Most people start planning their retirement life well in advance. The need for stable income during the retirement days is a must, especially when dealing with medical expenses during those years of your life. So, how do you ensure that you have sufficient income during retirement even with the lack of a consistent paycheck?

This is when your insurance plans come in handy. As a matter of fact, it necessary to start planning your retirement early in life. That timeframe allows you to build a robust financial source which you can rely on in the future.

In this article, we will discuss whether you should invest in ULIPs or Pension Plans.

ULIP vs Pension Plans

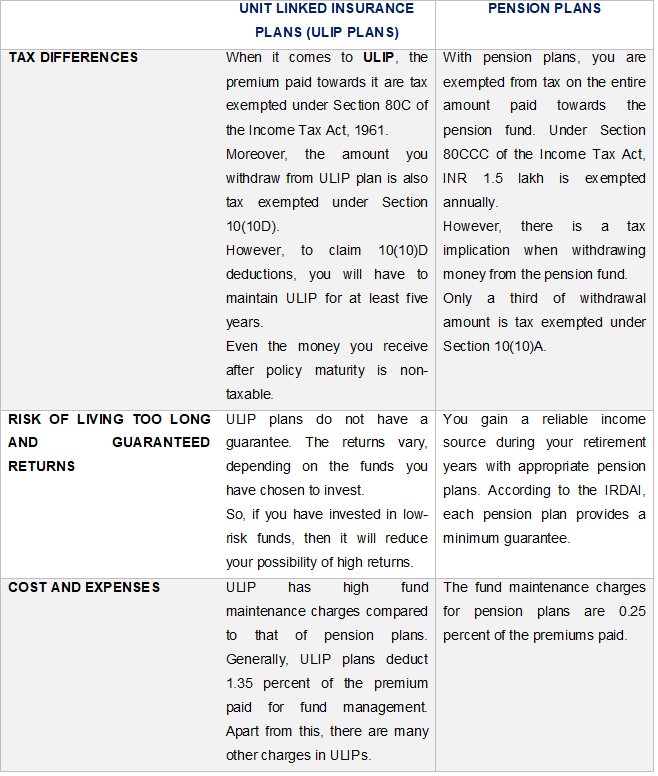

In the table below, we have compared the two based on a few factors:

Despite the additional charges in ULIP plans, it is still one of the most reliable insurance instrument available in the market. Moreover, with ULIPs, you have the flexibility to invest in funds of your choice [depending on your risk appetite].

Generally, you can invest in equity-oriented funds, debt funds, or a combination of the two. If your risk appetite is low, then consider investing in debt funds. However, for those with a high-risk appetite can invest in equity funds.

Closing Thoughts

Between ULIP plans and Pension plans, if you have started your retirement investment early, then you might as well consider investing in ULIPs. The ULIP returns over the long run are high and beneficial. But make sure that you are comparing different ULIP plans online before choosing one. Also, keep monitoring the stock market movement to make necessary changes to the fund investments.