It is the season of filing taxes and at least during this period of time, Tax and Savings momentarily become buzz words. One of the main reasons why it is momentary is because just like ‘New Year Resolutions’ that sometimes get fulfilled, our investment plans rarely take shape as per the plan. Investment plans many times change based on investment priorities, assets & liabilities, risk-taking appetite (which is based on your current stage of life, your current savings, dependents etc.).

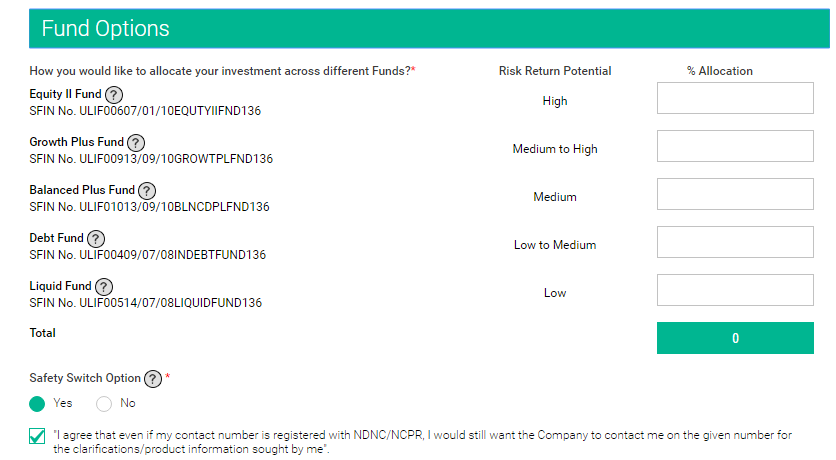

Investments could take either form – Investments in Stock Markets [market dependent, volatile & investor needs to be updated with the market scenario’s] or Investments in Mutual Funds, ULIP (Unit Linked Insurance Plan), Life Insurance etc. In the latter case, investment situation is very different since in case of Mutual Funds/ULIP’s, you as an investor need to keep a Check on Market Up’s/Down’s but in most cases, there would be a flexibility to switch between your fund options in order to maximize returns. Such investment options are best suited when you have a bird’s eye view of the capital market (not in-depth knowledge) and do not have risk-taking appetite !!

Image Source* – Online Term Plan

We had also mentioned about one very important investment – Life Insurance that can be termed as Life Assurance. It is an assurance that if some un-toward incident occurs in your life than your dependents do not have to take the brunt on it (from financial aspects). We insure our cars, house, bike and even mobile phones these days. In today’s fast paced world, life has become uncertain, so each one of us would definitely have a Life Insurance. With rising inflation, change in our life-style patterns, shift to nuclear families, Life Insurance is a must-have in your financial planning book !!!

Most of the Life Insurance policies in the market offer only ‘Life Cover’ i.e. the opportunity for wealth-creation is negligible. If you are an average Financial Maverick (i.e. you keep a check on market scenario on regular-basis) & require a Life Insurance that also creates Wealth than ULIP (Unit Linked Insurance Plan) provides you that option (Life Cover + Wealth Creation). There are many financial companies offering the same and Canara HSBC & OBC is set to launch a ‘Part Protection‘ and ‘Part investment plan‘. The plan provides protection features through different benefit options to suit your needs.

Canara, HSBC and OBC : Overview

Canara HSBC and OBC is a joint collaboration of Canara, HSBC, Oriental Bank of Commerce and it caters to the Life Insurance sector. It uses industry-accepted best security practices, controls and have a robust information security framework and underlying infrastructure that works round the clock towards protecting customer’s sensitive information.

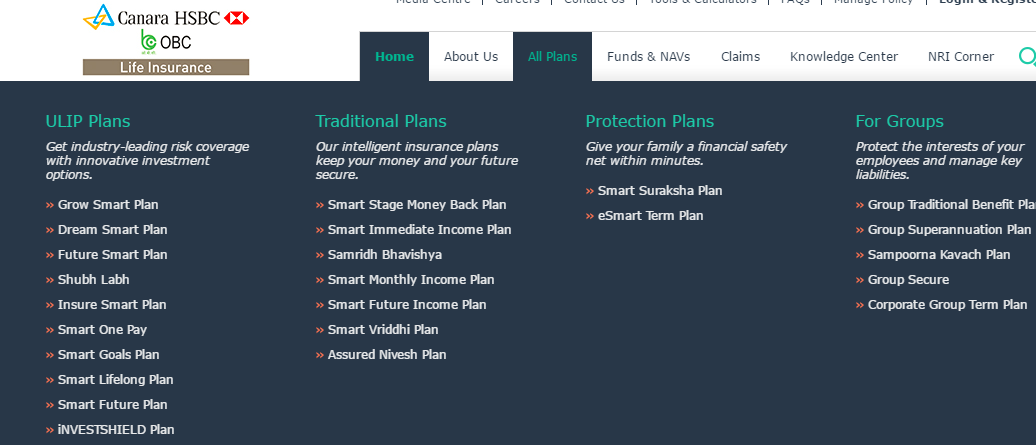

Canara, HSBC and OBC : ULIP Plans

As mentioned earlier, ULIP is a good product that offers you the benefit of investment in capital markets along with insurance. One of the major advantages of ULIP is that you can expect higher returns based on your scheme. With GST Bill passed by Rajya Sabha and overall reactions being ‘Positive’, I invested in a ULIP plan from this company based on consultation with my financial advisor.

Canara HSBC Oriental Bank of Commerce Life Insurance has some interesting ULIP Plans which an investor can look into based on his/her current investment portfolio. Some of the plans are below:

- Grow Smart Plan

- Dream Smart Plan

- Future Smart Plan

- Smart Goals Plans

You can more information about these plans & many other plans in the ULIP section of CanaraHSBCOBC The company has come up with new ULIP Plans – iNVESTSHIELD Plan and Assured Nivesh Plan.

Canara, HSBC and OBC : iNVESTSHIELD Plan

In line with the philosophy of ULIP Plans, #InvestShield Plan is a Value for Money Investment combined with Protection for your Family. The most promising aspect of the plan is that it is Highly customizable and you have the flexibility to do Partial Withdrawals.

In order to apply for the #InvestShield Plan, you need to follow these steps:

- Decide on your Premium and Choose your options

- Complete the Proposal

- Make Payment

- Submit the Documents

The entire process looks hassle-free and less cumbersome !!! Based on your risk-taking appetite, you can opt for a plan that suits your current & planned future requirements.

In order to Apply for the #InvestShield Plan, please visit InvestShield Plan Application Page

Canara, HSBC and OBC : Assured Nivesh Plan

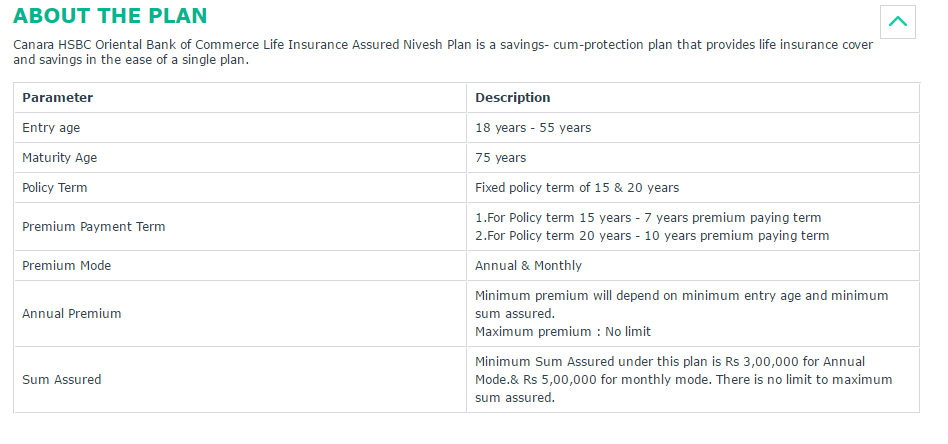

Assured Nivesh Plan is a plan with fixed Policy Term of 15 and 20 years. Depending on the Policy Term, you need to pay premium for 7 or 10 years. At the end of every year, the company would declare bonus throughout the policy term and that would be added to the sum assured.

On survival of the Life Assured to the end of the policy term the below defined maturity benefit is payable to the Policyholder provided the policy is in-force: Guaranteed Sum Assured at Maturity + Accrued Annual Bonus (If Any) + Final Bonus (If Any) where Guaranteed Sum Assured at Maturity is equal to Sum Assured. Please refer to BENEFITS section of Assured Nivesh Plan to get details about Life-Cover Benefits and Death Benefits.

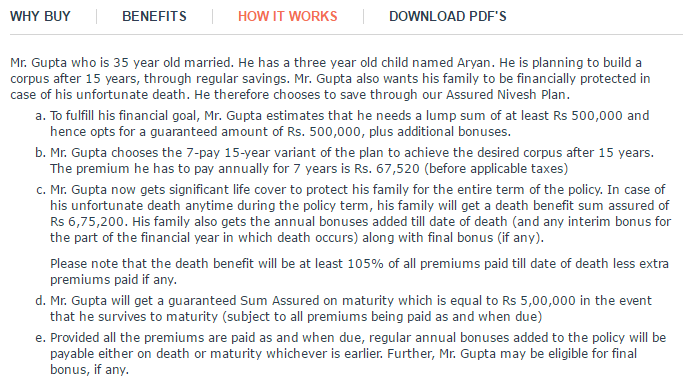

We are sure that there would be lingering doubts about the returns, benefits to family members in case of un-timely demise of the policy holder etc. The HOW IT WORKS section provides an answer to all your questions :

The Insurance Calculator section can definitely be a useful tool in case you have the initial doubt of “How much insurance you need ?” With an upswing in the market, increase in FDI, Passage of the GST Bill coupled with positive reactions from industry experts; this might be the right time to invest in a ULIP Plan 🙂

If you an investor in any policy from Canara HSBC OBC, please leave your review in the comments section…

Disclaimer : Information provided in the article is based on my research and I do not have any holding. Investment in stocks/ULIP/Mutual Funds involves risk, so consult your financial adviser or do your own analysis before making any investment.

![]()