Mutual funds or stocks? You must have often find yourself wandering between these two diverse investment products. Experts believe that it is hard to declare a conclusive winner as both investment products are highly dependent on the performance of the economy, individual companies, and sectors.

Mutual funds offer diversification opportunities to investors that is quite useful when the markets are volatile. What’s more, an investor can benefit from the price movements of the stocks by investing in mutual funds via a Systematic Investment Plan [SIP]. It also frees them from the urge to time the markets.

Stocks on the other hand offers investors with greater flexibility to invest in companies they know of and put their trust in. Stocks have a high risk-reward ratio.

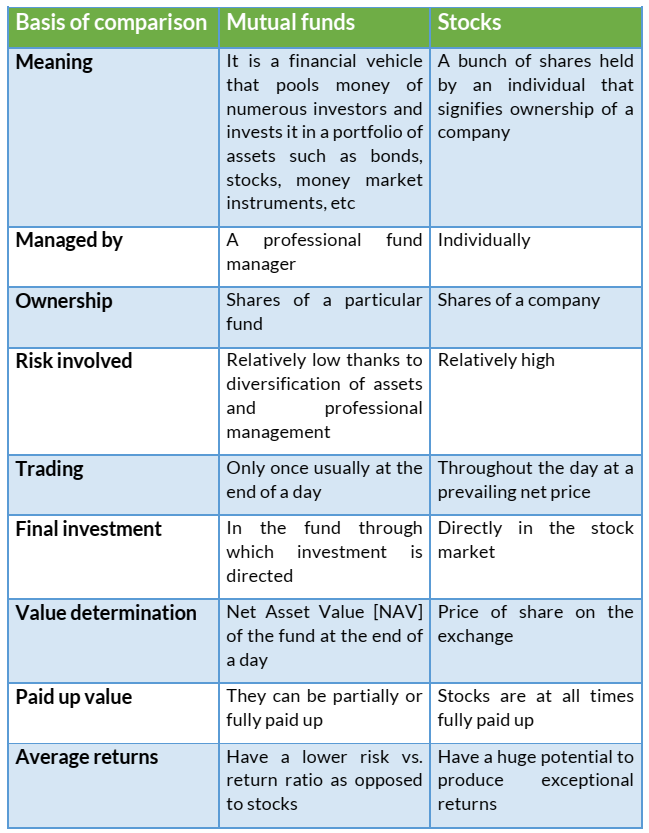

Mutual Funds vs Stocks

The following table summarizes the differences between mutual funds and stocks

Despite the COVID-19 pandemic that struck the entire world, followed by what seemed like a never-ending lockdown, investors interest in both the investment products – stocks and mutual fund SIPs has gone up in 2020.

What’s more, people started investing more in mutual funds via SIP during the lockdown, especially during the times the markets were very volatile. This portrays that there is a high awareness about the benefits of SIPs among user base as being the best investment tool during volatile markets. This is due to the concept of rupee cost averaging offered by SIP investments.

Mutual funds or stocks – Who will win the battle in 2021?

Whether you choose to invest in mutual funds or stocks must entirely depend on your investment portfolio. Stocks are suitable for investors who have a high risk appetite and are fine with the volatility in their investments to earn higher returns.

On the other hand, mutual fund investments are ideal for those investors who have a relatively lower risk profile and are looking to diversify their portfolio with different securities such as stocks, bonds, money market instrument, etc.

If you are still confused about the right investment product for your portfolio, you might consider taking the services of a mutual fund expert or advisor. Happy investing!