Mutual funds have become the toast of the market not only for benefits of diversification, professional management and extensive choice, but also for their systematic features such as Systematic Investment Plan (SIP), Systematic Transfer Plan (STP) and Systematic Withdrawal Plan (SWP). While SIP and STP deal in investing and transferring money among various schemes, respectively, investors get the money back in SWP – they can decide the amount and frequency of cash flows subject to the underlying corpus.

The attractiveness of SWPs has increased after the introduction of 10% Dividend Distribution Tax [DDT] on dividends from equity-oriented funds [another popular choice for regular cash flows] in the Union Budget 2018.

Illustration

Let’s start with a hypothetical case study.

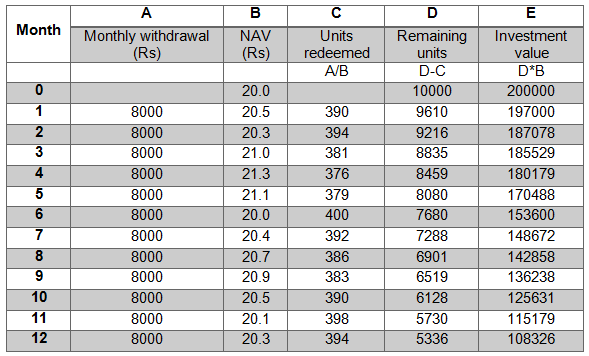

Rahul holds 10,000 units in a mutual fund scheme valued at Rs 2 lakh with Net Asset Value [NAV] of Rs 20. He wants a fixed amount of Rs 8,000 every month from his investment, which he can get via SWP in the following manner

As seen in the table, Rahul has systematically withdrawn a fixed amount every month for day-to-day expenses. Apart from meeting the financial commitments, SWP can be used to book profits, especially in a bull market. One can prudently withdraw only the appreciation amount from investments based on the amount of appreciation, while the principal is intact. In this case, Rahul withdraws units only when the NAV appreciates 5%. But this will rely on the market movement. Appreciation withdrawal may not yield a favorable outcome in a bear market.

How does SWP work?

SWP allows investors to withdraw/redeem money from a mutual fund scheme at pre-determined intervals. Investors can opt for monthly, quarterly, half-yearly or yearly withdrawals to meet their cash flow requirement. Based on investors’ instructions, an equivalent amount of money is deducted by the fund house. Investors can start the SWP by giving instructions to the asset management company and providing relevant details such as folio number, scheme name, withdrawal amount, timing, and bank account details in which the amount is to be credited.

Tax on each withdrawal will be the same as in the case of full redemption of equity and debt funds. For debt funds, Short-Term Capital Gains Tax [STCG] is levied as per the tax bracket if units are held for less than 36 months, and Long-Term Capital Gains Tax [LTCG] at 20% with indexation for a holding period of more than 36 months. In case of equity funds, STCG is 15% for a holding period of less than one year, while LTCG is 10% for a holding period of more than one year.

Advantages of SWP

- Inculcates discipline – A disciplined approach is one of the key requirements for long-term financial success. Investors who receive lump sum money at retirement may end up spending or mismanaging their funds. SWP ensures one receives the amount in parts rather than the whole, to effectively channelize spending.

- Customize outflows – Through SWP, investors can customize cash flows by deciding the timing and the amount at pre-determined levels. This cash can be useful for investors who want a pre-defined regular income, like the retirees, or those keen on booking profits at regular intervals.

- Favorable tax treatment – The dividend option lost its allure after the government introduced 10% DDT on dividends from equity-oriented funds in the Union Budget 2018. Hence, SWP emerges as a better option.

Disclaimer – CRISIL Research, a division of CRISIL Limited [CRISIL] has taken due care and caution in preparing this Report based on the information obtained by CRISIL from sources which it considers reliable (Data). However, CRISIL does not guarantee the accuracy, adequacy or completeness of the Data/Report and is not responsible for any errors or omissions or for the results obtained from the use of Data/Report. This Report is not a recommendation to invest/ dis-invest in any entity covered in the Report and no part of this report should be construed as an investment advice. CRISIL especially states that it has no financial liability whatsoever to the subscribers/users/transmitters/distributors of this Report.

CRISIL Research operates independently of, and does not have access to information obtained by CRISIL’s Ratings Division/CRISIL Risk and Infrastructure Solutions Limited (CRIS), which may, in their regular operations, obtain information of a confidential nature. The views expressed in this Report are that of CRISIL Research and not of CRISIL’s Ratings Division/CRIS. No part of this Report may be published/reproduced in any form without CRISIL’s prior written approval.