There is a very famous quote-Risk and Rewards are two sides of the same coin and one area that this is very apt is Investing. Higher the risk, more are the chances of yielding better returns and hence when it comes to investments there is certain amount of risk and with that risk can come pain, but also some gain. However, when we talk about investments, returns, risks, rewards, etc. those terms are very relative since the personal financial portfolio of each investor might look very different.

The primary reasons why the portfolio looks different is because it is dependent on factors namely investor’s age, liabilities, assets, financial goals, existing portfolio, market trends, market volatility, etc. Last few weeks, news has been abuzz with #Demonetisation due to which large number of old Rs. 500 and Rs. 1000 notes have been deposited into the banks. As per estimates, banks have received deposits worth Rs. 4.5 Lakh crore [Source]. With ample amount of deposits, banks have started cutting fixed deposit rates. PPF, Fixed Deposits and Recurring Deposits are some of the safest options for investments and mostly suited by passive investors. In such unplanned scenarios [like Demonatisation], even the safest of the investment options do not work and hence, it is always advisable to ‘Not put all your eggs in the same basket‘

Though maintaining a balanced portfolio is always on high priority of every investor’s list, for some novice investors the financial terminologies itself seem very confusing! This is where Edelweiss Financial Services, one of India’s leading financial services group aims to bring simplicity & intuitiveness in the entire process of investment.

Edelweiss : Decipher investment terminologies

Edelweiss recently launched the new avatar of http://www.edelweiss.in that is designed to make investment appear simple and intuitive, even a first time investor can navigate through the platform with ease and build his portfolio. The platform has sections catering to different investor sets, be it the experienced investors or the new ones.

There is an increased focus on financial content in the insights section which will help investors meet deeper understanding of financial markets, macroeconomics and investments. There is content for a wide range of audience, whether you are looking for research report or looking for personal finance views or seeking macro updates.

Edelweiss Guided Portfolios : Mutual Funds meets Artificial Intelligence

As mentioned earlier building a balanced portfolio is a daunting task since it takes time to master the market and market volatility is one factor that can play a spoil-sport in creating one. What if you could get tailor made portfolios that is built by experts in that domain! Sounds, great ain’t it? This is what Edelweiss Guided Portfolios is all about-Mutual Funds that suits your requirements.

It is an algorithm based intelligent system which designs mutual fund portfolios for investors and guides them towards their financial goals through systematic investments. Some of the salient features of Edelweiss Guided Portfolios is below:

1. Guide investors to achieve financial goals using algorithm driven systematic investment approach

2. Proprietary algorithm for asset allocation depending on investor risk profile

3. Fund selection based on internal scoring mechanism

4. Periodic monitoring and re-balancing on investor portfolios

5. Paperless mutual fund account opening process

6. Intuitive platform design

Having a Paperless approach to Mutual Funds is a very bold step that has been taken by Edelweiss, it definitely increases efficiency of their staff and simplifies customer on-boarding process! Lot of effort has been put by Edelweiss to keep the platform simple to understand and convenient to use so that anyone with any level of financial expertise can transact on it. Using Edelweiss Guided Portfolios, an investor can build his portfolio sitting in front of his desktop or mobile, open his account in a paperless manner and start investing!

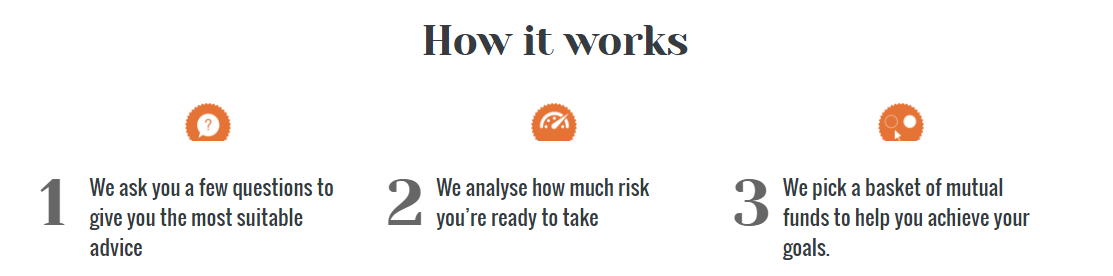

The next question that you would have in mind is how does it work, so let’s have a look into it.

Edelweiss Guided Portfolios : How it works

As discussed earlier, it is powered by internally developed proprietary asset allocation and mutual fund allocation algorithm. Based on financial goal and risk profile of the investor, the Artificial Intelligence [AI] driven system selects the best performing mutual funds for the investor as per the suggested asset allocation and internally assigned score of the selected mutual funds.

The system selects the best performing & best suited mutual funds from a pool of around 2000 funds. The pool of funds is also periodically updated based on the market performance. In order to keep the investment process transparent and to allow investors to make informed decisions, the platform also highlights the key reasons behind adding the selected funds in the investor’s portfolio.

Entry Strategy – Risk Appetite is the key factor on which it’s algorithm draws an entry strategy.

Portfolio Rebalancing – The algorithm comprises dynamic rebalancing algorithms that keep track of changing market conditions and performance of the selected mutual funds. The primary objective of this strategy is to help the investors so that they keep the best performing funds in their portfolios in order to get maximum returns.

Edelweiss Guided Portfolios is the result of Suno (listen to customers), Samjho (understand customer requirements) and Suljhao (solve customers’ problem by providing efficient solution) philosophy adapted by Edelweiss and the result definitely shows in their strategy.

Edelweiss Guided Portfolios : How to invest & it’s USP

With India marching it’s way towards being a Digital Nation (with Financial Inclusion being at fore-front), Edelweiss ensured that the barrier-to-entry i.e. tedious paperwork is completely eradicated when a prospective investor signs up for this product. For the very first time, Edelweiss has launched an Aadhar based paperless process for mutual fund account opening for new clients. The account opening process uses Aadhar based e-KYC for non KRA [KYC Registration Agency] verified participant. This step ensures that investors can sign-up for it in a hassle-free manner.

There is a question that comes to mind-How is Edelweiss Guided Portfolios different from other Portfolio Management Services [PMS] and the answer lies in the flexibility that investors get with the product. In the case of Portfolio Management Services, investors don’t have a say in the selection of stocks or funds. With Guided Portfolio from Edelweiss, you are allowed to control and monitor your investment at all times.

We are sure that there would be many more lingering questions in the minds of the investors like Who manages the portfolio, Are there any add-on charges for it, etc. The FAQ on Edelweiss Guided Portfolios provides the key to all these questions.

Conclusion

Guided Portfolios from Edelweiss is an interesting financial product that would appeal to both newbie as well as seasoned investors. Since AI being the key pillar of the product, it brings a whole new dimension to investments!

If you have tried Edelweiss Guided Portfolios then please leave your feedback/experience on the product in the comments section…

Disclaimer – Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

![]()