Doubling there number in just ten years, the number of two-wheelers sold in India crossed a figure of 20 million units. A whopping number of a category of vehicles which includes scooters, mopeds, and bikes.

As rose the number of two wheelers in use, there increased the number of accidents. The prime reasons established for collision include speeding bikes and no use of helmets. More than the loss of the two wheelers, the value of life lost in an accident is considered more precious.

Also, the new amendment in the Motor vehicle act made applicable from 1st Sept-2019, which increased the traffic penalty by a huge amount.

All above reasons made people buying Two-wheeler Insurance to protect from financial burdens, third party liabilities and avoid heavy traffic fines. Also, the digital insurance companies like Digit Insurance has made the overall process of buying Two Wheeler Insurance Online very easy and simple.

Before buying the two-wheeler policy, understanding the type of insurance is very important as it becomes complex for common people sometimes. Let’s discuss what are these.

What is Comprehensive Two Wheeler Insurance?

A Comprehensive Two Wheeler Insurance policy is the widest possible cover available for a vehicle. This type of insurance policy is said to offer two types of covers; one is Own Damage and the second one is Third-Party Liability. You can seek compensation in any of the following cases:

- For the own damage, that is, any kind of repairs needed in the two wheeler after a collision.

- For own damage that may arise due to natural calamities like floods, fire, or falling objects.

- For total loss of the vehicle which may happen due to theft of the two wheeler.

- For Third-Party Liability that arises if you happen to damage someone else’s property or body.

What is Third-Party Liability Insurance?

As per the Motor Vehicle Act,2019, the Third Party Two Wheeler Insurance policy has been made mandatory by the Government. Anyone using their two wheeler on the road should have the TP Liability policy. Failing to do so, the driver will have to pay a penalty and face imprisonment. TP Liability insurance will take care of your legal liability to pay for the losses caused because of you. To put it in simple words, the third-party liability policy will pay for you when you are held legally liable for bodily injury or property damage.

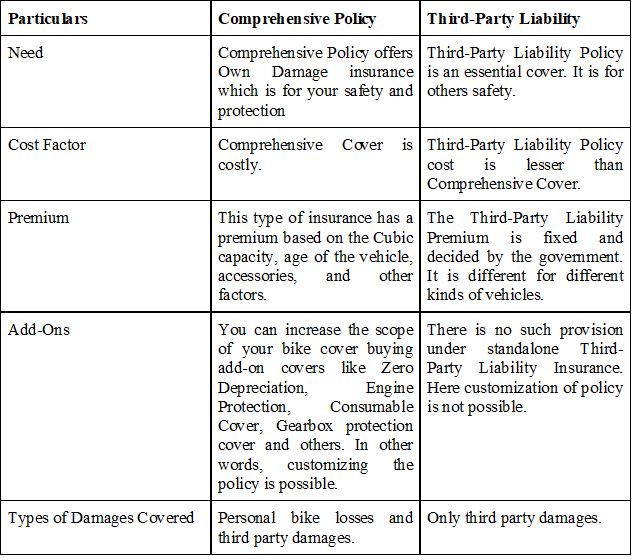

If you are still not sure of which cover is sufficient for your two wheeler, then you must know the difference between the two types of insurance policies. Here is how you can distinguish the two.

Difference between the Comprehensive and Third Part Two Wheeler Insurance Policy

Which is better?

Comprehensive two wheeler Insurance Cover offers dual protection to you that includes Own Damage and Third-Party Liability. Getting two covers is always beneficial as it will save your money in case of damages. Imagine you were taking a U-turn on your bike when the traffic from your opposite left side was flowing. You were in a hurry because of which you hit another biker. It was your mistake as you should have waited for the traffic to stop from the opposite end.

Both you and the other biker fell. Your bikes were damaged. It was your driving mistake and you were held responsible for the loss. But you had taken a Comprehensive Cover so your insurance company paid for both own damages as well as third-party liability losses. Hence, we can say buying Comprehensive is better than Third-Party Liability alone.

Only if your bike is very old then there is no point buying a Comprehensive Cover for it because then you can afford the cost of repairs.

Comprehensive Insurance Policy will pay for your personal damage which is not possible with the Third-Party Liability Policy.