Today, one of the main components of an increasingly digital world is data and with data being collected in heaps, there are thousands of companies working on how to capture, store and leverage it to derive maximum business value. They are on a continuous look out for innovative solutions that will help them change the world with data. NetApp being one of the leaders in the data domain comes with a rich legacy of innovation in the data management space. In June 2017, the company launched the NetApp Excellerator program [information about first cohort here] with an aim to help data driven startups realize their full potential and enable them to build innovative world-class products and solutions that are market-ready.

NetApp had selected six data driven startups for their second cohort of the NetApp Excellerator program. The selected startups had received $15,000 equity free grant and access to NetApp facilities, their technology, HR, Marketing and other functions that would help them scale to the next level. The startups from the second cohort of NetApp Excellerator working in interesting areas [Artificial Intelligence, Analytics, Cloud & Machine Learning] graduated in June, 2018 and are all set to enter the market.

We were invited for the ‘Startup Meet’ that was held at the NetApp Premises in Bengaluru. Ajeya Motaganahalli, Senior Director – Engineering Programs and Leader of NetApp Excellerator walked us through the following

- Overall selection process

- Status of the first cohort

- Learnings from the startup founders [and their team] and

- How these startups [first and second cohort] are an integral part of the entire eco-system.

They had received close to 450 applications for the first, from around 250 that registered for the first cohort. Of these, 11 were shortlisted to participate in a rigorous boot camp that concluded with the six being selected for the second cohort [the selection was based on their team and technical expertise, product capability, etc.]. He stressed upon how the NetApp Excellerator is more than a startup accelerator and how the startup’s team members are fueling the startup mojo and entrepreneurial culture in NetApp.

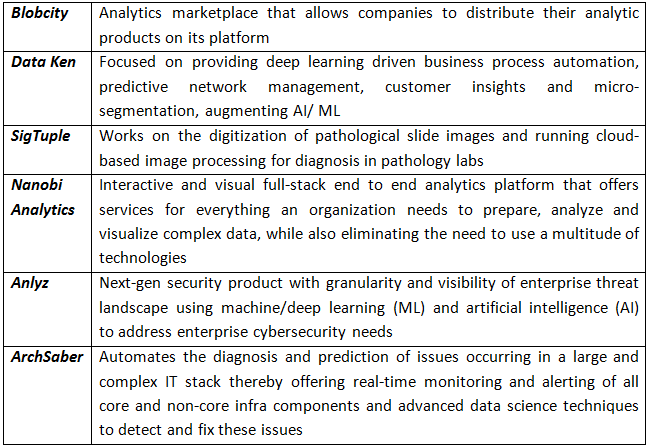

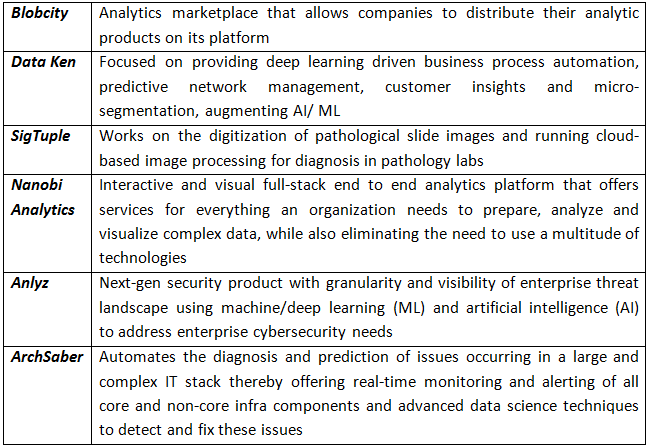

The six startups from the second cohort presented their respective ideas along with core differentiators, business potential, funding status, NetApp’s role in helping them with technology; marketing and deep-rooted expertise in building B2B focused products. Below are the startups that graduated from the second cohort

Blobcity

BlobCity provides its customers with end to end data capabilities by making storing and processing diverse data easy. Most analytic products today are required to collectively analyse data of diverse natures, BlobCity offers real-time analytics over this diverse data. For the analysis of transactional data at the speed of transactions, one needs a real-time analytics system. Example in case could be ATM fraud detection, where your analytical algorithm needs to analyse possible fraudulent nature of an on-going ATM swipe, before the machine actually dispenses the cash.

Unlike ATM’s, not all systems need analytics at real-time. If you want to analyse stock market data of the previous day, compare it with a year’s trend and then take a position when the market opens next day, you need a system that can perform this analysis with low-latency to be able to complete analytics for all stock quotes before the markets re- open. Depending on the nature and complexity of the requirement, the term low-latency covers processing times from a few milliseconds to even several hours. BlobCity’s analytics solutions are extremely well suited for such requirements and support high volume of transactions without compromising on analytics speeds. More information about Blobcity can be found here.

DataKen

Dataken’s Data Science Platform with cognitive capabilities provides Ingest, Transform, Visualize and Analyze capabilities to deliver actionable proactive and predictive business insights across segments. With highly scalable computational, storage and machine learning capabilities along with 250+ industry adaptors are designed to deliver results in complex ecosystem. The platform’s capability has empowered business and operations team to extract, configure and analyze data to meet business demand, real-time.

Dataken’s platform provides one-stop solution to meet the future demand of organizations embarking on IoT, SDN, NFV, LTE, Social commerce and data monetization. The business layer provides 100+ out-of-box solutions for Communications, Banking & Finance, Insurance, Health Care and Manufacturing sectors to accelerate their outcome. More information about DataKen can be found here.

SigTuple

SigTuple builds intelligent screening solutions to aid diagnosis through AI-powered analysis of visual medical data. They are building an artificial intelligence (AI) platform called Manthan which helps them analyze visual medical data efficiently for their customers. Manthan enable Sigtuple team to work on five major high-volume, screening processes of the healthcare industry – analysis of peripheral blood smears, urine microscopy, semen, fundus & OCT scans and chest x-rays.

They are working with pathology labs and hospitals to get data for developing our solutions. Each of their solutions is built in partnership with a medical institution and specialists so that the product scope and roadmap are in line with the requirements of the final users. More information about SigTuple can be found here.

Nanobi Data & Analytics

Nanobi delivers analytical insights to clients that help them better understand their customers. Their analytical solutions deliver measurable business impact across revenue upside, cost optimization and end-consumer delight to clients in the Healthcare, BFSI space.

Their powerful LiquiData Platform integrates data warehousing, business intelligence, predictive and prescriptive analytics into a single visual stack thereby allowing their clients the ease, efficiency and flexibility of using a one-stop platform to serve their analytical requirements. With a “nanomart” based data architecture and a rich API framework, solutions are built speedily and in easy to consume modules. Nanobi’s platform has built-in conversational bots, which makes it easy for anyone across the enterprise to use analytics to drive decision-making. More information about Nanobi can be found here.

Anlyz

Anlyz is a next-gen security product with granularity and visibility of enterprise threat landscape, using machine/deep learning and Artificial Intelligence (AI) to address enterprise cybersecurity needs.

In the current ecosystem, information is the most valuable currency. Anlyz’s wheels are constantly in motion, scanning the slightest digital cues to keep information safe for their clients. Equipped with advanced cyber capabilities like machine learning, AI & sophisticated hunting, Anlyz is geared to take on threats to predict and prevent attacks even much before they happen. More information about Anlyz can be found here.

ArchSaber

Founded in Feb 2016, ArchSaber automates the diagnosis and prediction of issues occurring in a large and complex IT stack. ArchSaber helps enterprises by giving real-time diagnosis of an incident including comprehensive details, from root cause(s) to the critical services, so the resolution can be handled immediately before it becomes an outage.

The firm does deep analytics over finely grained data and ensures that clients get clear causalities amongst events, depicting the domino effect in form of a cause & impact graph. More information about ArchSaber can be found here.

A snapshot of all the startups that presented is below

Adya & Scalend Technologies, startups from the first cohort also presented about their experience and business developments. Each team was given approximately five minutes for the presentation [which sounded more like an Elevator Pitch :)]. After the presentation, there was demo walk-through and interaction with the startups where we had a chance to interact with the members present from the respective startups. You can get more information about the ‘Startup Meet’ on NetApp India’s official Twitter Page.

We plan to interact with founders of a couple of startups from the second cohort, so if you have questions for any of the startups do leave them in the comments section.