iPredictt Data Labs, an advanced data analytics company introduced the Chatbots functionality based on Artificial Intelligence [AI] to their recruitment intelligence platform, Careerletics. The AI Chatbots automatically identifies the scope of missing data in the profiles of candidates who have uploaded their resumes on Careerletics and reaches out to those candidates to fill in the missing information via chat links. This will help resolve one of the key problems of incomplete data available in resumes for pre-interview evaluation.

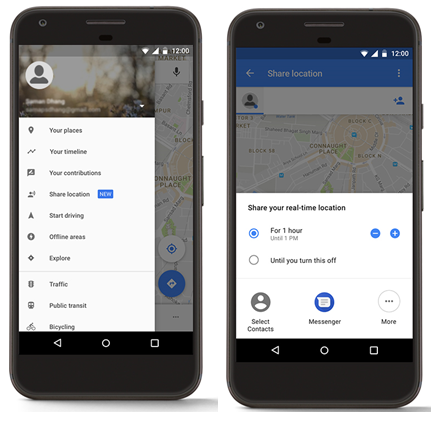

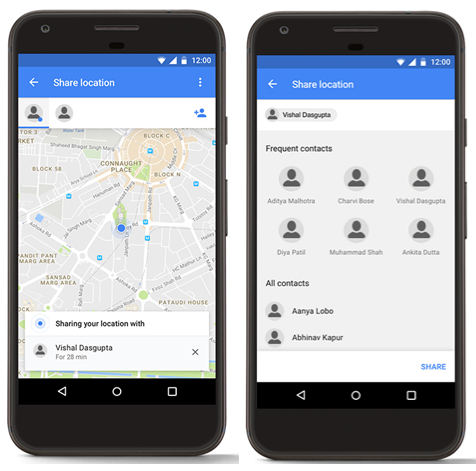

AI chatbots can assist users with rather simple quick responses and gives customer service representatives a chance to handle pressing problems for its clients. Once the set of resumes are uploaded on the platform, Careerletics, the Chatbot triggers a chat link with questions to the candidates. The candidate then clicks on the link and answers all questions such as current CTC, expected CTC, preferred location, reasons for applying for the job, notice period etc. This data immediately is saved into the database and enables the predictive algorithms to provide much more accurate results.

Rohit Verma, CEO, iPredictt commented

Resume data, the main source of information for a talent acquirer is mostly incomplete. Employers invariably then have an arduous task upon them to touch base with multiple candidates to source the missing data. This is a time taking process and delays the hiring time thus causing immense loss to the business.

We have automated that process by using an AI based Chatbot in our platform, Careerletics which can connect with hundreds of resumes at one time and collect information. This updates the data base in real time and helps simplify the process, making it easy for the TA to perform their function much more efficiently.

About Careerletics

Careerletics is a SaaS based recruitment intelligence platform by iPredictt Data Labs that uses advanced Predictive analytics to exponentially improve quality of new hires at added speed. The platform calculates an Employability Score and Probability of ‘Offer Decline’ for candidates. The Platform helps at the pre-selection stage by bringing in auto parsing of resumes, skill set identification and over median accuracy in JD-candidate matchmaking, thus delivering high quality of candidates from among searched resumes. For more information, please visit Careerletics

About iPredictt Data Labs

iPredictt Data Labs is a big data analytics company that provides machine learning software to B2C companies to solve their complex data challenges. The company brings groundbreaking new approaches to transform how data-rich companies can make sense of structured and unstructured data. The company differentiates itself by offering premium data science solutions that are customized for businesses trying to mine their data for getting better return on technology investment. For more information, please visit iPredictt Data Labs