YES BANK has announced the financial results for Quarter ending 30th June, below are some of the highlights and insights into revenue from various sectors.

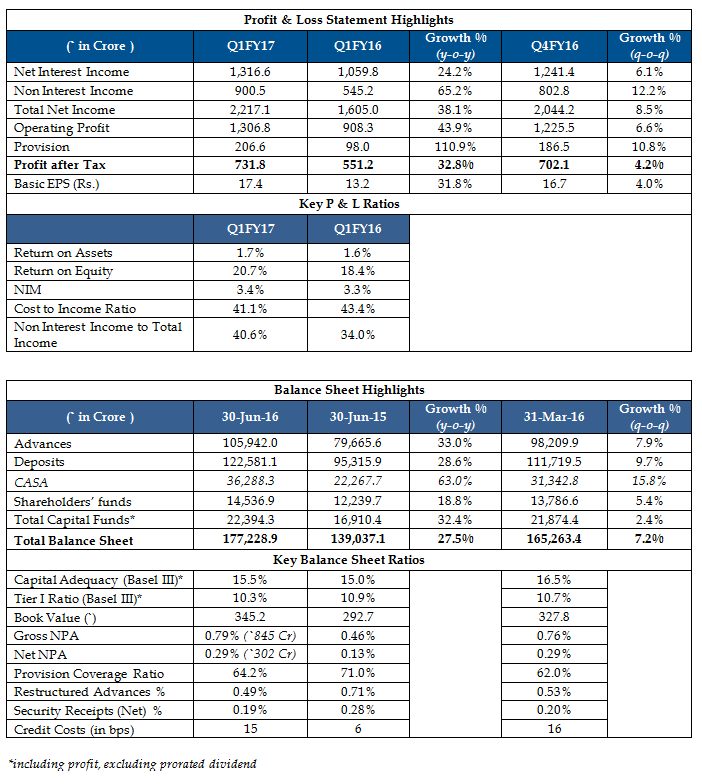

Key Profit & Loss (P&L) Statement Highlights

- Net Profit of INR 731.8 Crores in Q1 FY17; y-o-y growth of 32.8%

- Total Net Income of INR 2,217.1 Crores in Q1 FY17 y-o-y growth of 38.1%

- Net Interest Income of INR 1,316.6 Crores for Q1FY17; y-o-y growth of 24.2% on back of growth in Advances & CASA. NIM expanded to 3.4% in Q1FY17 from 3.3% a year ago

- RoA stands at 1.7%, RoE at 20.7% for Q1FY17

- Book Value at INR 345.2 per share as on June 30, 2016

Key Balance Sheet Highlights

- Y-o-Y growth in CASA of 63.0%; CASA Ratio improves to 29.6% from 23.4% a year ago, 6.2% improvement in one year. SA deposits posted robust growth of 81.6% y-o-y

- CASA+Retail FDs as % of Total Deposits stands at a healthy 55.3% as at June 30, 2016

- Advances grew by 33.0% y-o-y to INR 1,05,942.0 Crores as at June 30, 2016

- Total Capital Adequacy as per Basel III is robust at 15.5% with Tier I ratio at 10.3% (including profits and excluding prorated dividend)

Total Capital Funds at INR 22,394.3 Crores as of June 30, 2016

Key Asset Quality Highlights

- Credit Costs at 15 bps for Q1 FY17

- Gross Non Performing Advances (GNPA) at 0.79% and Net Non Performing Advances stable at (NNPA) at 0.29% as at June 30, 2016

- Provision Coverage Ratio (PCR) stands at 64.2% as at June 30, 2016

- Standard Restructured Advances as a proportion of Gross Advances at 0.49% (INR 522.9 Crores) as at June 30, 2016, down from 0.71% (INR 567.1 Crores) as at June 30, 2015. No additional restructuring done during the quarter.

- Security Receipts (SRs) stand at 0.19% (INR 199.4 Crores) of Gross Advances as at June 30, 2016. There has been no sale to ARCs during the quarter.

- Standard SDR Advances at 0.03% (INR 34.3 Crores) of Gross Advances as at June 30, 2016 from single SDR account undertaken during the quarter.

- Nil 5:25 refinancing during Q1 FY17

Financial Highlights from Q1FY17 Results

Commenting on the results and financial performance, Mr. Rana Kapoor, Managing Director & CEO, YES BANK said

YES BANK has delivered another highly satisfactory quarter of financial performance reflected in strong & quality growth, sustained profitability and continued resilience in asset quality. The Bank continues to witness a robust CASA growth with the CASA ratio improving to a healthy 29.6% from 23.4% a year ago demonstrating significant momentum in the underlying Retail franchise platforms, as well as ongoing mandate in several corporate relationship groups. Further, YES BANK has received an in-principle approval from the Securities & Exchange Board of India (SEBI) to setup an Asset Management Company (AMC) which will further deepen our value proposition for our retail customers. Given the improving macroeconomic environment along with stable Asset quality and accelerating Retail franchise, the Bank is well poised to capture Market share across Retail and Corporate segments at an enhanced pace.

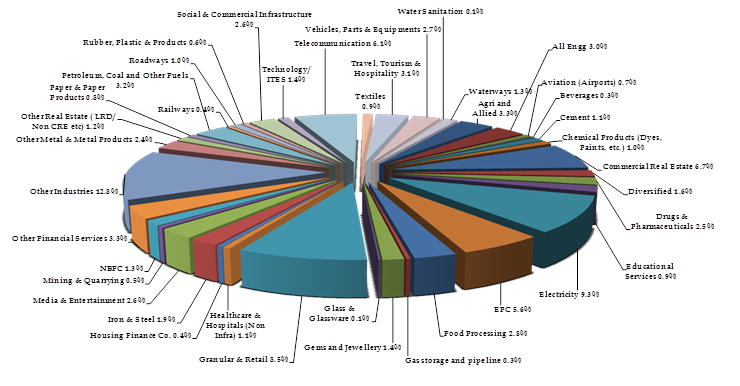

Sectoral Distribution

Overall portfolio is well distributed with significant deployment in YES BANK focused knowledge sectors where the Bank has developed considerable sectoral expertise with specialized Relationship Managers, Product Managers and Risk Managers.

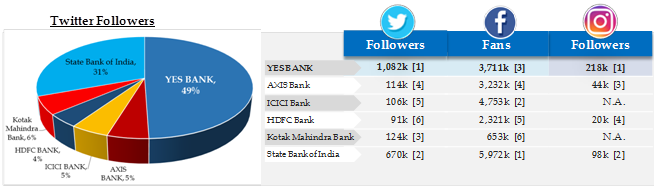

Social Media

According to the recent ranking by The Financial Brand publication, YES BANK is ranked amongst the Top 5 Global Bank Brands on Social Media.

- As per the same report, YES BANK is the Highest followed Global Bank Brand on Twitter with over 1 million followers, and also the Fastest Growing Global Bank Brand on Facebook with more than 3.5 million Page Likes.

- YES BANK is also the Highest Followed Bank Brand on Instagram in India with over 2 lakh followers.

- YES BANK is the 1st Bank in India to launch ‘Facebook at Work’ to its workforce & have achieved 100% registration across over 16,000 employees.

Digital Banking

YES Bank continues investing significantly in new-age mediums and digital technologies to achieve a heightened customer engagement and experience. Some of the Bank’s key digital initiatives revolutionizing payments ecosphere are as follows:

- YES Money program: One of the largest Domestic Remittance program encompassing over 5.1 million customers with a cumulative transaction throughput of INR 13,000 Crores.

- Over 2.4 million YES Bank co-branded Virtual prepaid Cards issued on the MasterCard platform since launch in January 2016, the ‘largest virtual prepaid card’ program in the world.

- Over 34 million YES Bank powered Freecharge Wallets issued since launch in September 2015.

- Launched ‘QR Code’ based Proximity Payments in collaboration with Click & Pay.

Expansion & Knowledge Initiatives

- Total headcount stands at 16,421 as at June 30, 2016, an increase of 1,421 employees in the quarter and 4,878 incremental employees since June 30. 2015.

- The Bank’s branch network stood at 900 branches as on June 30, 2016, an addition of 40 branches in the quarter. Total ATM network stands at 1,680 as on June 30, 2016, of which 428 are Bunch Note Acceptors (BNA)/Recyclers.

- YES BANK has received RBI approval post approval from the CCEA (Govt. of India) to raise its Foreign Investment Limit to 74%. This has made YES BANK the FIRST Bank in India to have an operational fully fungible composite foreign ownership limit of 74%

- YES BANK has received an in-principle approval from the Securities & Exchange Board of India (SEBI) to sponsor a Mutual Fund and to setup an Asset Management Company (AMC), and a Trustee Company. The AMC and the Trust Company shall be set up as wholly owned subsidiaries of YES BANK Limited. This is further to the Reserve Bank of India (RBI) approval for AMC granted to YES BANK in October 2015

- YES BANK has announced commitment of INR 250 Crores towards two key focus areas of livelihood and water security, and environment sustainability by 2020 through its focused and intensified CSR and Sustainability action.

- YES BANK has pledged GBP 1 Million to the London School of Economics and Political Science (LSE) to support the IG Patel Chair– named in honour of the former Governor of the Reserve Bank of India and former Director of LSE. The funding from YES BANK will also support the work of the LSE India Observatory, which was established in 2007 to continue to develop and enhance research and programmes related to India’s economy, politics and society with a specific focus on Climate Change and Sustainability.

For more insights into the Quarterly results, please visit YES BANK Q1 FY17 results