What is one word that you can associate with Banking? The answer would be synonymous-Endless paper work, Multiple follow-ups for account related transactions, Long queues [irrespective of the transaction] to name a few. Fast forward now, things have definitely improved and one of the driving factors that made ‘banking transactions’ less hassle-free is the smartphone revolution and rapidly growing internet penetration.

Before you further read on, we request you to re-read the previous statement again 🙂 It mentioned Banking Transactions have become hassle-free but once in a while you still need to visit the Bank !! The treatment that you would receive at a particular bank branch would also depend on whether it is your ‘Home Branch’ or not. Bank going ‘Paperless’ as well as ‘Branchless’ would be considered a highly exaggerated statement.

With the Digital India, Digital Banking and Financial Services landscape looks positive. Some of the major factors that can impact [and some are already impacting] ‘Digital Banking’ are:

- Aadhar by UIDAI [Unique identification for every Indian resident]

- Banking to the un-banked

- Introduction of the ‘Digital Locker’ [Secure storage provided by the Government of India for storing your important documents]

- Massive policy changes for incentivizing Digital Payments [as announced in Union Budget 2016]

- Introduction of Unified Payment Interface [UPI]

Banks have been taking massive steps in order to make Banking hassle-free, environment friendly ensuring that safety & trust is not compromised (at any step). Though Online Transfers, E-Passbook, Bill payment contribute a lot to making banking more ‘Green’, opening an account in a bank still requires submission of lot of documents 🙁 This was the ‘vacuum’ in the banking sector that was required to be filled-in and DBS (Development Bank of Singapore), Singapore’s best and Asia’s safest bank has decided to take the lead to make Banking : Paperless, Hassle-free and Rewarding [via Cash-backs] with introduction of Bio-metrics authentication and account opening with only Aadhar Card.

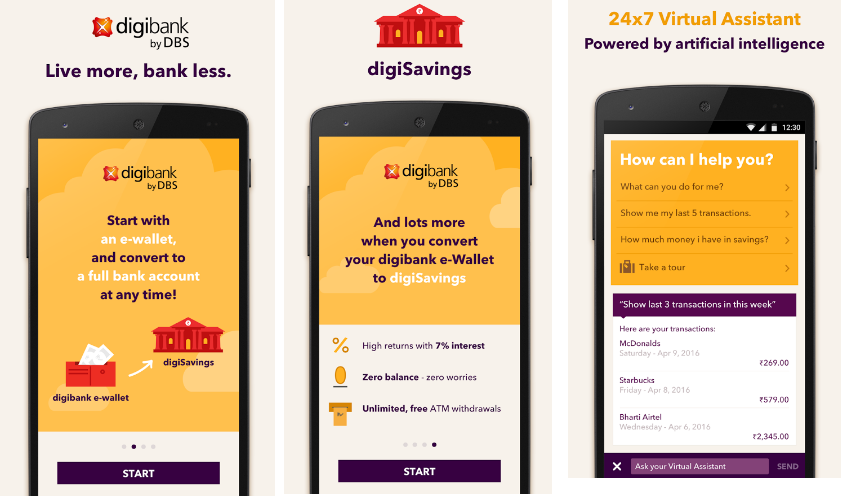

Say hello to a new way of banking so you can live more, bank less [#livemorebankless] with Digibank. Let’s look into the salient features of Digibank and how they are embarking a new banking revolution by making the Bank truly ‘Digital Bank’ !!

Digibank is broadly divided into two sections – DigiExpress & DigiSavings.

Open new savings account in a whisker

Once you download Digibank on your smartphone, you can open an e-wallet account in less than 90 seconds. Once the account has been setup, you get a virtual VISA debit card to shop, pay utility bills, book ticket etc. In today’s time, it is very important to have an efficient ‘Partner Eco-System’ and Digibank has partnered with 10000+ e-commerce merchants so that customers get ‘Cash-back’ when they shop 🙂

You can convert your account into zero balance DigiSavings account by just submitting your Aadhar Card or PAN Card details and completing your bio-metrics authentication at their partner outlets. They have ensured that all the ‘Safety and Trust’ standards are adhered so that banking using Digibank is more secure !!

DigiSavings – Single account, multiple benefits

Compared to interest rates offered by banks on savings account, customers get high returns [7% interest on Rs. 1] when they convert their Digibank’s e-wallet account into DigiSavings account. You also get cash-back of 5~10% when you shop using Digibank on their partner websites.

You can maintain Zero balance account [with zero maintenance fees] and enjoy unlimited [& free] ATM withdrawals. This is definitely an interesting step to make e-banking more secure & hassle-free.

Easy and Secure payments

Adding a new payee or biller on the Digibank app is very simple. Digibank has a dynamic in-built security which is even more secure than the OTP. The entire transaction process is seamless yet very secure. The breezy UI just makes banking on Digibank enjoyable 🙂

24*7 Virtual Assistant, Personalized offers and Money Optimizer

Digibank comes with 24*7 Virtual Assistant that is powered by artificial intelligence. It keeps a track on your spending’s, shopping habits etc and provides you with customized alerts, bill payment reminders etc.

This ensures that customers get ‘tailor made alerts’ which are of their interest thus increasing the conversion rate. The offers do not only stop there but you also get Hyper-local offers based on your ‘shopping history’ as learnt by the virtual assistant. Get answers to all your banking queries in an instant with the 24*7 virtual assistant either via Voice or Text.

Brand Ambassador & Brand Mascot that ‘itself’ speaks for the product

Sachin Tendulkar is the brand ambassador of Digibank and being a cricket fanatic, I loved that the ‘most respected batsman’ is associated with the right products and Digibank as product has all the promise !! As a brand, it is very important that it’s mascot conveys the right message at the very first moment.

Digibank has played the cards right by having Digor, a dino that has adapted to change and has been evolving since pre-historic times just like the Digibank app (that has made banking more secure and seamless).

Closing Thoughts

As seen in the Digibank product launch, time has come for customers to #unbankit and switch to Digibank, India’s first mobile-only bank. You should definitely have a look at the launch video where Digor unleashes the power of DigiBank & showcasing the simplicity of DigiBank. DBS’s Digibank is an exciting step towards making banking Paperless, Signature-less without compromising the security features [thanks to extensive use of Bio-metrics] of physical banking !! We are sure that this is just the baby-step in taking banking to a whole new level by combing Bio-metrics and Aadhar Card authentication. You can find more about Digibank here

Join the Digibank revolution! You are an existing Digibank customer, please leave your experience/feedback in the comments section…

![]()