When there is a discussion about ‘Salaried Class’ in India, there is a clear classification made as to whether a salaried person belongs to the “Organized” or the “Unorganized” sector. This classification is done by the Government Of India. All public sector employees are in organised sector. Private sector establishments with more than 10 employees in non agricultural sector are classified as organised sector. The Private sector companies have to register sales tax, pay employee’s PPF etc. Everyone else is in un-organised informal sector. As per the data available on https://data.gov.in, in 2011 there were 28.9 million workers in organised sector out of a total labour force of 469 million. As per the report, though there is a dip in the organized work force vis-a-vis labour force has fallen since 1990’s; people who are in good jobs in private sector companies are making more money than ever before 🙂

With the rise of the upper and lower middle class; salaried class people developed higher aspirations like Planning a vacation abroad, Home improvement, Planning a grand wedding etc. The aspirations can sometimes be endless.. Most of the times these aspirations may not be fulfilled with the ‘Salary’ coming from their jobs and this is where Personal Loans act as a catalyst in managing your finances and helps in putting your plans into ‘tangible’ actions. Many of the NBFC’s [Non Banking Financial Companies] offer Personal Loan but either their interest rates are very high or you get stuck in endless paper work [which starts from account creation and never seems to end :(].

When one of my colleague’s who is falling in the ‘Premium category of the salary bracket’ was looking out for a ‘Exquisite Wedding’ [which was bit beyond his budget], he took a Wedding Loan from Bajaj Finserv Lending, one of the most diversified non-banks in the country. Yes, you read it right; Wedding loan :). Bajaj Finserv has launched online services to offer personal loan to premium salaried class professionals.

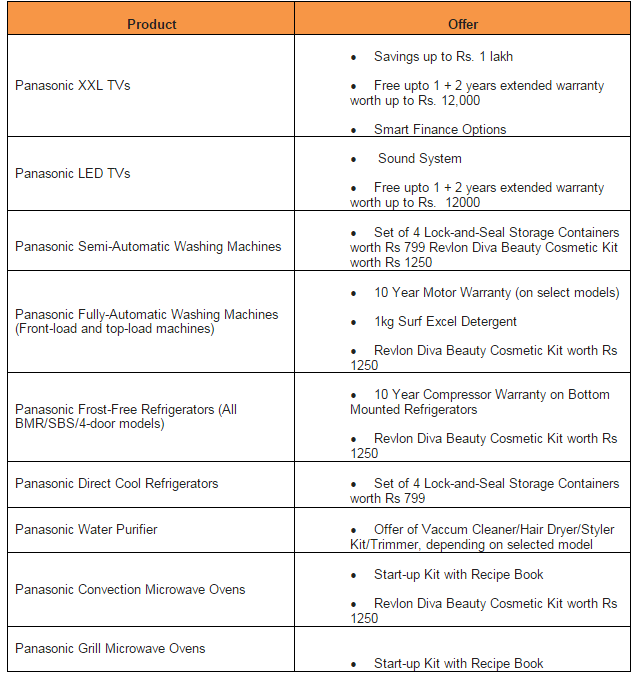

It sounded very interesting proposition and hence we decided to have a closer look at their offerings in the ‘crowded’ Loan sector. Let’s have a look at their overall offerings.

First Mover Advantage

Bajaj Finserv Lending is one of the first NBFC’s to offer ‘Specialized’ Personal Loan catering to the Premium salaried class professionals. This is where they have an upper edge over their competitors who are also looking to enter into the rising Personal Loan market. With Bajaj Finserv’s deep technical and financial expertise, they definitely have a huge first mover advantage over it’s competitors !!!

Whatever your need, BFL has a Loan

As discussed earlier, my colleague took Personal Loan to fulfill his wish to plan an exquisite wedding. Thanks to BFL he was able to realize his dream into reality. Bajaj Finserv offers Personal Loan for salaried class whether you are looking to fund your child’s education, home renovation, planning a grand vacation or planning a grand wedding (for self or family). Whatever, your Loan requirement, BFL has an answer to it.

No Running around.. Hassle Free

Unlike other NBFC’s & Banks that offer Personal Loan, BFL offers 100% end-to-end Personal Loan solutions. Yes, you read it right 🙂 You can apply for a loan online and before applying for the Loan, you can check the eligibility by going to their Eligibility Calculator so that you do not waste your precious time by applying for a loan only to come to know that you are not eligible (for the Personal Loan).

If that is not all, once you confirm your eligibility for the loan; you can apply for a Personal Loan in less than 5 minutes. Customers can avail loan from range of 1 Lakhs to 25 Lakhs (depending on various parameters).. The disbursal from the bank normally happens in less than 72 hours, which in our opinion is “pretty swift” !!! With this process, it ensures that the customer does not have to take the pain of filling lengthy forms and waiting for an executive to collect the documents. Just like e-commerce, customer can now enjoy the benefits of ‘Loan Commerce’ 🙂

Flexi Loans : Lower Interest Rates & more Benefits

BFL has come up with many industry first’s in the ‘Personal Loan’ category with Flexi Loan being one of them. As the name signifies, once a customer signs up for this facility; (s)he can save interest cost via pre-payment or by just having funds lying idle in your account. The main benefit of this facility is that there is no interest levied on the part-paid amount.

While availing any loan, Loan Pre-payment is an important question that comes up in any customer’s mind. Once the customer opts for Flexi Loan facility, they can pre-pay the loan with the idle funds that are lying in their account, that too at no additional cost !!! To top it all, customer can also save huge money on Interest Payment since Interest is only levied on the utilized loan amount (Pre-paid amount is out of the radar of interest).

With so many benefits, it is needless to even mention that you would have Online access to your account so that you can access it even when you are on-the-move 🙂

So, why wait for the right moment ? Whether you are planning for a grand vacation or an extravagant wedding; you have Bajaj Finserv Personal Loan at your rescue !!!

Time to realize your plans and turn your Dreams into Reality….

![]()