Many individuals draw a handsome salary but are unable to convert the salary into tangible returns. One of the probable reasons is minimal understanding about putting the money in the right investment vehicles. It goes without saying that each one of us wants to make the most out of our investments but that is something that can be imagined only in the wildest dreams.

The financial needs and wants of every individual are different. They largely depend on factors like risk profile, financial goals, and assets [& liabilities]. To see your savings grow, it is important to participate in the ‘India Growth’ story. Investing in the best-suited investments is an absolute necessity else your savings might not give you significant returns.

[Read – Why Investing Is Necessary]

Before jumping into the investments game, you should take into account the following factors:

- Status of existing portfolio

- Current assets & liabilities

- Rate of Inflation

- Volatility on Investment Markets

- Liquidity

- Risk Profile [or risk tolerance]

Lastly, the goals set for your investments are dependent on your risk profile. As an investor, it is essential to understand that higher returns means higher risk. If you are a risk-averse investor, opt for a investment avenues where risk is aimed to be kept at minimal level and endeavour is to provide reasonable returns! The upside of this approach is that there are minimal chances of losing money. Should you go for risk-averse (low returns) investing or high-risk (high returns) investing? The investment option chosen by will squarely depend on the answers to the above questions and whether your goal is short-term or long-term.

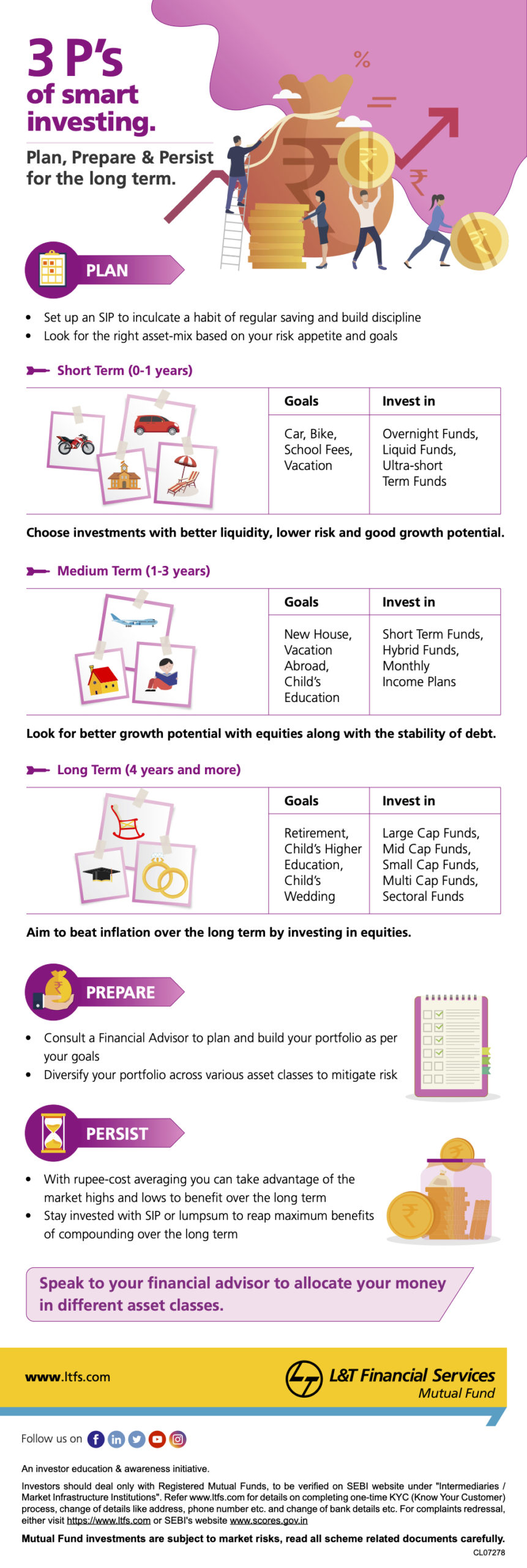

The infographic below shows how you can stay invested for a long-term [or should we say that it helps in being a smart investor]:

Now that you are aware of the primary benefits of investing, the next important question that comes to mind is ‘Which are the major avenues of investing‘?. Here are some of the major investment avenues that are preferred by investors spanning different investment goals:

- Equity Mutual Funds

- National Pension System [NPS]

- Public Provident Fund [PPF]

- Debt Mutual Funds

- Bank Fixed Deposits [FD]

Lastly, if you are not a risk-averse investor, you should give a shot to the stock market! On the other hand, systematic investment route like Systematic Investment Plans [SIPs] are suited for investors that are looking for long-term returns with regular investments of as low as Rs. 500. The best thing about SIP is that staying invested for a long term helps in accumulating a sizable amount of potential wealth over time.

SIP calculator can be used for calculating the monthly SIP amount that has to be invested for aiming to achieve the said goals in a particular time period. Depending on the market conditions, you can switch between different types of mutual funds [e.g. debt, equity, etc.] to minimize the risk and maximize the returns.

However, keeping a tab on the performance of SIPs and choosing the ones that meet your end goals can be a daunting task! This is especially true when you do not have much time and energy to focus on the financial aspects.

This is where a Robo Advisor, a digital platform that provides AI-driven, automated, and algorithm-driven financial planning services can be of immense help. Since the platform is AI-driven, there is no human intervention and you can get the best investment advice in the least possible time.

Robo Advisor is a financial advisor minus human intervention

Robo Advisors offer the same benefits as financial advisors i.e. providing financial advice to the investors based on their expertise and requirements. You can plan your investments in a much better way by going through a financial advisor (or even a robo advisor).

Here are the major benefits of engaging with a financial advisor [or robo advisor]:

- Chalking out SMART [Specific, Measurable, Achievable, Realistic and Time-bound] goals

- Laying out an investment plan that aligns with your financial goals

- Regular monitoring of investment portfolio

- Revising [or rebalancing] portfolio based on market conditions

There are a number of investment avenues to choose from and a financial advisor can be a boon to help you realize your financial goals. If you are inclined to invest in Mutual Funds; do check out the schemes offered by L&T Mutual Fund and Equity Linked Saving Schemes [ELSS] which offer Tax Saving. Always have the habit of reading the scheme related documents before investing to understand the scheme type, investment patterns and the risk factors associated with particular investments and consult your financial advisor to understand the implication of any investment. The provisions pertaining to tax applicability and exemption are as per the current tax laws and are subject to change

Start Investing Now So That Your Money Works For You

Disclaimer: This information is for general information only and does not have regard to the particular needs of any specific person who may receive this information. L&T Investment Management Limited, the asset management company of L&T Mutual Fund or any of its associates; does not guarantee/indicate any returns/and shall not be held liable for any loss, expenses, charges incurred by the recipient. The recipient should consult their legal, tax, and financial advisors before investing. The recipient of this information should understand that statements made herein regarding future prospects may not be realized or achieved.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.