Gaming has been a crucial part of the mobile industry since the launch of the App Store in 2008. For seven years in a row, gaming apps have been used more than apps from any other category. Consequently, mobile gaming has truly shaped how we engage on our smartphones today. However, since 2015, gaming sessions have been on the decline. Does that indicate the end of the mobile gaming era ?

Flurry Analytics reviewed the gaming industry based on app usage [Flurry Analytics tracks over 940,000 apps across all app categories which provides insights into 2.1 Billion devices]. To investigate current mobile gaming trends, they examined gaming categories combining iOS and Android data and bundled related gaming categories together.

Who are the heavy gamers ?

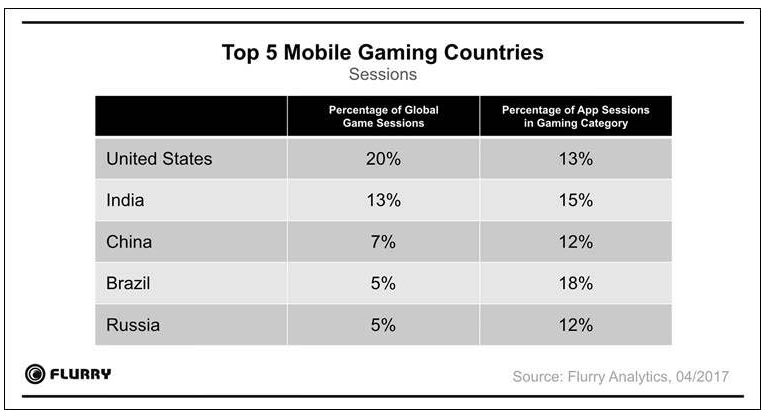

The top 5 mobile gaming countries [United States, India, China, Brazil and Russia] are driving 50% of all global gaming sessions. While the United States, India, and China take the top positions for gaming sessions, other countries are also showing a growing percentage of gaming addicts. For example, the United States accounts for 20% of all gaming sessions globally, but only 13% of all U.S. app sessions are games.

According to Electronic Entertainment Design and Research, users who are spending more than 5 hours per week in mobile games in North America are 52% female, 38.6 years old, and use both a smartphone and a tablet for gaming in 60% of all cases. While the real gaming addicts are in Europe [users in Netherlands and Sweden spend both 31% of all their app sessions in games], these countries don’t have a significant attribution to the overall global gaming sessions. In fact, Netherlands only accounts for 2% and Sweden for about 1% of all global gaming sessions.

Key Gaming Categories in Decline

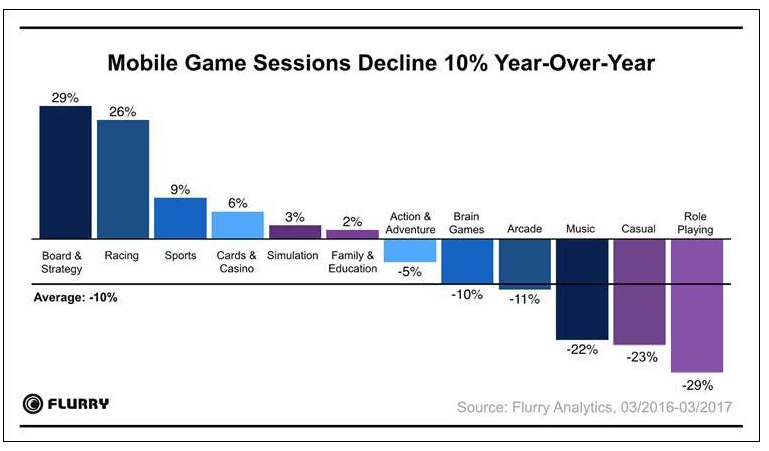

For the second year in a row, gaming sessions are declining year-over-year. Three years ago, arcade, casual and brain games were driving 55% of all gaming sessions. Since then, there has been substantial declines in two of those categories – Arcade and Casual games. Arcade games, which accounted for 24% of all gaming sessions in 2014, decreased by 34%, and casual games by 50%. The declines of those two very large gaming categories were a key factor for the overall game session downturn within the last two years. A lot of those sessions simply dropped and were not spent in other gaming categories.

Are there any winners in a time of decline ?

While mobile gaming sessions have declined by 10% year-over-year, some categories continue to gain traction in usage. This year, card & casino apps reached a spot in the top three gaming categories. Sessions grew by 22% since 2014, and the category now accounts for 15% of all gaming sessions. Separately, the growth of smaller app categories is driving diversification for the industry. For example, board and strategy games grew 29% year-over-year from 2016 to 2017 and sessions are up 80% since 2014. This rise increased the category’s session share of all gaming apps from 1.6% to 4.0%.

They also identified similar trends in other smaller categories such as racing. Racing grew by 26% year-over-year and increased its game app session share from 1.6% in 2014 to 2.1% in 2017.

Fewer but longer gaming sessions

Flurry data shows that time spent in gaming apps has remained steady over the last year [+1%]. The average US consumer spends 33 minutes per day in mobile games, and our data showed that the average session length grew from 6 minutes and 22 seconds in 2016 to 7 minutes and 6 seconds in 2017. This is a significant advance, considering that the average session length never exceeded 6 minutes in 2014 or 2015. Additionally, the latest year-over-year session length growth equals an increase of 44 seconds (+12%) per session, which indicates higher in-game user engagement than in previous years. These statistics reveal that while more gamers open gaming apps less often, they often spend more time playing games during each session.

Size does Matter

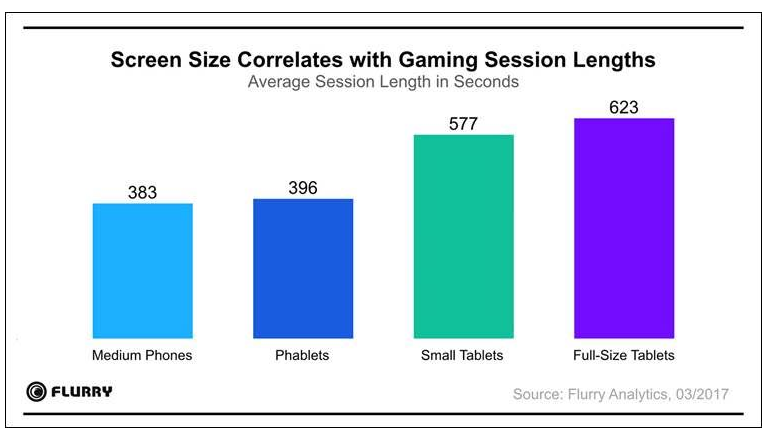

In the gaming industry, one thing remains true : the bigger the screen, the greater the engagement.

When users play on-the-go, they take their medium-sized phone or phablet. However, if they are purposely dedicating time out of their day to mobile gaming, they are more likely to pick up their full-size tablet device, which explains average session lengths of over 10 minutes on full-size tablets.

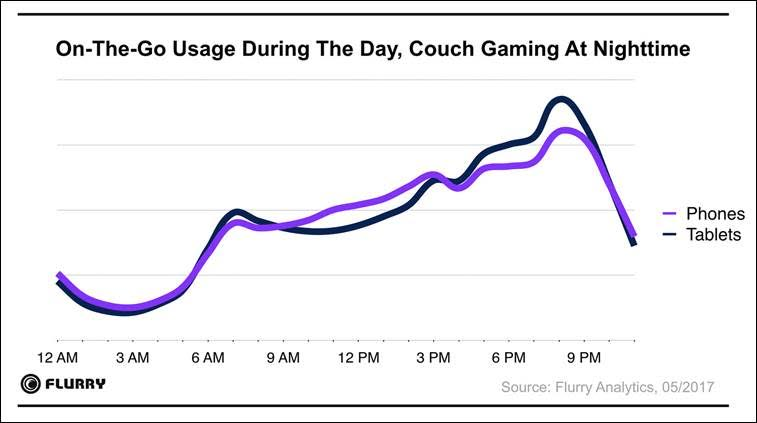

With regard to the hours of the day that are most popular for on-the-go versus on-the-couch gaming, tablet gaming showed a steady peak in the morning. Most users carry their phone with them during the day, especially in the morning as they commute to school or work, so this is when many gamers play on-the-go. On the other hand, the use of tablets for couch gaming peaks in the evening, as more users log in from the comfort of their couch or bed. While gaming time on the phone still peaks in the evening, it’s important to consider that overall phone usage peaks at that time as well.

New users reflect increased revenue opportunities

As noted above, the reported shift in time spent on apps leads to more engaged attention spans at a time, which creates new monetization opportunities. Recently, SensorTower disclosed that the combined mobile gaming app store revenue on iOS and Android increased from $7.8 Bn in Q1 2016 to $11.9 Bn in Q1 2017. This equals a 53% year-over-year revenue growth. Besides different gameplay periods, users are becoming more comfortable spending money in apps, which is positively impacting mobile game revenue. SensorTower also found that download to revenue conversion on iOS has increased by 38% from January 2016 to January 2017. All of these observations lead to the conclusion that the mobile gaming industry still has high potential to drive revenue.

Mobile gaming beyond 2017 and tips for app developers

The gaming industry remains a very attractive category for app developers, especially as revenue conversions are growing. We’re seeing that longer session lengths are opening up new opportunities for innovative engagement and monetization tactics. For example, the peak usage hours on mobile devices are between 6 and 9 pm, which app developers can leverage to target specific users with acquisition or engagement campaigns.

Looking ahead, Flurry anticipates new technologies such as virtual reality and augmented reality to open a new chapter of mobile gaming and to enhance the in-app experience as a whole. And gamers are ready – they are already having longer game-plays on their favorite gaming apps than ever.

The complete report can be downloaded from here