CASHe, India’s most preferred digital lending company for young salaried millennials, promoted by serial entrepreneur and private equity investor Mr. V. Raman Kumar, announced its partnership with Mswipe, India’s leading mobile POS payment services provider, to launch the CASHe emi Mcards for its customers. The co-branded emi Mcard will give customers an instant pre-approved credit of up to Rs 10,000 with a 3 equated monthly repayment plan. The emi Mcard will be an additional option for the customers to choose from the existing portfolio of loan products available on the app.

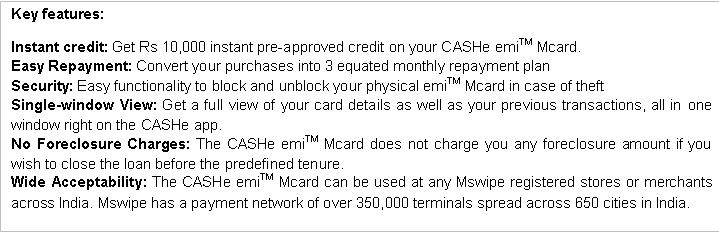

Unlike other card schemes, purchases made from the CASHe emi [Electronic Mswipe Identification] Mcards will automatically be converted into equated monthly installments payable over a period of three months at lower interest rates. The customer can make a minimum purchase of Rs 2,500 per transaction up to the limit of Rs 10,000 set on the card. The CASHe emi Mcard can be used at any merchant or online store which has a Mswipe terminal or is a registered Mswipe merchant.

The CASHe app also enables users to find merchants who accept emi Mcards. Currently, Mswipe has a payment network of over 350,000 terminals spread across 650 cities in India.

The customer can make multiple transactions in a day not exceeding Rs 10,000. All transactions for the day will be converted into a single loan on which his equated monthly installment-based repayment plan will be set by CASHe. There will be no transactional or processing fee on making the purchase for the cardholder. Once the purchase is made within the assigned credit limit, the user can make the installment payments directly to CASHe.

The user can further track the equated monthly installment payment plan on the CASHe app itself. Customers who chooses to opt for the CASHe emi Mcard loan option on the CASHe app will be issued a physical card in their name along with a welcome kit which will have a user manual to operate the card. The company further stated that it will increase the pre-approved credit limit of the card to a higher value soon.

Ketan Patel, CEO – CASHe, said

We are happy to join hands with Mswipe, a formidable player in the merchant POS services business, and offer a compelling solution to enable CASHe customers to avail electronic credit at a wide range of merchants across the country. With the launch of the CASHe emi Mcard, we are driving an altogether new level of attractive and hassle- free loan experience at the point-of-sale. With this value add, we are adding an affordable equated monthly installment payback options without the need for credit cards, which we hope will provide a better purchasing experience for the CASHe customers.

Manish Patel, Founder & CEO – Mswipe said

We are excited to launch a first of its kind consumer loan solution through our emi Mcards. As the country’s leading independent POS merchant acquirer, we have seen the importance of easy access to credit at the point of sale. These emi Mcards are a win-win for every stakeholder. For the customers, emi Mcards represent the simplest way to use their pre-approved loan. For NBFCs like CASHe, emi Mcards provide them complete control and a picture of how their loan is being used. For our merchants, these cards mean additional business and customers.

About CASHe

CASHe is India’s most preferred digital lending company for young salaried millennials. CASHe provides immediate short-term personal loans to young professionals based on their social profile, merit and earning potential using its proprietary algorithm-based machine learning platform.

In April 2016, Aeries Financial Technologies Pvt. Ltd, launched its innovative technology-driven lending platform for the young, urban millennials. CASHe provides almost instantaneous loans on-demand. CASHe’s target audience is young working professionals in the age group of 23-35 years. CASHe offers loans from Rs 10,000 to Rs 2,00,000 payable over 15~180 days. For more information, please visit CASHe