A lot of people resolve to start investing at the start of the New Year. But how many actually follow through with their resolution? Well, don’t worry if you haven’t kept up your resolution. This Gudi Padwa, you have another chance.

Gudi Padwa is a spring time festival that is considered as the traditional New Year by the people of Maharashtra. With the festival coming up, how about investing in mutual funds in order to create wealth for the future!

Gudi: The symbol of victory

It is believed that Lord Ram defeated Ravana and returned to Ayodhya on this day. The ‘Gudi’ or flag symbolizes victory and inspires people to achieve spiritual and material success.

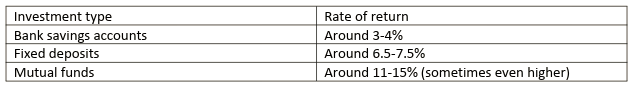

This can be achieved by investing in mutual funds. Generally, most people put their money in savings accounts and fixed deposits. While these avenues offer capital protection, the returns are not very high. Mutual funds can be a better alternative. They have the potential to provide returns that are higher than the prevalent inflation rates, which generally hover around the 4~5% mark in India.

By steadily investing in mutual funds, you can successfully meet your financial goals such as buying a car or a house or creating a corpus for your retirement.

The Gudi Padwa offering : an assorted mix

The traditional Gudi Padwa offering comprises of various items such as dal, neem leaves, neem flowers, honey, jaggery and cumin seeds. All these ingredients differ in aroma and taste. And to make the dish correctly, all the different ingredients should be in the right quantity. You don’t want it to be too sweet or too bitter.

Similarly, there are different mutual funds choices available for investing. Equity funds, debt funds, index funds, sectoral funds and so on. Each fund is tailored to meet specific needs of the investor.

For example, equity funds have the potential to offer high returns. But on the flip side, they are prone to higher market risks. The returns on debt funds may be comparatively lower but they offer capital preservation.

A good portfolio shouldn’t be exposed to too much risk. At the same time, it should try and maximize the returns of the investor. In other words, there should be a perfect balance; just like the holy offering.

Unity in diversity

Unlike other investment avenues, mutual funds offer the benefit of diversification in a very easy manner. Instead of investing in 20 to 30 stocks, it is possible to invest in a single index fund and achieve the same level of diversification.

And the best part is you don’t even need to spend a lot of money to achieve this. In fact, through Systematic Investment Plans [SIPs], you can start your investment journey with as little as Rs 500 each month. Slowly, you can increase the monthly investment amount as your income level grows.

Conclusion

As the festivities for the New Year begin, how about starting your investment journey too? This Gudi Padwa, make a resolution to increase your wealth by investing in mutual funds.