The Banking and Finance sector (BFSI) is witnessing one of its most interesting and enriching phases. Apart from the evident shift from traditional methods of banking and payments, technology has started playing a vital role in defining this change. The phenomenal swing from offline payments to online payments over the last two decades has been aided by mobile apps, plastic money, e-wallets and bots. Now, the use of Artificial Intelligence (AI) in BFSI is expediting the evolution of this industry.

AI enables a computer to behave and take decisions like a human being. Coined in 1956 by John McCarthy at MIT, AI was little known to the layman and merely a subject of interest to academicians, researchers and technologists. However, over the past few years, it is more commonly seen in our everyday lives; in our smartphones, shopping experiences, hospitals, travel etc. The BFSI sector uses AI because of its inherent advantages-efficiency and faster processing, accuracy, daily application & data availability. Here are some artificial intelligence technologies and what they offer for Banking and Finance.

Machine Learning, Deep Learning, NLP Platforms, Predictive APIs and Image and Speech Recognition are some core AI technologies used in BFSI today. Machine Learning recognizes data patterns and highlights deviations in data observed. Data is analysed and then compared with existing data to look for patterns. This can help in fraud detection, prediction of spend patterns and subsequently the development of new products. Key Stroke Dynamics can be used for analyzing transactions made by customers. They capture strokes when the key is pressed (dwell time) and released on a keyboard, along with vibration information. As second factor authentication is mandatory for electronic payments in India, this can help detect fraud, especially if the user’s credentials are compromised. Deep Learning is a new area in Machine Learning research and consists of multiple linear and non-linear transformations. It is based on learning and improving representations of data. A common application of this can be found in the crypto-currency, Bitcoin.

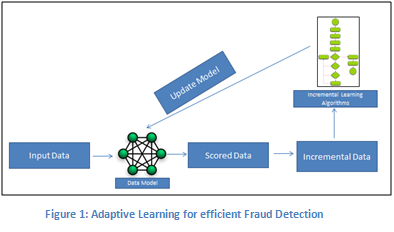

Adaptive Learning is another form of AI currently used by Indian banks for fraud detection and mitigation. A model is created using existing rules or data in the bank’s system. Incremental learning algorithms are then used to update the models based on changes observed in the data patterns.

Natural Language Processing (NLP) is the ability of a computer to understand human speech as it is spoken. In India, ICICI has started using NLP for sentiment mapping. It is predicted that the NLP market will reach USD 13.4 billion by 2020 at 18.4% CAGR. NLP and AI bots may also be used for Whatsapp-based banking, similar to how WeChat is used for banking in China. Voice Recognition used for secure banking transactions can take payment security to the next level. The Santander Group, based in Spain, has already announced the usage of this feature in their app. Similarly, AI can be used to answer customer questions as well. Swedbank uses Nina (a web assistant) to artificially interact with customers and build loyalty.

Banks across the globe, including India, are increasingly providing Spend Analysers and Smart Wallets as value added services to customers, helping track expenses and understanding spending patterns. The lending industry can also use AI to derive user needs, borrowing patterns and the payment sequence, making lending a less risky proposition. Predictive APIs can be used for detecting frauds and for speech/voice recognition.

In India, one can see increased momentum for research and funding of AI start-ups. According to CB Insights, venture capitalist funding in AI firms has increased from USD 415 million in 2012 to USD 2.38 billion in 2016. Image recognition, product and service discovery chat bots and developer tools for enterprises to create their own AI systems are some technologies that start-ups are focusing on.

In the gamut of BFSI and the imminent marriage of Fintech companies and banks, using AI becomes all the more significant to accelerate change and improve customer experience and design. Soon we will see Advanced Robotics being implemented, Digital becoming mainstream, Blockchain playing a key role in payments and regulators turning to technology. With Asia taking the lead in technology innovation and playing a prominent role in the world of payments by 2020, BFSI should accelerate the adoption of AI and make it the core engine for business transformation.

About the author

Sanjay Goswami is the VP-Software Development at Worldline India, a leader in payment and transaction services. At Worldline India, Goswami leads product development, technology and competency building with a focus on new and emerging businesses and innovation. Prior to Worldline, Goswami has worked with reputed companies like Samsung, HCL, CSC and Syntel Inc. Sanjay is a BE graduate & has completed the Executive General Management Program from IIM, Bangalore.