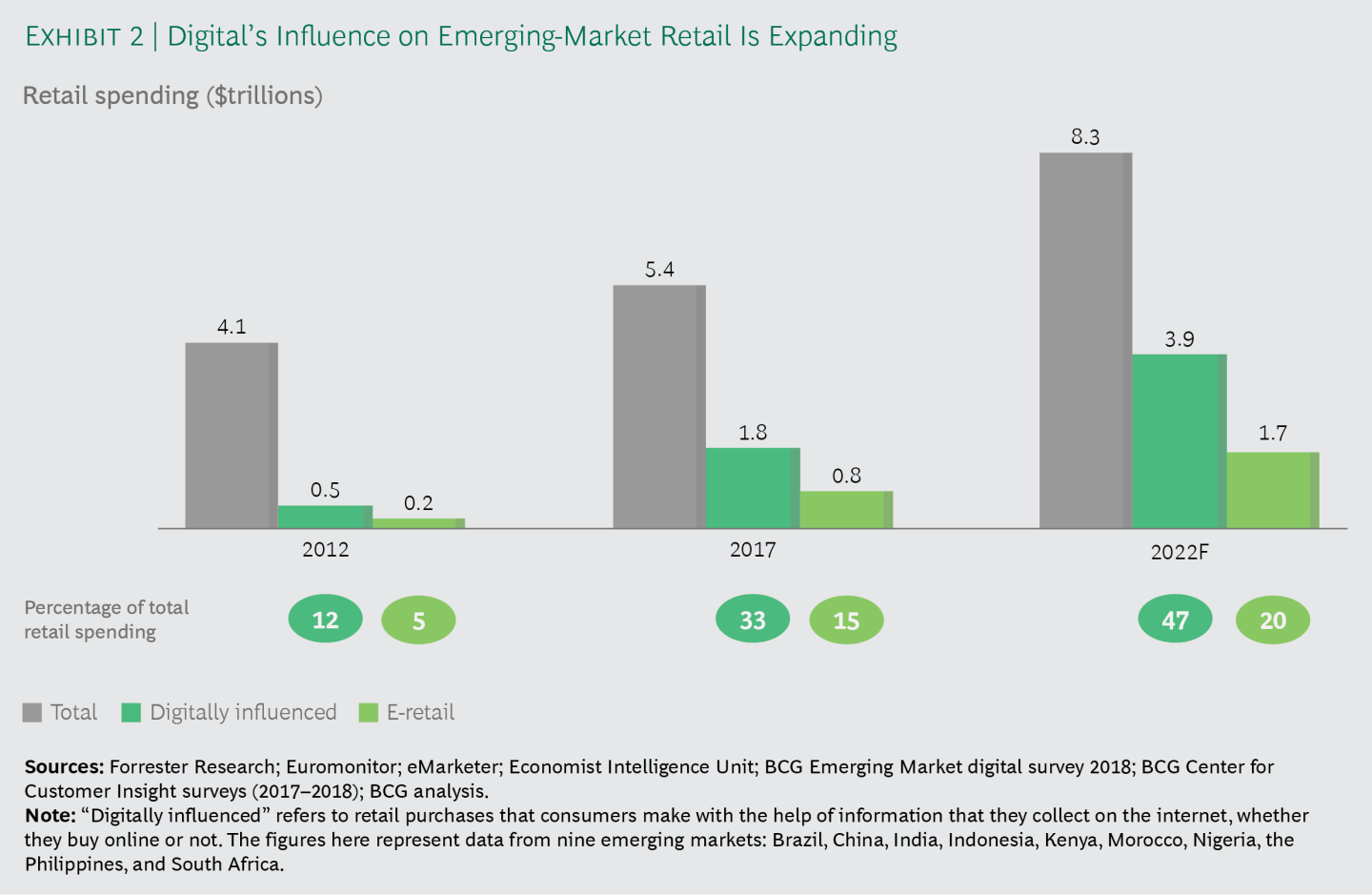

The value of digitally influenced spending in emerging markets will approach $4 trillion by 2022, amounting to about 50% of all retail spending in Asia, Latin America, and Africa. But the dynamics will vary widely between markets, requiring B2C companies to ‘de-average’ their offerings in order to succeed, according to a report by The Boston Consulting Group [BCG] that was presented at the World Economic Forum. The report is titled Digital Consumers, Emerging Markets, and the $4 Trillion Future.

Half of the population in emerging markets worldwide is now connected to the internet, the report says – a stunning increase from 2010, when fewer than a quarter of those in emerging markets were online. In addition, by 2022, nearly 900 million more emerging-market consumers will be online, versus just 80 million new internet users in developed markets. That means that more than 90% of all internet newcomers during the next four years will be from emerging markets.

Smartphone penetration doubled in emerging markets between 2013 and 2017, from 22% to 44%, and smartphones are the preferred way for people in these markets to access the internet. The report was led by BCG’s Center for Customer Insights [CCI] and is based on a survey of more than 15,000 urban internet users in Brazil, China, India, Indonesia, Kenya, Nigeria, Morocco, the Philippines, and South Africa.

Nimisha Jain, a BCG partner in New Delhi, who leads CCI in emerging markets, said

Emerging markets are on the brink of a major digital revolution. The share of digitally influenced retail in total retail spending will surge from 33% in 2017 to 47% by 2022. There are major differences across emerging markets, however – and in order to succeed in those markets, B2C companies will have to approach each one differently.

China is leading other emerging-market countries in internet usage, with 20% of its retail sales already coming from e-commerce. But e-commerce is advancing in other emerging economies, too. Overall, e-commerce in emerging markets will grow from about 15% of all retail sales in 2017 to 20% of all retail sales in 2022. The online portion of retail in China already exceeds that of the United Kingdom [16%], the United States [13%], and Germany and France [11% each].

A Shift in Consumer Behavior

Even more dramatic in emerging markets will be the growth of digital influence—the effect of information that consumers collect online, often by smartphone, on their online and offline purchases. By 2022, there will be $3.9 trillion in digitally influenced expenditures in emerging markets, BCG forecasts. That huge number represents both a challenge and an opportunity for B2C companies, the authors say.

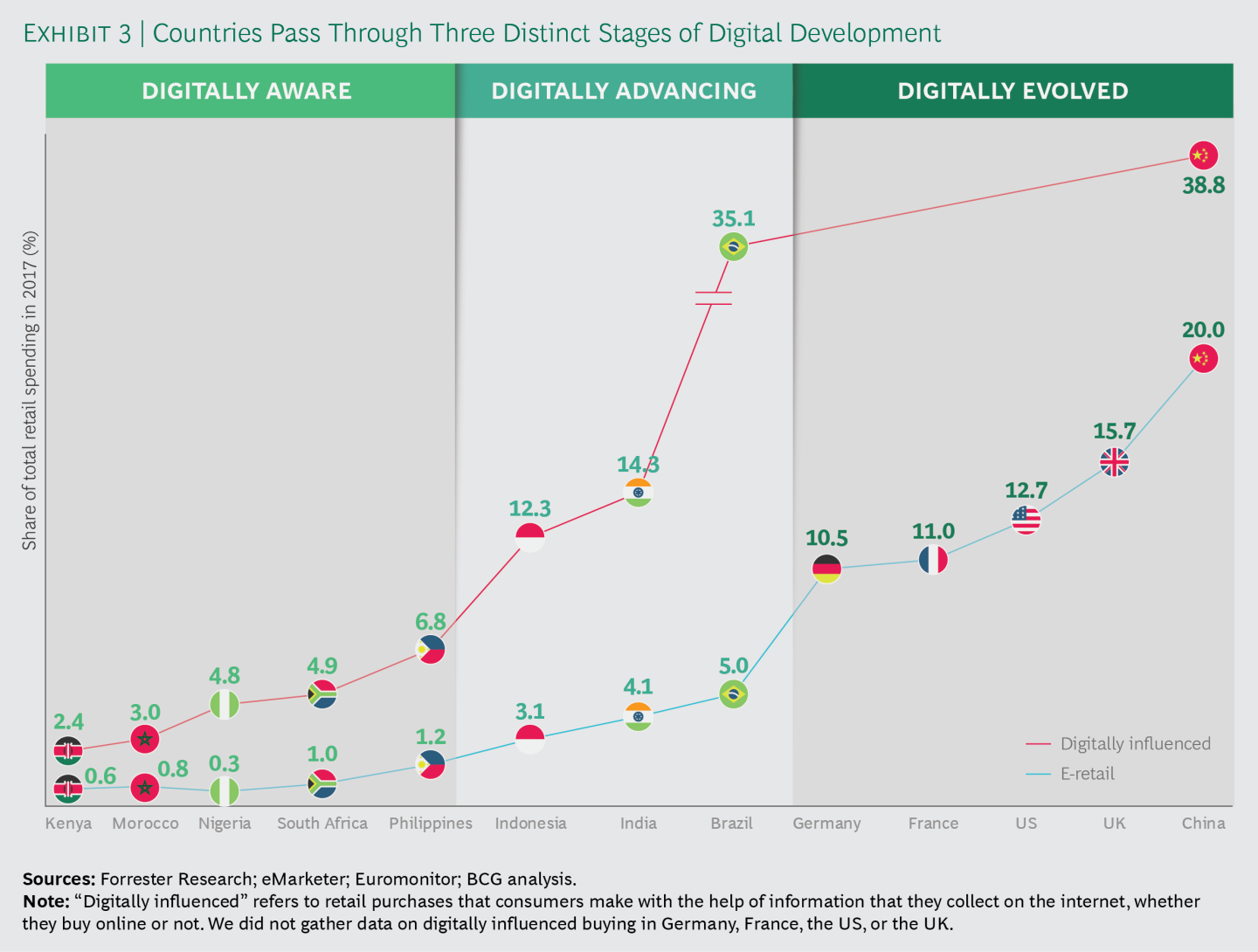

How digital influences consumer behavior differs by country and by category. The report identifies three stages of digital evolution: digitally aware, digitally advancing, and—farthest along – digitally evolved. People in China [now in the digitally evolved category] are the most apt to turn to the internet for help in making a retail purchase; 39% percent of retail spending in China is digitally influenced. Brazil, India, and Indonesia [which are in the middle category, digitally advancing] have high levels of digital influence [35%, 14%, and 12%, respectively], but relatively low levels of online spending [between 3% and 5%]. Kenya, Morocco, Nigeria, South Africa, and the Philippines are in the first category, digitally aware. In these early-stage countries, a variety of factors, from modest-size middle classes to a relatively undeveloped fintech ecosystem, have constrained the growth of e-commerce.

When a country’s markets advance from one digital stage to the next, consumer behaviors change, too, the report shows. One such change is in the expectation of a better experience, whether that takes the form of something practical like a good recommendation engine or something fun like the ability to see oneself in a shirt or hat that one is considering buying.

Altogether, 81% of people in digitally evolved markets say that they look for a fun or enjoyable experience in deciding where to buy. In contrast, the shopping experience matters to only about one in four people in digitally aware markets, and to only one in ten people in digitally advancing markets.

Another difference relates to how people pay for their online purchases. In less advanced digital markets, cash on delivery is still common – used by 88% of Filipinos, 86% of Moroccans, 58% of Kenyans, and 54% of Nigerians. In more advanced digital markets, buyers almost always pay for online purchases digitally – whether through an online mobile wallet or a credit or debit card. For instance, 94% of Chinese use a digital method of payment, as do more than three-quarters of Brazilians. In addition, Chinese consumers make 70% of their online purchases through smartphones, a level of mobile commerce that sharply exceeds the level in developed countries. In 2016, Chinese mobile payments were nearly 50 times as great as those in the US.

Jeff Walters, a BCG partner and CCI’s leader in Greater China, said

One lesson of this study is that emerging market consumers aren’t uniform in their behaviors. Different markets have distinct requirements. This is something any online seller would learn if it tried to enter China without appreciating the need to create a fun experience or if it tried to do business in parts of Asia or Africa without understanding the workings of cash on delivery.

Developing Economies’ Use of Social Media

Social media is a big part of digital influence in emerging markets. In CCI’s survey, 95% of Filipinos and 74% and 73%, respectively, of Kenyans and Moroccans say they sometimes use social media to guide their retail purchases. At 37%, Indian consumers are the least apt of all emerging-market consumers to use social media to guide them in making a retail purchase; if they are looking for an online source of information, internet users in India are much more inclined to go to a shopping website.

Social media is also popular as a venue for direct e-commerce, whether through a brand’s social media account or in peer-to-peer transactions in which consumers buy and sell from one another with no intermediary. Peer-to-peer transactions over social media are especially popular in the Philippines, Indonesia, and Thailand.

In all emerging markets, air travel is the category most subject to digital influence and the product or service most likely to be bought online, with mobile phones a close second, the survey shows. But countries can be outliers in certain product categories. For instance, Brazilian consumers are much likelier than Indian or Indonesian consumers to buy a small appliance online. And Indian consumers don’t book their holidays online at anything like the same frequency that Brazilian consumers do.

BCG’s report comes at a time when emerging markets are growing at three times the rate of developed markets and contributing much of the world’s growth. In the last two decades, according to the World Bank, emerging markets’ share of the world’s gross domestic product has risen from 11% to 28%, and their share of global household consumption expenditures has risen from 11% to 24%.

The complete report can be downloaded here