A very famous quote on investing says – ‘Risk & Rewards are two sides of the same coin’. This means that in most of the cases, higher the amount of risk involved chances of maximizing the returns are also very high! The investment portfolio of every person would differ since it is dependent on various factors like risk appetite, assets, liabilities, dependencies, etc. and hence, it becomes virtually impossible for any investment firm to cater to varied investment requirements of such a large audience.

This is where emerging technologies like Machine Learning and Artificial Intelligence can play a vital role in creating a tailor-made investment plan based on your long-term and short financial requirements. Machine Learning has already the paved way into the Fintech market, be it approving loans, documentation, managing assets, etc. Many Fintech startups are leveraging machine learning, AI, Chatbots and helping banking institutions to either enhance the existing banking experience or creating kick-ass products in the areas of wealth management, personal finance, customer service, etc.

When it comes to investing, there are different types of investors – Novice and seasoned investors. There are options for investing in FD, RD, Gold, etc. that are used for many years, are less risky and yield lesser returns. On the other hand, there are options like investing in stocks, equity markets, Gold bonds, etc that yield higher returns but the investor needs to have at least basic know-how about the markets. According to a report by Bloomberg, less than 1.5% of the Indian population invested in equity markets and only 2% of India’s household savings were exposed to equity.

Most of the investment firms reserved their advisory services for HNI’s, with none of them catering to the expanding retail investors and middle-income groups. This is where founders of Fintech startup WealthApp saw an opportunity and created WealthApp with a single aim to make goal-based investing easier by combining their wealth management expertise with the power of Machine Learning. In simple terms, WealthApp is an algorithm based, tech-driven investment platform created by seasoned finance professionals that help you create your ‘Perfect’ investment portfolio as per your requirements and risk appetite. We had earlier interviewed Gaurav Dhawan, Co-Founder of WealthApp and today we do a detailed review of the app w.r.t features, enhancements, competition, etc.

Note – Since it is an app related to finance, we have blurred out certain things that might be personal or related to my investment portfolio.

WealthApp: Changing the Investment Habit for ‘Better Financial Planning’

As mentioned earlier, investment in the equity markets is not very popular option amongst investors in India but that scene is changing rapidly! 60,000 new investors are investing in Mutual Funds and this is where fin-tech startups like WealthApp are acting as a change agent. WealthApp is using Machine Learning, AI and proprietary algorithms to invest, track, redeem, etc. in Mutual Funds owned by different AMC’s [Asset Management Company].

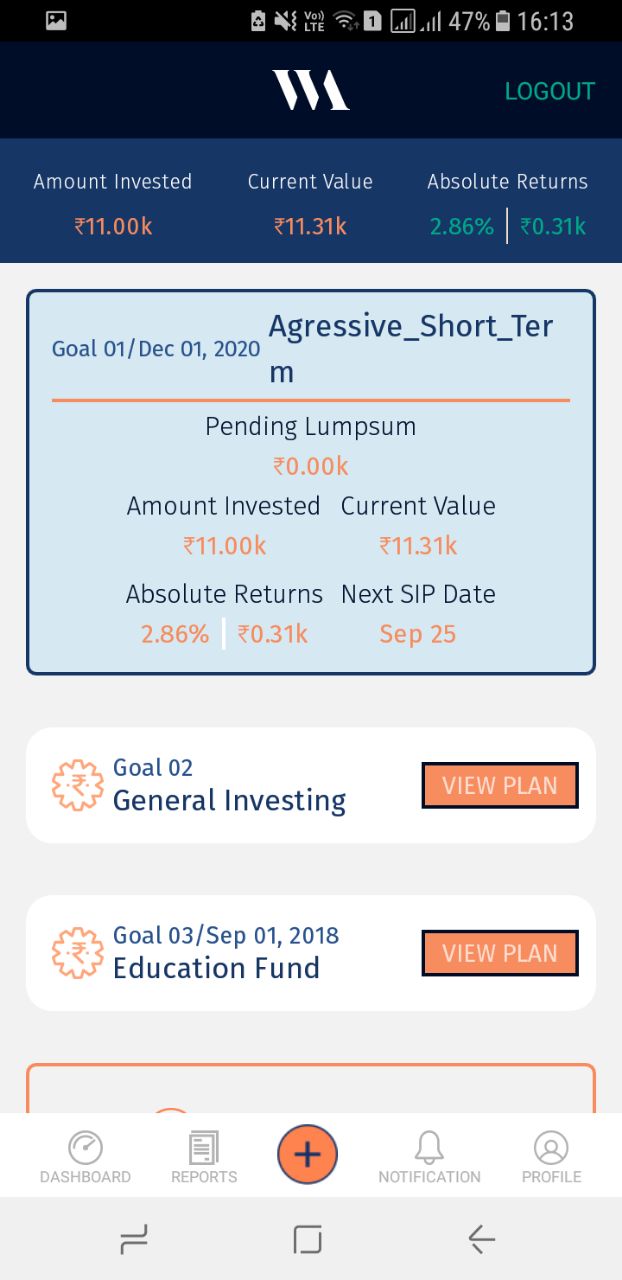

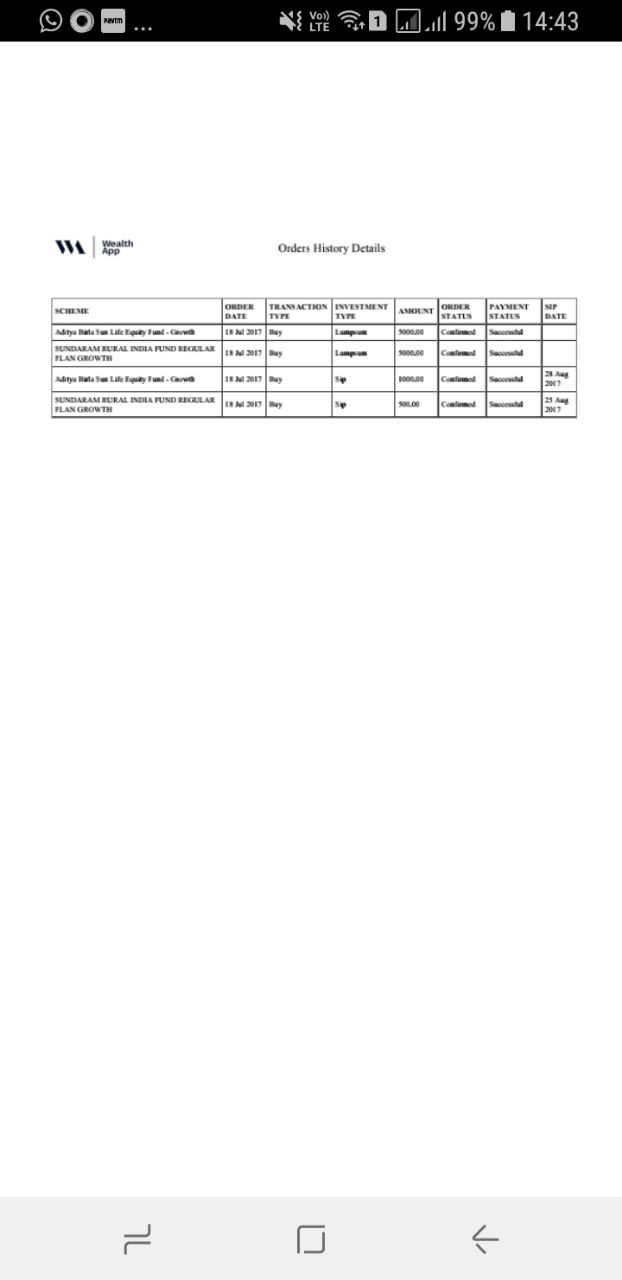

Apart from in-depth know-how about the Mutual Fund [MF] industry, another problem faced by investors is that in order to keep a track of their MF investment, they have to log on to the website of each AMC for checking the performance, invest in other MF’s from the same AMC, etc. WealthApp has tied-up with different AMC’s due to which investors can track their investments from AMC’s, invest in Mutual Funds from other popular AMC’s in a single window. As an investor, you have to create a profile on WealthApp, allow WealthApp to access your portfolio information from the corresponding AMC & you are done 🙂

With WealthApp, there is an end to the long winding process, paper work and emergence of proper guidance in investment methods by a team that has extensive experience in managing individual investment portfolios.

WealthApp: Goal-based investing, dedicated fund manager and more

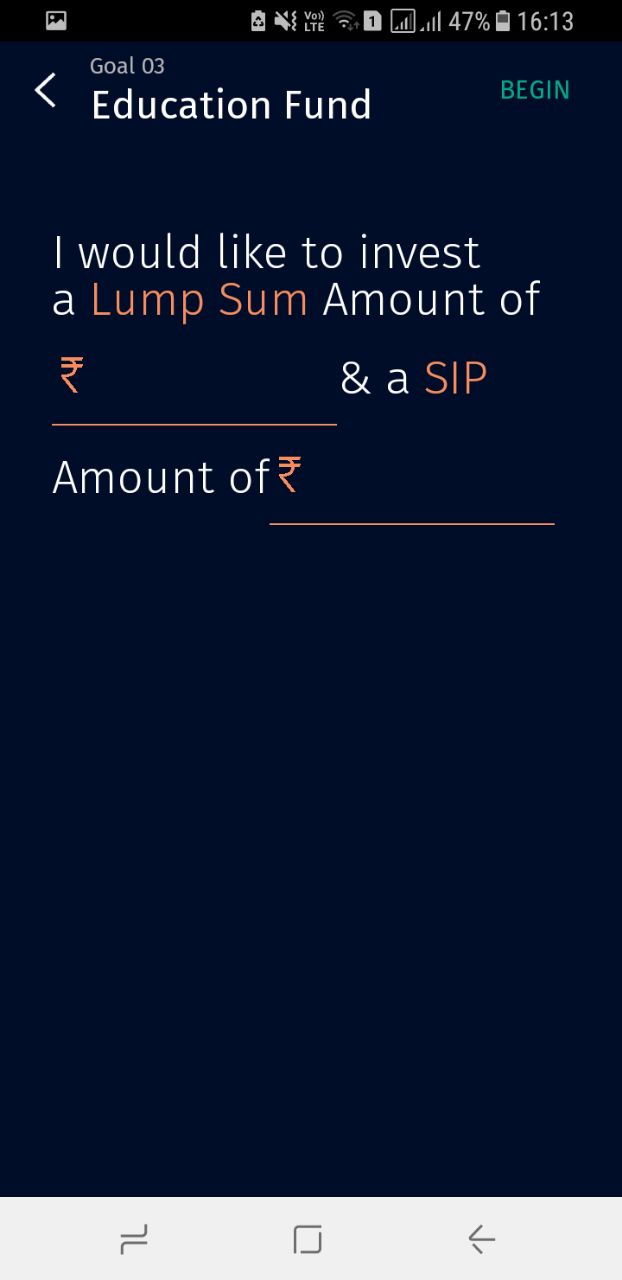

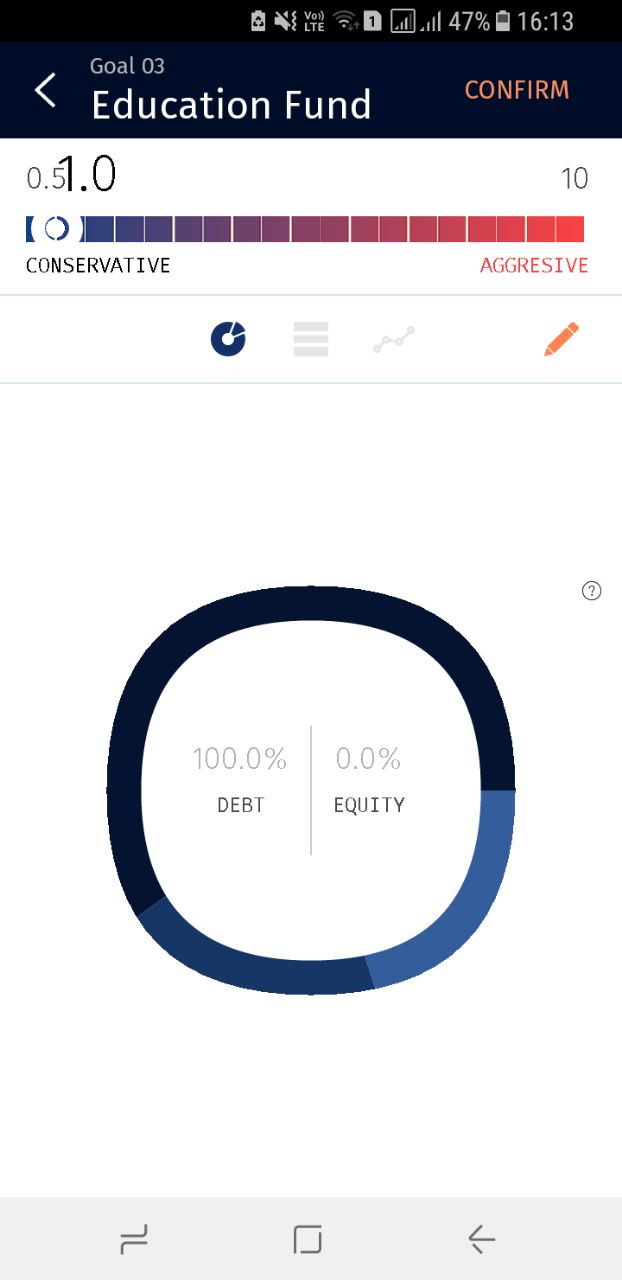

Each one of us has short-term as well as long-term goals and ambitions like going for an overseas vacation, buying a house, overseas education, etc. and this is where ‘Goal-Based Investing’ plays a very crucial role. Goal-based investing aims to get around the drawback of the traditional investment approach, which generally focuses on outperforming the market while staying within the investor’s threshold for risk. Instead, it uses individual asset pools with an investment strategy that is tailored to the client’s specific goals [Source].

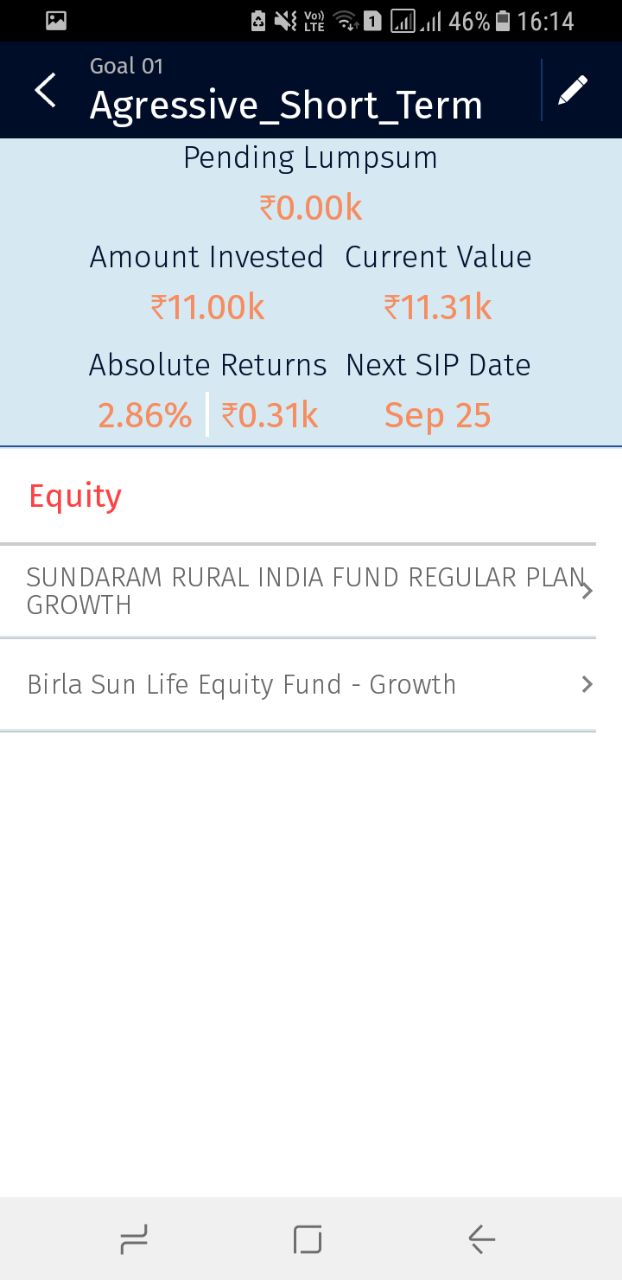

Goal-based investing: Once you create your profile on WealthApp, you would be recommended with relevant and personalized investment options based on your risk profile, goal & aspirations set by you. There is an automated and continuous monitoring, re-balancing of your portfolio according to changing market conditions so that you can maximize the returns on your investments!

Dedicated fund manager: Couple of months back when we interviewed Gaurav Dhawan, he raised a very valid point ‘Investors are interested to invest in Mutual Funds but most of them feel that MFs are difficult to understand’. This is where WealthApp wants to create a dent in order to drive investor’s interest in MFs. This is one of the primary reasons why every investor on WealthApp has a dedicated fund manager assigned to him/her. The fund manager would hand-hold you in the on-boarding process, efficiently managing your portfolio, guiding you to maximize returns and more…

Frictionless on-boarding process: The KYC is done in a paperless manner, you no longer to submit multiple paper documents for the on-boarding process 🙂 Since the platform runs on high-end machine learning algorithms, the entire advisory process is automated so that investors can get timely investment tips and latest updates on their investments.

Investment tips & Detailed reports: Once you have your account setup and records of your MF investments are imported on WealthApp, you start receiving personalized e-mailer based on your investment profile, goals and other important criteria that might impact your long-term & short-term investment goals!

Also if you want to make further investments, you need not go to the AMC’s website but can continue investing in MFs via WealthApp. At any point in time, you can download the performance reports of your investments.

The design of the app is very simple since there is a possibility that the app could be used by someone who is not well versed with mobile/technology but has good knowledge about MF’s, equity markets, etc.

WealthApp: Improvements, Competition…

WealthApp amalgamates technology [AI, Machine Learning] with finance/investing and makes lives of MF investors easy since now they no longer have to log-in to each & every AMC’s website where they have invested their funds! However, in many cases investing is a long-term strategy and hence, it becomes important that reports are very detailed. The reports should highlight the performance of any particular fund in a graphical representation so that that data dishes out much more information. As seen in the screenshot below, the reports of funds that an investor has invested in are not detailed and the overall format also needs some improvement.

There has been a meteoric rise in the fintech startup landscape in H1, H2 of 2017 with e-commerce, FinTech startups top Funding Charts in H1 2017 [Source]. Many of the fintech companies are leveraging Machine Learning, Artificial Intelligence, Social Data Intelligence, Blockchain, etc. in order to solve critical business problems, including the one being solved by WealthApp. A fintech startup UpWardly is also leveraging Machine Learning to Upwardly, which facilitate goal-based investments in mutual funds.

WealthApp: Conclusion

Overall, WealthApp is a simple yet effective service from seasoned finance professionals that makes ‘goal-based investing’ easier. Even after you have downloaded the WealthApp application, there is still a human-touch to investing via your dedicated fund managers. Barring a few improvement areas, it is an app that a retail investor can use in order to test the waters of Mutual Fund Investing. If you are a seasoned investor, WealthApp solves the major hurdle of logging on-to individual AMC’s website for maintaining your investment portfolio.

You can download WealthApp for Android from here and WealthApp for iOS from here. If you are an existing user of WealthApp, do leave your feedback/experience in the comments section.