnov, a global management and strategy consulting firm, today launched its annual start-up report, titled, ‘Indian Tech Start-up Ecosystem – On the March to Trillion Dollar Digital Economy‘.

With over 1600 tech start-ups and a record number of 12 additional unicorns added in 2020 –the highest ever added in a single calendar year, the Indian tech start-up base is witnessing a steady growth at a scale of 8-10 percent year-on-year growth.

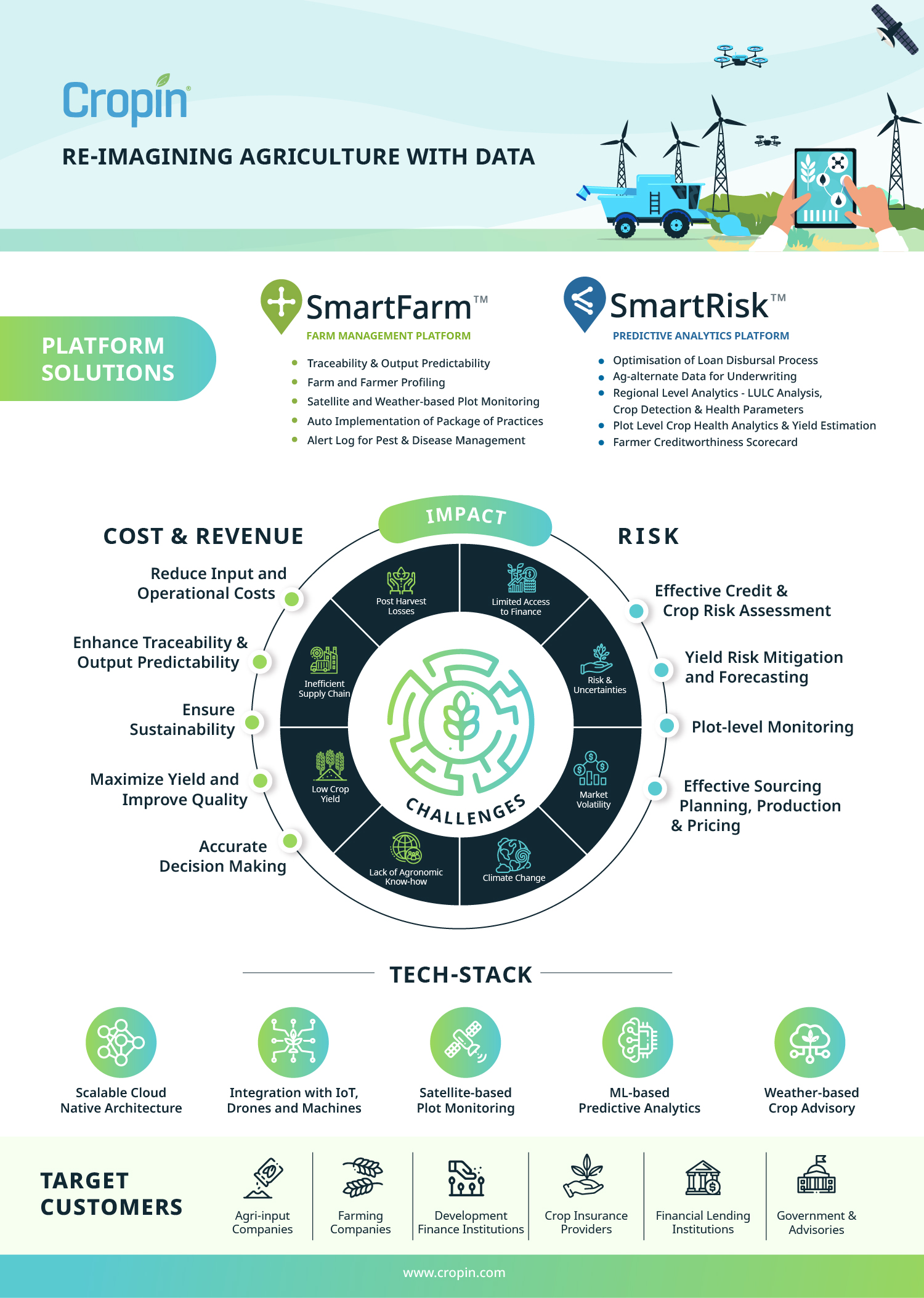

COVID-19 has accelerated digital adoption and the shift to online in the country. This has created new opportunities for tech start-ups that are capitalizing on this opportunity with rapid digital acceleration and a shift to SaaS-based solutions. Deep-tech is also getting deep-rooted into start-ups’ DNA with 19 percent of tech start-ups leveraging deep-tech solutions to build product competencies for market expansion.

This has led to significant momentum in the deep-tech space with increased interest from Venture Capital firms (VCs) and funding agencies to invest in deep-tech start-ups. 14 percent of total investments in 2020 were in deep-tech start-ups, up from 11 percent in 2019. Further, 87 percent of all deep-tech investments were in AI/ML start-ups, in 2020.

Speaking on the occasion, Debjani Ghosh, President, NASSCOM, said

The Indian tech start-up ecosystem’s performance in 2020 has demonstrated the resilience and can-do spirit of the Indian entrepreneur. The continued innovation, right decision making and strong investor commitment have positioned the Indian start-up ecosystem as a key contributor in accelerating India’s digital economic growth.

With the continued addition of new start-ups, booming unicorns and increased adoption of deep-tech, the ecosystem shows an even more promising future. Depending on headwinds, 2021 promises to be a positive year for Indian tech start-ups – marching steadily towards $1 Trillion digital economy goal.

Pari Natarajan, CEO, Zinnov, opined that

The resilience and fortitude demonstrated by the Indian start-up ecosystem in 2020 was unparalleled and unprecedented. It was about defying the odds with extraordinary innovation and exceptional leadership. 2020 saw start-ups increasingly leveraging and piggybacking on the foundational infrastructure that the government has in place – the India Stack, UPI infrastructure, GST norms, FASTag, etc. – that offers up a unified set of layers with contactless and presence-less digital economy truly coming into its own.

These pillars reached an inflection point in the wake of COVID-19, with start-ups not only innovating on top of these layers, but bringing in the unaddressed and underserved tier-2/3 cities into the larger digital economic inclusion mix. Khatabook, Udaan, etc., are cases in point. In the face of adversity, start-ups have been able to create a flywheel of sustained innovation that will be instrumental in helping the Indian start-up ecosystem achieve escape velocity. 2021 will be the ‘Decade of Collaboration’ where entrepreneurs engaging more with not just their peers but also with the government, corporates, and the manufacturing ecosystem, will catapult India’s dreams of becoming a trillion-dollar economy.

Despite a lower number of total start-up deals in 2020, seed-stage investments are recovering at a good pace as investor activity at lower ticket sizes has increased. Seed-stage funding in 2020 recovered to more than 90 percent of 2019 levels.

Early and Late-stage investments are also recovering steadily. An increase in median deal size is further underscoring investor confidence and a willingness to take big bets. Sectors with COVID-19 tailwinds such as EdTech, BFSI, AgriTech, Gaming, etc., are witnessing a steady increase in first time funding, up from 29 percent in 2019 to 42 percent in 2020, garnering a 14 percent growth in absolute numbers.

In 2020, Indian tech start-ups not only managed to stay afloat amidst uncertainties and rapid experimentations, but also strategically strengthened their playbook by converting the crisis into opportunity. As a result, Indian enterprises’ Digital Maturity has jumped to 55 percent in 2020 from 34 percent in 2018.

Customer experience and retention are back in focus as founders rethink growth strategies in a post-pandemic scenario. There is a steady focus on operating margins to allow growth capital to be used for investments. 50-55 percent of tech start-up founders felt profitability to be given weightage alongside valuation in the future.

Remote working continues to see significant adoption amongst tech start-ups, with around 30-35 percent offering remote roles and 15-20 percent companies having committed to remote work culture, as per NASSCOM tech start-up survey. Further, with rising digital adoption and remote working reducing geographical disadvantages, tech start-ups are expanding into global markets; 28-30 percent tech start-ups are targeting the overseas market for growth and business expansion.

Cross border trade restrictions in 2020 accelerated peer-to-peer collaborations and public-private partnerships, leading to fast and effective knowledge transmission. In fact, as per the survey, 66 percent of tech start-up founders are exploring partnerships post-COVID-19.

Although cautiously optimistic, 2021 promises a return to normalcy for the Indian tech start-up ecosystem. Deep-tech and new start-up hubs will continue to grow at 40-45 percent CAGR. While the investments in 2020 were significantly lower than in 2019, recovery in deal pace and investments is expected to return to 2019 levels, if not exceed in 2021. In terms of total Unicorns, India is on track to have a 50-plus strong Unicorn club in 2021. M&A deals and IPO pipeline are also expected to accelerate in 2021.

However, as normalcy returns for start-ups in the new year, certain proactive measures are required to ensure the continued momentum and growth. These include Government investment in building infrastructure and strengthening policies; Ecosystem collaboration for market access for early stage start-ups; Acceleration of corporate participation; Increasing seed-stage investments for tech start-ups, which is currently less than 10 percent of the total investment received each year; Increase in the share of domestic capital and; Expansion of experienced talent base in the country.

NASSCOM defines tech start-ups ecosystem as active technology product or platform companies incepted in the last 5 years in 2015 or later.