Fintech startup MoneyTap [Earlier coverage – MoneyTap review, Q&A with Bala Parthasarthy] has raised a total of USD 12.3 million in funding to drive the continued expansion of its app-based consumer credit line in India. The investment was led by Sequoia India and supported by existing investors, NEA and Prime Venture Partners.

As a testament to its continued popularity among its users, MoneyTap is on target to issue credit lines worth INR 300 crores by the end of the current fiscal year. With this fresh funding, MoneyTap plans to solidify its leadership position by improving credit accessibility for other segments of customers, partnering with 6 other Banks and NBFCs and expanding to 50 cities in India by the end of 2017.

Since its launch in September 2016, India’s first app-based consumer credit line has attracted over three hundred thousand [300k] users. The majority of users have a monthly income of INR 30,000~40,000 and are aged between 28~32 years.

The Indian consumer finance market is estimated to grow at a compounded growth rate of 18 percent to become a USD 1.2 trillion opportunity by 2020. Reports also suggest that it is also one of the most underpenetrated markets for lending, with close to 70% of the population being underserved by institutional lenders. Penetration of unsecured personal loans has been extremely poor in India with the organized credit presence at around 1% in the country.

According to RBI data of August 2016, in a country of 1.2 billion Indians, only 26.4 million have credit cards. Comparatively, there are about 600 million active mobile phones in India and mobile banking transactions rose from Rs 4,185 billion in 2012 to Rs 5,243 billion in October 2016. All this data points out to the fact that consumer-lending startups such as MoneyTap, supported by financial institutions, can serve a huge creditworthy but financially excluded customer base previously overlooked by the lending businesses.

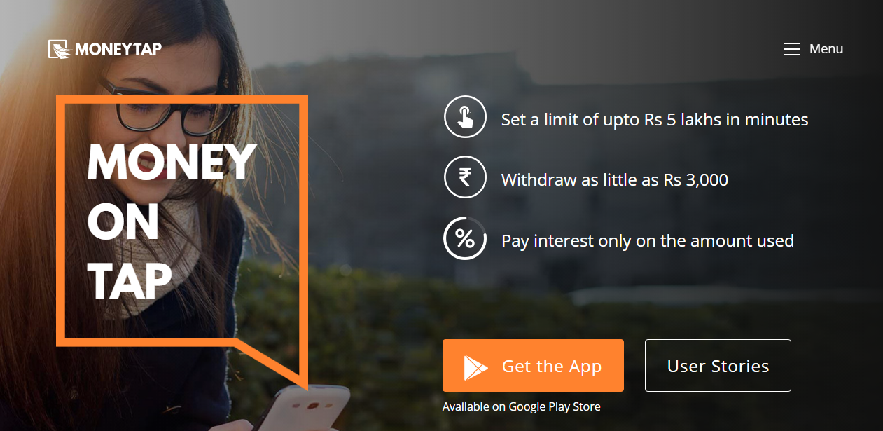

MoneyTap is available on Android Playstore and is targeted at salaried individuals and self-employed professionals earning more than INR 20,000 per month. MoneyTap evaluates the user’s eligibility in less than 4 minutes after which it provides an instant, real-time decision on the application along with the amount they are eligible for. Using the credit line, consumers can choose to borrow as little as INR 3000 or as much as INR 5 lakhs or up to their maximum eligibility limit. Customers can decide their own EMI plans with flexible payback periods ranging from 2 months to 3 years. Interest is paid only on the amount borrowed and rates can be as low as 1.25% per month. If the user does not borrow any amount, then no interest needs to be paid. The credit limit also gets topped up once EMIs are paid back.

MoneyTap along with RBL Bank is able to provide its customers, instant decisions and instant access to money, 24/7. All financial transactions such as billing and repayment are directly dealt with the bank but through the MoneyTap App using secure APIs, thus ensuring 100% secure transactions.

Bala Parthasarathy, Co-founder, MoneyTap said

These are exciting times at MoneyTap. We deeply believe that the rapidly growing middle-income group in India is largely underserved by financial institutions. They are app-savvy and very demanding. We have been fortunate to partner with Sequoia, NEA & Prime – all of whom are top tier investors with deep fintech and operational expertise to take us to the next level.

Abheek Anand, Principal, Sequoia Capital India Advisors said

Consumer credit in India is highly under-penetrated and is a complex problem to solve. MoneyTap combines an experienced team with a thoughtfully designed product – and their strong early traction is a testament to the efficacy of their approach to address this massive market opportunity.

Ruchir Lahoty, Managing Director, NEA India said

MoneyTap is using the power of technology to provide a seamless lending experience to what currently is a largely broken discovery process with long execution timelines for consumers. Also, MoneyTap works with banks & NBFCs instead of competing with them therefore getting access to large amount of lending capital while managing the consumer journey throughout the lending lifecycle.

Shripati Acharya, Managing Partner, Prime Venture Partners said

MoneyTap’s strong growth since its inception is testament to both the innovative nature as well as rapid consumer adoption of their solution which addresses a monster opportunity – providing effortless credit to worthy consumers entirely through an app. We are privileged to be associated with this stellar team from the start of their journey and be part of their vision to reinvent the unsecured consumer lending landscape.

About MoneyTap

MoneyTap is a Bengaluru-based