Shoot for the moon. Even if you miss, you’ll land among the stars. This quote sounds inspiring. In other words, it says: follow your goals even if they appear to be a tad improbable. You do so even when you draw up a financial plan for yourself, especially if you are planning for your retirement.

In this article, let’s find out why the traditional retirement plan may seem a bit unrealistic but also show how an unrealistic goal can actually be achievable.

Unrealistic goals

Small exercise: go online and use a retirement calculator. The calculator asks you to fill in a few answers about your age, current salary and expenses. Based on this data, the calculator throws up a number. This is roughly the amount you would have to save in order to enjoy a comfortable retirement. If this number is around Rs 5-10 crore [or even more], don’t be alarmed. This is the reality.

Most people are surprised about the ‘unrealistic’ retirement goals. In truth, traditional retirement options end up being unrealistic when the time comes for you to retire.

Traditional retirement plans

Pension plans have been widely popular among Indians for a long time. However, these plans do not offer very high returns. And in the end, they end up covering a small portion of your varied expenses post your retirement.

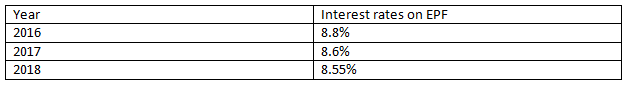

Employee Provident Fund [EPF] and Public Provident Fund [PPF] are good saving tools, no doubt. But if you see the trend, the interest rates on these plans have been gradually decreasing over the years.

In the last three years itself, EPF has seen a steady decline in interest rates. In comparison, the rates were as high as 12% two decades ago [Source]. This downward trend can pose a problem in the long term.

Inheritance

Assets such as gold, silver and real estate have passed on from one generation to the other for a long time. Many people take comfort in thinking that their inheritance would take care of their expenses during retirement. This is partly true. However, you cannot overestimate the extent of these assets. When you consider factors such as rise in inflation, medical expenses and lack of other sources of income, the inheritance can vanish quickly.

Post-retirement job

Once you retire from your job, you do have the option to look for other sources of employment during your retirement. For instance, you can take up teaching jobs at a local school or university to supplement your income. But this is not an option for everybody. Many people prefer to spend more time with their friends and family during this phase in life. And even if you do work during your retirement, there is the question of how long. As you grow older, it can get tougher to meet the physical demands of a regular job.

What you can do?

What if you had a simpler alternative to the above options? Yes, you heard right. Investing money! That’s all you need to do for a creating a solid retirement plan. The trick is to start investing at a young age. In other words, don’t think of retirement planning as you your retirement day nears. Instead, you should start investing right from the moment you start your career.

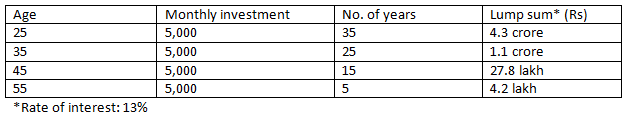

For instance, even investing as little as Rs 5,000 each month in a Systematic Investment Plan [SIP] can help you create a large corpus of money by the time you retire.

Here is a table of the benefits of early retirement planning [Source]

Unrealistic?

Well, check again. By investing just Rs 5,000 each month, you can create a lump sum of Rs 4.3 crore!! No fancy investment schemes or plans. Just a simple SIP investment each and every month can help you enjoy a comfortable retirement.

Also observe how the lump sum amount decreases drastically as you delay your retirement planning. This shows how important it is to kick-off your retirement planning early. Even a delay by a decade can create a large setback for your retirement plans.

Conclusion

Retirement is a period of life when your expenses continue [and grow, in fact] but your income stops. And to live comfortably in this stage, you need a good financial plan. Unfortunately, a lot of people ignore this until it is too late. But the best part is, by starting early, you don’t need to worry about it too much. Just invest steadily and you can create a large corpus of money for your retirement. Imagine your happiness when you find out that your account has Rs 4 crore at the time of retirement! Now that calls for a great retirement party!!