According to recent industry reports, 156 million of Indians who comprise the ‘urban mass’ and ‘urban middle’ section representing an annual income of USD 3000 and above have the potential of mass adoption of consumer credit. Of this the ‘urban mass’ constituting approximately 129 million have been mostly deprived of credit due to lack of credit history.

Addressing this major concern, CASHe, India’s leading digital lending company, promoted by serial entrepreneur and private equity investor V. Raman Kumar, announced the launch of India’s first alternate credit rating system – The Social Loan Quotient [SLQ].

India’s first social behaviour-based credit-rating system, SLQ is a fast, unique and a path-breaking real time platform which leverages big data analytics, artificial intelligence and predictive tools. The innovative platform will help score millions of Indians, who otherwise have been left in the lurch for lack of consumer credit in the absence of credit history.

Considering the young urban mass prefer to avail small ticket loans for short term, the existing traditional lending platforms such as banks and NBFCs’ find it unviable to serve the segment. In addition, the lack of credit history further dampens the situation. Here SLQ will play a pivotal role in helping this large untapped population to avail credit on the basis of the score generated by the system. Soon, the platform will also be set open to other institutions [banks, NBFCs’ and credit bureaus] to integrate and avail the system thereby helping them reach out to the masses.

Unlike conventional lending agencies who rely only on an applicant’s past financial transactions, CASHe’s revolutionary approach links multiple online and offline data points like his mobile, social and media footprint, education, remuneration, career and financial history to calculate the borrower’s credit score.

Speaking on the launch of this new credit scoring innovation, the CEO of CASHe, Ketan Patel, said:

Credit is critical for the growth of an economy. It incorporates the element of aspiration and infuses growth to keep the economy up and running. However, the lack of alternative credit models, challenging capital eco-system and an unviable cost structure have kept mass India deprived of quick and reliable credit.

Through SLQ, we are focused on those who may have little or no credit history with traditional lending institutions. We hope this will revolutionize the digital lending space in the country and encourage other credit institutes and agencies to avail ‘SLQ’ as the go-to platform to assess credit worthiness of mass India.

There are millions across the country who have never obtained a bank loan, however, they are internet users who shop on line, have a good social media presence, have a stable residential status and also have been using their mobile phones actively. SLQ will now use these factors or data points into consideration when assessing a customer’s creditworthiness.

The platform will analyze unstructured data from various sources – social media profiles, mobile data, KYC documents – to provide the users with a system that will instantaneously and continuously update a borrower’s credit worthiness and insure sound underwriting.

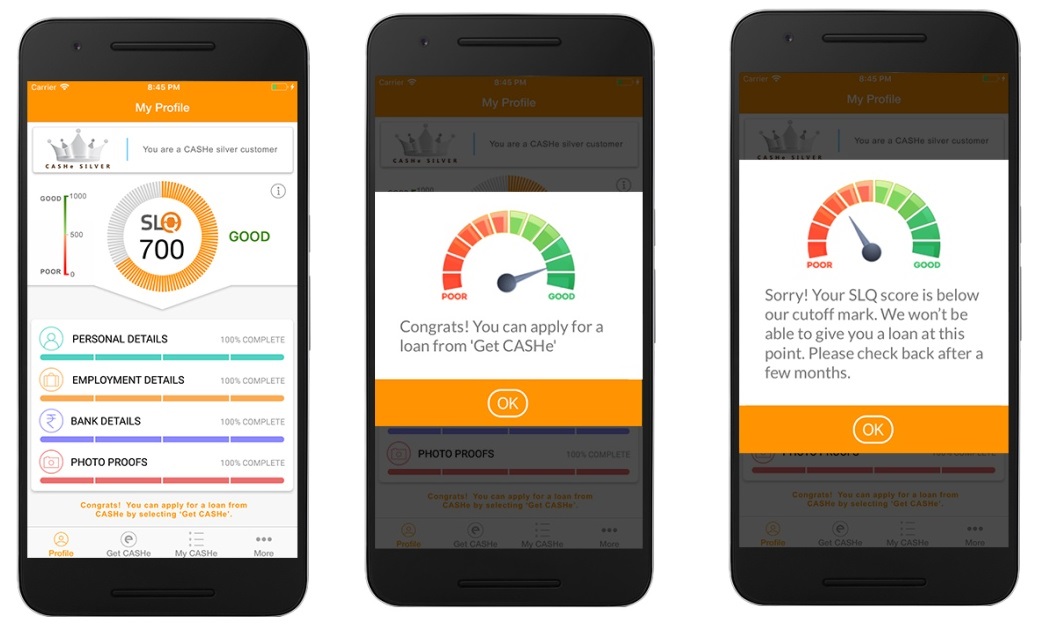

The scores are generated in Real Time and will enable the customer to know, within a few seconds, if he qualifies for a loan with CASHe or not. Subsequently, on completion of the loan application process, every customer’s personal SLQ score will now be displayed to him. This will provide the user with a reliable tool for accessing his/her creditworthiness.

Srinivas Nidumolu, Chief Technology Officer – CASHe, added

This is a service that is sorely needed by many Indians. SLQ is developed using proprietary deep learning and artificial intelligence technologies that will analyze a wealth of data to find recurring patterns of credit behavior that will indicate an individual’s willingness and ability to pay his financial obligations.

CASHe, over the past two years have built a very large data set of customer information based on their digital footprint and mobile data to spur the financial inclusion of many deserving credit worthy Indians who do not have access to financial services. This allows us to build credit scores even for individuals with little or no formal credit information but who may actually be good candidates to obtain credit.

With more than 2 million downloads, 180,000 customers, 480 crore loan disbursals, 30,000 loans processed in a month, over 1000 loan applications in a day and 75% repeat customers CASHe has amassed a huge wealth of data encompassing rich customer information which can be potentially analyzed for credit behaviour.

About CASHe

CASHe is India’s most preferred digital lending company for young salaried millennials. CASHe provides immediate short-term personal loans to young professionals based on their social profile, merit and earning potential using its proprietary algorithm based machine learning platform. In April 2016, Aeries Financial Technologies Pvt. Ltd, launched its innovative technology-driven lending platform for the young, urban millennials. CASHe provides almost instantaneous loans on-demand. Its user-friendly digital interface enables faster loan application process and quicker loan disbursal’s. CASHe provides hassle-free loans with its app enabled documentation and loan disbursal/repayment process. For more information, please visit CASHe